Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Styles

9

10

11

12 1 13

14 15

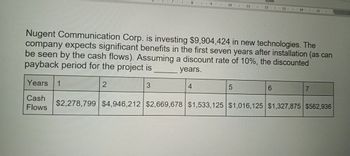

Nugent Communication Corp. is investing $9,904,424 in new technologies. The

company expects significant benefits in the first seven years after installation (as can

be seen by the cash flows). Assuming a discount rate of 10%, the discounted

payback period for the project is

2

3

years.

4

5

6

7

Years

1

Cash

Flows

$2,278,799 $4,946,212 $2,669,678 $1,533,125 $1,016,125 $1,327,875 $562,936

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Please provide Answer need HeLparrow_forwardNeed Solutionarrow_forward- B tyfes 9 10 8 11 12 13 14 15 Nugent Communication Corp. is investing $9,904,424 in new technologies. The company expects significant benefits in the first seven years after installation (as can be seen by the cash flows). Assuming a discount rate of 10%, the discounted payback period for the project is Years 1 Cash years. HSSE 5 6 話 Flows 21 KON KEYNES $2,278,799 $4,946,212 $2,669,678 $1,533,125 $1,016,125 $1,327,875 $562,936 ** 路 59 维arrow_forward

- Consider the following investment project: n An I0 -$8,500 9%1 $4,400 12%2 $4,400 10%3 $1,500 13%4 $3,500 12%5 $4,300 10%Suppose, as shown in the preceding table, that the company's reinvestment opportunities (that is, its MARR) change over the life of the project. For example, the company can invest funds available now at 9% for the first year, 12% for the second year, and so forth. Calculate the net present worth of this investment, and determine its acceptability.arrow_forwardWhat is the net present value of a project that has an initial cost of $40,000 and produces cash inflows of $8,500 a year for 10 years if the discount rate is 13 percent? $4,678.09 $6,500.00 $6,123.07 $7,189.34 $6,712.03arrow_forwardCoughlin Motors is considering a project with the following expected cash flows:Year Project Cash Flow0 -$700 million1 200 million2 370 million3 225 million4 700 millionThe project's WACC is 10 percent. What is the project's discounted payback?a. 3.15 yearsb. 4.09 yearsc. 1.62 yearsd. 2.58 yearse. 3.09 yearsarrow_forward

- 6. Anderson Motors Inc. is contemplating building a new plant. The company anticipates that the plant will require an initial investment of $2 million in net working capital today. The plant will last 10 years, at which point the full investment in net working capital will be recovered. Given an annual discount rate of 6%, what is the net present value of this working capital investment? -$883,210 $503,110 -$598,983 -$2,000,000arrow_forwardQ9arrow_forwardConsider a project with the following information: Year 1 2 3 4 5 6 Initial outlay= $950,000 Compute the NPV if the company's discount rate is 10%. 1) $268,244 2) $201,650 3) $213,050 $129 After-tax cash flows $300,000 $400,000 $400,000 $200,000 $150,000 $150,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning