Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

All production is sold as it is produced?

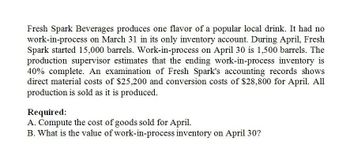

Transcribed Image Text:Fresh Spark Beverages produces one flavor of a popular local drink. It had no

work-in-process on March 31 in its only inventory account. During April, Fresh

Spark started 15,000 barrels. Work-in-process on April 30 is 1,500 barrels. The

production supervisor estimates that the ending work-in-process inventory is

40% complete. An examination of Fresh Spark's accounting records shows

direct material costs of $25,200 and conversion costs of $28,800 for April. All

production is sold as it is produced.

Required:

A. Compute the cost of goods sold for April.

B. What is the value of work-in-process inventory on April 30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An examination of Buckhorn Fabricators records reveals the following transactions: a. On December 31, the physical inventory of raw material was 9,950 gallons. The book quantity, using the weighted average method, was 10,000 gal @ .52 per gal. b. Production returned to the storeroom materials that cost 775. c. Materials valued at 770 were charged to Factory Overhead (Repairs and Maintenance), but should have been charged to Work in Process. d. Defective material, purchased on account, was returned to the vendor. The material returned cost 234. e. Goods sold to a customer, on account, for 5,000 (cost 2,500) were returned because of a misunderstanding of the quantity ordered. The customer stated that the goods returned were in excess of the quantity needed. f. Materials requisitioned totaled 22,300, of which 2,100 represented supplies used. g. Materials purchased on account totaled 25,500. Freight on the materials purchased was 185. h. Direct materials returned to the storeroom amounted to 950. i. Scrap materials sent to the storeroom were valued at an estimated selling price of 685 and treated as a reduction in the cost of all jobs worked on during the period. j. Spoiled work sent to the storeroom valued at a sales price of 60 had production costs of 200 already charged to it. The cost of the spoilage is to be charged to the specific job worked on during the period. k. The scrap materials in (i) were sold for 685 cash. Required: Record the entries for each transaction.arrow_forwardHello question is attached, thanks.arrow_forward[The following information applies to the questions displayed below.] Pacific Ink had beginning work-in-process inventory of $750,960 on October 1. Of this amount, $307,920 was the cost of direct materials and $443,040 was the cost of conversion. The 51,000 units in the beginning inventory were 25 percent complete with respect to both direct materials and conversion costs. During October, 108,000 units were transferred out and 33,000 remained in ending inventory. The units in ending inventory were 75 percent complete with respect to direct materials and 35 percent complete with respect to conversion costs. Costs incurred during the period amounted to $2,556,000 for direct materials and $3,278,760 for conversion. Required: a. Compute the equivalent units for the materials and conversion cost calculations. Equivalent units for materials Equivalent units for conversion costs b. Compute the cost per equivalent unit for direct…arrow_forward

- * The 30,000 liters remaining in Filtration's ending Work-in-Process Inventory were 80% of the way through the filtration process. Spring Water has no beginning inventories.arrow_forwardBellevue Chemicals had beginning work-in-process inventory of $256,535 on March 1. Of this amount, $102,215 was the cost of direct materials and $154,320 was the cost of conversion. The 24,360 units in the beginning inventory were 45 percent complete with respect to direct materials and 65 percent complete with respect to conversion costs. During March, 58,540 units were transferred out and 15,800 remained in ending inventory. The units in ending inventory were 70 percent complete with respect to direct materials and 15 percent complete with respect to conversion costs. Costs incurred during March amounted to $969,625 for direct materials and $1,069,971 for conversion. Required: a. Compute the equivalent units for the materials and conversion cost calculations. b. Compute the cost per equivalent unit for direct materials and for conversion costs for March using the weighted-average method. Complete this question by entering your answers in the tabs below. Required A Required B Compute…arrow_forwardBellevue Chemicals had beginning work-in-process inventory of $253,885 on March 1. Of this amount, $102,205 was the cost of direct materials and $151,680 was the cost of conversion. The 24,300 units in the beginning inventory were 45 percent complete with respect to direct materials and 65 percent complete with respect to conversion costs. During March, 58,450 units were transferred out and 15,500 remained in ending inventory. The units in ending inventory were 70 percent complete with respect to direct materials and 15 percent complete with respect to conversion costs. Costs incurred during March amounted to $944,225 for direct materials and $1,051,665 for conversion. Compute the costs of goods transferred out and the ending inventory for March using the weighted-average method. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Cost of goods transferred out= Ending Inventory=arrow_forward

- Gore’s Green Chemicals inventory goes through 2 distinct processes. Process 1 had beginning WIP inventory of $98,260 on October 1. Of this amount, $31,400 was the cost of direct materials, and $66,860 was for conversion costs. The 8,000 units in the beginning inventory were 30% complete with respect to both direct materials and conversion costs. During October 17,000 units were transferred out, 500 were spoiled, and 4,500 units remain in ending inventory. Spoiled units were 100% complete with respect to materials and 50% complete with respect to conversion costs. The units in ending WIP were 80% complete with respect to direct materials and 40% complete with respect to conversion costs. Cost incurred during the period amounted to $390,600 for direct materials and $504,640 for conversion costs. Required: Prepare a production cost report for Process 1 using weighted-average costing. What journal entry would be made after preparing the production cost report for process 1?arrow_forwardshobhaarrow_forwardProvide answer this questionarrow_forward

- Pacific Ink had beginning work-in-process inventory of $750,960 on October 1. Of this amount, $307,920 was the cost of direct materials and $443,040 was the cost of conversion. The 51,000 units in the beginning inventory were 25 percent complete with respect to both direct materials and conversion costs. During October, 108,000 units were transferred out and 33,000 remained in ending inventory. The units in ending inventory were 75 percent complete with respect to direct materials and 35 percent complete with respect to conversion costs. Costs incurred during the period amounted to $2,556,000 for direct materials and $3,278,760 for conversion. a-1. Compute the cost of goods transferred out and the cost of ending inventory using the FIFO method. Compute the cost of goods transferred out and the cost of ending inventory using the FIFO method. (Do not round intermediate calculations.) Cost of goods transferred out Cost of ending…arrow_forwardon August 4, Carrothers Company purchased on account 31,000 units of materials at $16 per unit. During August, raw materials were requisitioned for production as follows: 7,900 units for Job 50 at $11 per unit and 6,100 units for Job 56 at $16 per unit. Journalize the entry on August 4 to record the purchase. If an amount box does not require an entry, leave it blank. Journalize the entry on August 31 to record the requisition from the materials storeroom. If an amount box does not require an entry, leave it blank.arrow_forwardOn September 1, the Blending Department of Jo's Bakery had costs carried forward from August totaling $50,000. Resources consumed to complete the beginning inventory totaled $39,000. The total cost of units started in the Blending Department during September was $500,000. On September 30, costs assigned to the department's ending inventory totaled $64,000. Compute the costs transferred out of the Blending Department during September. Kelly's Fitness Center purchased a new step machine for $18,000. The apparatus is expected to last four years and have a residual value of $750. What will the depreciation expense be for each year under the straight-line method? (Round to 2 decimals)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning