Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What are the direct materials price variance?

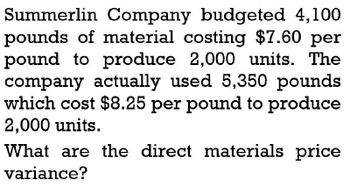

Transcribed Image Text:Summerlin Company budgeted 4,100

pounds of material costing $7.60 per

pound to produce 2,000 units. The

company actually used 5,350 pounds

which cost $8.25 per pound to produce

2,000 units.

What are the direct materials price

variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardTaylor Corporation is analyzing the cost behavior of three cost items, A, B, and C, to budget for the upcoming year. Past trends have indicated the following dollars were spent at three different levels of output: In establishing a budget for 14,000 units, Taylor should treat A, B, and C costs as: a. semivariable, fixed, and variable, respectively. b. variable, fixed, and variable, respectively. c. semivariable, semivariable, and semivariable, respectively. d. variable, semivariable, and semivariable, respectively.arrow_forwardRose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forward

- Judges Gavel uses this information when preparing their flexible budget: direct materials of $3 per unit, direct labor of $2.50 per unit, and manufacturing overhead of $1.25 per unit. Fixed costs are $49,000. What would be the budgeted amounts for 33,000 and 35,000 units?arrow_forwardUse the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 696,000 units, estimated beginning inventory is 106,000 units, and desired ending inventory is 89,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.71 per poundMaterial B: 1.00 lb. per unit @ $1.89 per poundMaterial C: 1.20 lb. per unit @ $0.84 per poundThe dollar amount of Material B used in production during the year isarrow_forwardGonzales Corp. needs to set a target price for its newly designed product EverReady. The following data relate to this product. Per Unit Total Direct Material $20 Direct Labor $40 Variable manufacturing Overhead $10 Fixed manufacturing overhead $1,200,000 Variable selling and administrative $5 Fixed selling and administrative $1,120,000 The costs shown above are based on a budgeted volume of 80,000 units produced and sold each year. Gonzales uses cost-plus pricing methods to set its target selling price. Because some managers prefer absorption-cost pricing and others prefer variable-cost pricing, the accounting department provides information under both approaches using a markup of 50% on absorption cost and a markup of 70% on variable cost.…arrow_forward

- Gonzales Corp. needs to set a target price for its newly designed product EverReady. The following data relate to this product. Per Unit Total Direct Material $20 Direct Labor $40 Variable manufacturing Overhead $10 Fixed manufacturing overhead $1,200,000 Variable selling and administrative $5 Fixed selling and administrative $1,120,000 The costs shown above are based on a budgeted volume of 80,000 units produced and sold each year. Gonzales uses cost-plus pricing methods to set its target selling price. Because some managers prefer absorption-cost pricing and others prefer variable-cost pricing, the accounting department provides information under both approaches using a markup of 50% on absorption cost and a markup of 70% on variable cost.…arrow_forwardHelp me with thisarrow_forwardUse the information below for Mandy Corporation to answer the question that follow.Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 640,000 units, estimated beginning inventory is 98,000 units, and desired ending inventory is 80,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.60 per poundMaterial B: 1.00 lb. per unit @ $1.70 per poundMaterial C: 1.20 lb. per unit @ $1.00 per poundThe dollar amount of Material C used in production during the year isarrow_forward

- Edgar, Inc. has a materials price standard of $1.75 per pound. eight thousand pounds of materials were purchased at $2.20 a pound. The actual quantity of materials used was 4,000 pounds, although the standard quantity allowed for the output was 5,400 pounds. Calculate the materials price variancearrow_forwardTotal production costs for Jordan, Inc. are budgeted at P2,300,000 and P2,800,000 for 50,000 and 60, 0 units of budgeted output, respectively. Because of the need for additional facilities , budgeted fixed costs for 60,000 units are 25 percent more than budgeted fixed costs for 50,000 units. How much is Jordan's budgeted variable cost per unit of output?arrow_forwardFor the current year, Power Cords Corp. expected to sell 42,000 industrial power cords. Fixed costs were expected to total $1,650,000; unit sales price was expected to be $3,750; and unit variable costs were budgeted at $2,250.Power Cords Corp.'s margin of safety (MOS) in units is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub