FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Give me correct answer

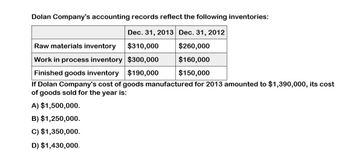

Transcribed Image Text:Dolan Company's accounting records reflect the following inventories:

Dec. 31, 2013 Dec. 31, 2012

Raw materials inventory

$310,000

Work in process inventory

$300,000

Finished goods inventory

$190,000

$260,000

$160,000

$150,000

If Dolan Company's cost of goods manufactured for 2013 amounted to $1,390,000, its cost

of goods sold for the year is:

A) $1,500,000.

B) $1,250,000.

C) $1,350,000.

D) $1,430,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me answer the questionarrow_forwardBenson Inc.'s accounting records reflect the following inventories: Dec. 31, 2016 Dec. 31, 2017 Raw materials inventory $ 80,000 $ 64,000 Work in process inventory 104,000 116,000 Finished goods inventory 100,000 92,000 During 2017, Benson purchased $1,450,000 of raw materials, incurred direct labor costs of $250,000, and incurred manufacturing overhead totaling $160,000.How much raw materials were transferred to production during 2017 for Benson? Select one: A. $1,386,000 B. $1,450,000 C. $1,466,000 D. $1,434,000arrow_forwardThe comparative inventory data for SAN JOSE Manufacturing Corporation for the year ended December 31, 2014 is summarized below: January 1 P 55,000 December 31 P 53,000 Raw Materials inventory Work in process inventory Finished goods inventory 49,000 59,000 45,000 47,000 During the year 2014, the corporation completed, among others, the following transactions: Purchases, all on account, direct materials, P2,100,000; indirect materials, P400,000. The total materials requisitioned for use during the year included P360,000 for indirect materials. The payroll for the year was a follows: direct labor, P1,650,000, indirect labor, P550,000. The payroll was vouchered, and analysis disclosed the following details: w/H Tax a. b. C. d. Gross P 1,650,000 P80,000 Phil Health P 12,000 SS HDMF ECC Direct labor P 40,000 P 38,000 P 6,000 Indirect labor 550,000 40,000 12,500 3,000 12,000 1,500 e. Other manufacturing expenses vouchered amounted to P920,000, and depreciation charges were P450,000 on plant…arrow_forward

- Ogleby Inc's accounting records reflect the following inventories: Dec. 31. 2016 T Dec 31, 2017 Raw materials inventory $120,000 $96.000 Work in process inventory 156,000 174,000 Finished goods inventory 138.000 150,000 During 2017, Ogleby purchased $890,000 of raw materials, incurred direct labor costs of $175,000, and incurred manufacturing overhead totaling $224,000. How much is total manufacturing costs incurred during 2017 for Ogleby? $1,403,000 $1,313,000 $1,385,000 $1,379,000arrow_forwardThe following cost and inventory data are taken from the accounting records of King Company for the year ending 31/12/2021. They relate to 20,000 units produced. Units sold during the year were 18,000 units. Direct labor cost € 50,000 Indirect labor 30,000 Indirect materials cost 3,000 Selling and distribution costs 80,000 Administrative salaries 40,800 Purchases of direct materials 150,000 Other costs and expenses (60% factory / 40% sales and administration) 30,000 Factory Heat, water and power 25,000 Beginning of End of the year the year D/M inventory € 5,000 €12,000 Work in process inventory 9,000 4,000 Finished goods inventory 0 ? Required Prepare the schedule of the cost of goods manufactured What is the cost of…arrow_forwardThe following accounts of ABC Manufacturing Co. appeared in its balance sheets on December 31, 2013 and December 31, 2014: Materials inventory Work in process inventory Finished goods inventory 2013 P60,000 34,000 46,000 Materials used Cost of goods sold Direct labor Indirect labor The following amounts appeared in the company's statement of comprehensive income for 2014: P 600,000 1,840,000 410,000 140,000 2014 P90,000 35,000 36,000 REQUIREMENT: Compute for the: a) Amount of raw materials purchased b) Cost of goods manufacturedarrow_forward

- I want to correct answer general accountingarrow_forward. Pan Company's accounting records reflect the following inventories: Dec. 31, 2016 $260,000 160,000 150,000 Raw materials inventory Work in process inventory Finished goods inventory Dec. 31, 2017 $310,000 300,000 190,000 During 2017, $800,000 of raw materials were purchased, direct labor costs amounted to $670,000, and manufacturing overhead incurred was $640,000. The total raw materials available for use during 2017 for Pan Company isarrow_forwardThe following information is available for Crouching Alligator Manufacturing Company for the month ending October 31, 2016: Cost of goods manufactured $450,000 Selling expenses $144,500 Administrative expenses $75,900 Sales $911,250 Finished goods inventory, July 1 $101,250 Finished goods inventory, July 31 $93,800 For the month ended October 31, 2016, determine Crouching Alligators (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forward

- Cille Yuan Manufacturing Company makes only one product. The company has a normal capacity of 32,000 units annually. Cille Yuan is expecting to produce 30,000 units next year but during the year, it actually produced 31,000 units. The company accountant has budgeted the following factory overhead costs for the coming year: Indirect materials P2 per unit 144,000 plus P2 per unit 60,000 plus PO.04 per unit 20,000 plus PO.34 per unit 16,000 plus PO.12 per unit 210,000 per year 50,000 per year 12,000 per year Indirect labor Plant utilities Repairs for the plant Material handling costs Depreciation plant assets Rent of plant building Insurance on plant building Using the most appropriate overhead application based, the applied factory overhead for the year isarrow_forwardProvide solution for this questionarrow_forwardInventory balances for the Jameson Company in October 2018 are as follows: October 1, 2018 October 31, 2018 Raw materials $ 20,000 $21,000 Work in process 48,000 37,200 Finished goods 108,000 90,000 During October, purchases of direct materials were $36,000. Direct labor and factory overhead costs were $60,000 and $84,000, respectively. What is the cost of materials used in production?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education