SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

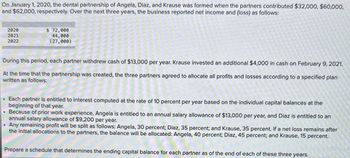

Transcribed Image Text:On January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $32,000, $60,000,

and $62,000, respectively. Over the next three years, the business reported net income and (loss) as follows:

2020

2021

2022

$ 72,000

44,000

(27,000)

During this period, each partner withdrew cash of $13,000 per year. Krause invested an additional $4,000 in cash on February 9, 2021.

At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan

written as follows:

•

Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the

beginning of that year.

Because of prior work experience, Angela is entitled to an annual salary allowance of $13,000 per year, and Diaz is entitled to an

annual salary allowance of $9,200 per year.

Any remaining profit will be split as follows: Angela, 30 percent; Diaz, 35 percent; and Krause, 35 percent. If a net loss remains after

the initial allocations to the partners, the balance will be allocated: Angela, 40 percent; Diaz, 45 percent; and Krause, 15 percent.

Prepare a schedule that determines the ending capital balance for each partner as of the end of each of these three years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 9 images

Knowledge Booster

Similar questions

- On January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $44,000, $75,000, and $74,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2020 $ 84,000 2021 56,000 2022 (39,000 ) During this period, each partner withdrew cash of $16,000 per year. Krause invested an additional $6,000 in cash on February 9, 2021. At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows: Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year. Because of prior work experience, Angela is entitled to an annual salary allowance of $12,500 per year, and Diaz is entitled to an annual salary allowance of $10,400 per year. Any remaining profit will be split as follows: Angela, 20…arrow_forwardOn January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $48,000, $75,000, and $78,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2020 $ 88,000 2021 60,000 2022 (43,000 ) During this period, each partner withdrew cash of $20,000 per year. Krause invested an additional $5,000 in cash on February 9, 2021. At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows: Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year. Because of prior work experience, Angela is entitled to an annual salary allowance of $14,500 per year, and Diaz is entitled to an annual salary allowance of $10,800 per year. Any remaining profit will be split as follows: Angela, 20…arrow_forwardOn January 1, 2020, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $34,000, $65,000, and $67,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2020 $ 77,000 2021 49,000 2022 (32,000 ) During this period, each partner withdrew cash of $18,000 per year. Krause invested an additional $4,000 in cash on February 9, 2021. At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows: Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year. Because of prior work experience, Angela is entitled to an annual salary allowance of $15,500 per year, and Diaz is entitled to an annual salary allowance of $9,700 per year. Any remaining profit will be split as follows: Angela, 20…arrow_forward

- On January 1, 2023, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $45,000, $74,000, and $76,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2023 $ 86,000 2024 58,000 2025 (41,000) During this period, each partner withdrew cash of $18,000 per year. Krause invested an additional $8,000 in cash on February 9, 2024. At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows: Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year. Because of prior work experience, Angela is entitled to an annual salary allowance of $13,500 per year, and Diaz is entitled to an annual salary allowance of $10,600 per year. Any remaining profit will be split as follows: Angela, 25 percent; Diaz, 40 percent; and Krause,…arrow_forwardPlease help me to solve this problemarrow_forwardsarrow_forward

- Hardevarrow_forwardAlford, Beeson, and Carlton have operated a coffee shop for a number of years as a partnership. At the beginning of 2024, capital balances were as follows: Alford Beeson Carlton Due to a cash shortage, Alford invests an additional $10,000 in the business on April 1, 2024. Each partner is allowed to withdraw $600 cash each month. The partners have used the same method of allocating profits and losses since the business's inception: • Each partner is given the following compensation allowance for work done in the business: Alford, $14,000; Beeson, $30,000; and Carlton, $4,000. $ 94,000 74,000 20,000 • Each partner is credited with interest equal to 20 percent of the average monthly capital balance for the year without regard for normal drawings. • Any remaining profit or loss is allocated 5.3.2 to Alford, Beeson, and Carlton, respectively. The net income for 2024 is $27,000. Each partner withdraws the allotted amount each month. Required: Prepare a schedule showing calculations for the…arrow_forwardAlford, Beeson, and Carlton have operated a coffee shop for a number of years as a partnership. At the beginning of 2024, capital balances were as follows: Alford Beeson Carlton Due to a cash shortage, Alford invests an additional $10,000 in the business on April 1, 2024. Each partner is allowed to withdraw $800 cash each month. The partners have used the same method of allocating profits and losses since the business's inception: Each partner is given the following compensation allowance for work done in the business: Alford, $15,000; Beeson, $25,000; and Carlton, $8,000. $ 84,000 64,000 20,000 • Each partner is credited with interest equal to 20 percent of the average monthly capital balance for the year without regard for normal drawings. Any remaining profit or loss is allocated 5:2:3 to Alford, Beeson, and Carlton, respectively. The net income for 2024 is $26,000. Each partner withdraws the allotted amount each month. Required: Prepare a schedule showing calculations for the…arrow_forward

- On January 1, 2017, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $30,000, $58,000, and $60,000, respectively. Over the next three years, the business reported net income and (loss) as follows: During this period, each partner withdrew cash of $15,000 per year. Krause invested an additional $5,000 in cash on February 9, 2018. At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows: Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year. Because of prior work experience, Angela is entitled to an annual salary allowance of $12,000 per year and Diaz is entitled to an annual salary allowance of $9,000 per year. Any remaining profit will be split as follows: Angela, 20 percent; Diaz, 40 percent; and Krause, 40 percent. If a net loss remains after the…arrow_forwardsarrow_forwardPurkerson, Smith, and Traynor have operated a bookstore for a number of years as a partnership. At the beginning of 2021, capital balances were as follows: $ 50,000 30,000 10,000 Purkerson Smith Traynor Due to a cash shortage, Purkerson invests an additional $4,000 in the business on April 1, 2021. Each partner is allowed to withdraw $500 cash each month. The partners have used the same method of allocating profits and losses since the business's inception: · Each partner is given the following compensation allowance for work done in the business: Purkerson, $10,000; Smith, $20,000; and Traynor, $6,000. • Each partner is credited with interest equal to 15 percent of the average monthly capital balance for the year without regard for normal drawings. • Any remaining profit or loss is allocated 4:2:4 to Purkerson, Smith, and Traynor, respectively. The net income for 2021 is $25,000. Each partner withdraws the allotted amount each month. Prepare a schedule showing calculations for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you