Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Kindly help me with accounting questions

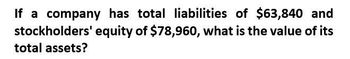

Transcribed Image Text:If a company has total liabilities of $63,840 and

stockholders' equity of $78,960, what is the value of its

total assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the value of total assets?arrow_forwardScare Train, Inc. has the following balance sheet statement items: current liabilities of $779,470; net fixed and other assets of $1,329,896; total assets of $3,237,746; and long-term debt of $621,991. What is the amount of the firm's net working capital?arrow_forwardIf a company computes its current ratio to be 3.56, what does this mean interms of the company’s current assets and current liabilities?arrow_forward

- What is the value of its total assets on these financial accounting question?arrow_forwardThe company’s profitability on each dollar invested in assets is represented by which of the following ratios: a. Profit margin. b. Asset turnover. c. Return on assets. d. Return on equity.arrow_forwardA company has net working capital of $2,287, current assets of $6,525, equity of $22,305, and long-term debt of $10,565. What is the company's net fixed assets?arrow_forward

- Arredondo, Inc., has current assets of $394, net fixed assets of $17,137, current liabilities of $4,228, and long-term debt of $8,254. How much is net working capital?arrow_forwardWhich of the following should be used when calculating the weights for a company's capital structure? OA. Historic accounting values OB.Book values OC. Current market values OD. Par and face valuesarrow_forwardWhat are the annual sales for a firm with $116,044 in total liabilities, a total debt ratio of 0.48, and an asset turnover of 4.75?arrow_forward

- use the following information to make a Common size income statementarrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardWhat is the company's debt to equity ratio of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT