Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

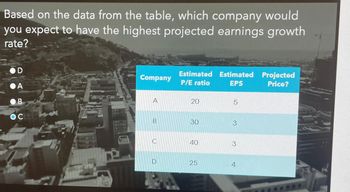

Transcribed Image Text:Based on the data from the table, which company would

you expect to have the highest projected earnings growth

rate?

D

A

B

OC

Company

A

B

C

D

Estimated Estimated Projected

P/E ratio

EPS

Price?

20

30

40

25

5

3

3

4

**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- go.3arrow_forwardif a company profit margin is 0.6 and the current ratio is 0.6, is it advisable to invest in the company or not?arrow_forwardDetermining PB Ratio for Companies with Different Returns and Growth Assume that the present value of expected ROPI follows a perpetuity with growth g (Value = Amount/ [r - g]). Determine the theoretically correct PB ratio for each of the following companies A and B. Note: NOPAT = NOA » RNOA. Company Net Operating Assets Equity RNOA ROE Weighted Avg. Cost of Capital Growth Rate in ROPI $100 $100 19% 19% 10% 2% $100 $100 12% 12% 10% 4% A B Round answers to two decimal places. PB Ratio Company A Company Barrow_forward

- b) Indicate which of the following companies are likely to have share prices increases by placing the number in the marked square Expected Cash Returns Required Return Company A Company B Company C Company D Company E 10% 9% 11% 13% 12% 10% 13% 12% 14% 14% 1 A 2 A and B 3 В 4 A, C and D Earrow_forwardUse the information below to answer the question 52WH 52WLo Ticker Div Yield % P/E Vol 00s High Low Close Net Chg 52.53 28.31 KO 0.65 1.34 13.80 6,412 54.12 32.50? -0.81 What was the previous day's closing price? O $51.32 O $48.74 O $50.10 O $49.32arrow_forward1. Calculate the expected return for the following six returns for thetwo companies below: Company A Company B10% 13%17% 23%-9% 3%21% 15%11% 18%19% -10%arrow_forward

- In the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 10 On average, profit (loss) amounts deviate from the expected profit by ______ thousand. a $114.77 thousand b $112.52 thousand c $110.31 thousand d $108.15 thousandarrow_forwarda Rance 0ortotal tSpendingjJariance The Walnut Division of Benton core hurdle rate isug9o. Calculate the return on investment Calculate the profit, nmargin ÇalculateThe invest ment turnover (alculate the residual incomearrow_forwardThe price-earnings per share of A, B, C, D and E is P6.00, P6.25, P6.80, P6.90 and P6.20. If A has earnings per share of P1,200.00, it would currently be ____ by ____ compared to the group average. a. Overvalued by P516 b. Undervalued by P540 c. Undervalued by P516 d. Overvalued by P550arrow_forward

- YYYYMM Return(Stk1) Return(Stk2) Return(Market) Return(T-bill) 201701 7.75% 3.00% 6.18% 0.20% 201702 1.27% 2.12% 1.63% 0.20% 201703 7.63% 1.50% 1.56% 0.15% 201704 9.25% -1.01% 2.09% 0.30% 201705 10.20% 2.66% 4.25% 0.30% 201706 4.33% 2.59% 0.41% 0.30% 201707 12.25% 10.41% 6.05% 0.35% 201708 4.98% -2.94% 2.37% 0.45% 201709 2.19% -1.69% -1.49% 0.20% 201710 4.05% 3.43% 2.51% 0.20% 201711 13.78% 8.29% 3.30% 0.15% 201712 2.01% 1.96% 2.54% 0.30% 201801 14.19% 23.60% 9.92% 0.30% 201802 -6.77% -4.18% -6.21% 0.55% 201803 -5.23% -10.14% -2.44% 0.60% 201804 -4.54% 1.93% 2.38% 0.20% 201805 2.32% -1.32% -1.10% 0.20% 201806 -1.35% -7.01% -4.97% 0.15% 201807 -9.80% -1.86% -1.29% 0.30% 201808 -4.28% -1.95% -2.43% 0.30% 201809 -4.94% 0.27% -0.36% 0.75% 201810 -17.39% -7.14% -10.11% 0.30% 201811 16.85% 9.62% 6.11% 0.55% 201812 0.64% -0.61% -2.49% 0.60% 201901 10.19% 7.68% 8.11% 0.20% 201902 -2.95% 10.90% 2.47% 0.20% 201903 7.50% 2.26% 1.46% 0.20%…arrow_forward* A company provided the following information: ROA= 15% Financial Leverage Ratio 1.8 What is the company's financial leverage percentage? (Round your answearrow_forwardFind out the 1- standard deviation 2- variance weight Investment*expected return stock weight Investment Investment Amount expected return stock stocks 0.261 1.45 75000 0.18 Alba Co. 0.0504 0.56 75000 0.09 Batelco Co. 0.0371 0.1 75000 0.371 Delmon poultry. 0.3485 225000 Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education