Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

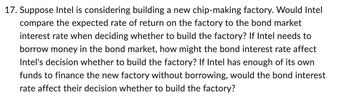

Transcribed Image Text:17. Suppose Intel is considering building a new chip-making factory. Would Intel

compare the expected rate of return on the factory to the bond market

interest rate when deciding whether to build the factory? If Intel needs to

borrow money in the bond market, how might the bond interest rate affect

Intel's decision whether to build the factory? If Intel has enough of its own

funds to finance the new factory without borrowing, would the bond interest

rate affect their decision whether to build the factory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Lluvia Manufacturing and Paraguas Products both seek funding at the lowest possible cost. Lluvia would prefer the flexibility of floating-rate borrowing, while Paraguas wants the security of fixed-rate borrowing. Lluvia is the more creditworthy company. They face the following rate structure. Lluvia, with the better credit rating, has lower borrowing costs in both types of borrowing. Lluvia wants floating-rate debt, so it could borrow at LIBOR+1.000%. However, it could borrow fixed at 8.500% and swap for floating-rate debt. Paraguas wants fixed-rate debt, so it could borrow fixed at 12.500%. However, it could borrow floating at LIBOR+2.000% and swap for fixed-rate debt. What should they do? (LIBOR is 5.500%.) Lluvia's comparative advantage is % (round 3 decimals) Paraguas's net interest after a swap with Lluvia is (round 3 decimals) Lluvia's savings on borrowing versus net swap is (round 3 decimals) Paraguas's savings on borrowing versus net swap is (round 3 decimals)arrow_forwardRoyal Bank of Belgium (RBB) will be worth €100 million or €120 million with equal probability in one year. RBB is highly leveraged and has bonds outstanding promising to pay €90 million next year. RBB is considering a risky project that will payoff €50 million or -€65 million with equal probability. Would RBB’s shareholders want you to engage in the risky project? What is the expected payoff to RBB’s existing shareholders? How would your answers change if the bondholders could convert the bond to 80% of RBB’s equity?arrow_forwardYou are International Business Manager at a UK based company. Considering high demand your company plans a full-scale expansion. Your company has identified USA and Europe as potential markets. You are requested to analyse both projects and advise. In considering such large project, you must work out the risk of each project, cost of capital and NPV. Allocate discount rate for each project accordingly and justify why you allocated this rate in your discussion. Discuss how international risks can be managed. Projected cash flows in respective currencies: Year Net Cash Flow – USD USA Net Cash Flow - EUR Europe0 -20 million -20 million 1 2 million 2 million2 4 million 3 million3 5 million 4 million4 6 million 8 million5 8 million 8 million Instructions:a. Discuss viability of both projects in today’s global business context and allocate discount rate. b. How much investment is needed for each project and what is the NPV of each project? c.…arrow_forward

- 2. Consider the model of Moral Hazard where firms choose between investing one unit of output in a less risky or more risky project. The safer project yields with probability and zero otherwise while the risky project yields 2 with probability and zero otherwise i.e. TG = G = TB B = 2. Suppose firms finance their investment by borrowing 1 unit from a the fiinancial market at interest rate R. The financial market is risk neutral and requires an expected rate of return equal to the risk free rate which is assumed to be zero. Will there be an equilibrium with lending to firms from the financial market A. Yes B. No C. Not enough information D. None of A-Carrow_forwardAB Borda shall establish a risk-adjusted required rate of return as part of their investment analysis. The company has produced the following information: • The investment will be financed to 40% with bank loans and 60% with equity • The company's tax rate is 22% • The government bond for the intended investment period has an interest rate corresponding to 2% • The company has negotiated with the bank for a loan for the investment with an interest rate of 5%. • For the investment period, the company has an expectation that the index for the market portfolio will increase from the current 110 to 119.9 at the end of the investment period. • The company's intended investment has a covariance with a market portfolio of 120 and that the standard deviation for the market portfolio is 7.56. a) Calculate the company's nationally adjusted return requirement for the investment.arrow_forward(Related to Checkpoint 8.1) (Expected rate of return) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) Data Table State of Economy Rapid expansion and recovery Modest growth Continued recession Falls into…arrow_forward

- The market for capital Firms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost called the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk, and inflation. Suppose the Federal Reserve (the Fed) decides to tighten credit by contracting the money supply. Use the following graph by moving the black X to show what happens to the equilibrium level of borrowing and the new equilibrium interest rate. Q1. Which tend to be more volatile, short- or long-term interest rates? Long-term interest rates 2. Short-term interest rates Q2. If the inflation rate was 3.20% and the nominal interest rate was 4.20% over the last year, what was the real rate of interest over…arrow_forwardSuppose IBM signed a contract to buy a supply of computer chips from a German firm. Theprice is 10 million euros, and the chips will bedelivered immediately, but IBM can delay payment for six months if it wants to. What riskwould IBM be exposed to if it delays payment?Can it hedge this risk? Should it pay now ordelay payment?arrow_forwardHi, I am working on this problem but don't know how to solve it. Can you please show the steps in solving this corporate finance question? Question below: Consider a risky investment, Security 1, that costs $950 today, and pays you $900 in one year if the economy is weak, which occurs with a probability of 50%, or $1100 in one year if the economy is strong, which occurs with a probability of 50%. What is the expected payoff? What is the expected return? What is the risk premium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education