EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hi teacher please help me this question general accounting

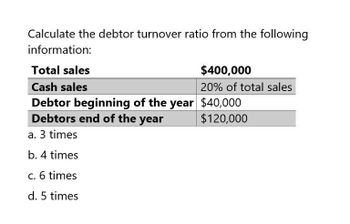

Transcribed Image Text:Calculate the debtor turnover ratio from the following

information:

Total sales

Cash sales

$400,000

20% of total sales

Debtor beginning of the year $40,000

Debtors end of the year

$120,000

a. 3 times

b. 4 times

c. 6 times

d. 5 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- COMPUTE FOR THE FOLLOWING ACCOUNTS: (THE BALANCE SHEET SHOULD BALANCE) (In Pesos) Annual Credit Sales 1,800,000 Cash 32,720 Gross Profit Margin 25% Marketable Sec. 25,000 Inventory Turnover 6 Accounts Receivable ? No. of days in a year 365 Inventories ? Average Collection Period 45 days Total Current Assets ? Current Ratio 1.6 Net Fixed Assets ? Total Asset Turnover Ratio 1.2 Total Assets ? Debt ratio 60% Accounts Payable 120,000 Notes Payable ? Accruals 20,000 Gross Profit ? Total Current Liabilities ? Long Term Debt ? *ALL SALES ARE CREDIT SALES Stockholders' Equity 600,000 Total Liab. And Equity ?arrow_forwardCalculate the activity and liquidity ratios for P for the year ended 31 December 20X9. Revenue Gross profit Inventory Trade receivables Trade payables Cash Short-term investments Other current liabilities $m 1,867.5 489.3 147.9 393.4 275.1 53.8 6.2 284.3 Current ratio= Current assets Current liabilities Inventory days Inventory days = inventory+ cost of sales × 365 Receivable days Receivable days - receivables + credit sales x 365 Payable days Payable days = payables ÷ credit purchases x 365.arrow_forwardwant answer from optionarrow_forward

- The financial statements of Stone Limited for the most recent two years is shown below. Extract from statement of profit or loss for the year ended 30 April 2019 2018 £'000 £'000 224,000 195,000 (169,200) (136,500) 54,800 58,500 (32,700) (38,040) (10,900) (12,680) (1.900) 9,300 Revenue Cost of sales Gross profit Administrative costs Distribution cost Finance cost-loan note interest Statement of financial position as at 30 April. Assets Non-current assets Current assets: Inventory Trade receivables Cash balance Total assets Equity and liabilities Ordinary share capital Retained earnings £'000 2019 12,800 24,600 1,600 £'000 37,000 39,000 76,000 16,000 26,200 42,200 (1.380) 6,400 2018 £'000 £'000 28,600 9,800 21,600 2,400 33,800 62.400 16,000 18,600 34,600arrow_forwardMaloney Company had net credit sales during the year of $1,200,000 and cost of goods sold of $750,000. The balance in accounts receivable at the beginning of the year was $120,000, and the end of the year it was $180,000. What was the accounts receivable turnover ratio? Question 15 options: A) 6.7 B) 8.0 C) 10.0 D) 5.0arrow_forwardGiven the following items , compute the required ones. REQUIRED COST OF SALES GIVEN Asset Turnover : Gross Margin: 1,2 0,3 NET SALES TOTAL SALES CURRENT ASSETS Fin.Goods InventoryTurnover Av. Finished Goods Inventory 120.000 Working.Capital Cycle Trade Receivables Turnover CURRENT RATIO 200 days 4 AV.TRADE RECEIVABLES TOTAL DEBT Long Term Debt Total Debt / Equity 250.000 TOT.DEBT/ TOTAL SOURCESarrow_forward

- What company is better in the short term investmentarrow_forwardThe financial statements of the Sheffield Corp. reports net sales of $690150 and accounts receivable of $98000 and $31000 at the beginning of the year and end of year, respectively. What is the accounts receivable turnover for Sheffield Corp.? O 22.3 times O 5.4 times O 7.0 times O 10.7 timesarrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forward

- What are the annual sales for adorn with $0.5 M in liabilities a total debt ratio of 0.5 and an asset turnover of 4.0 assume assets remain unchanged?arrow_forwardExamine the selected data over the 5-year period as shown in the table below for Dumbledore Ltd. Item Sales Cost of sales EBIT Interest NPAT Current assets Total assets current liabilities Total liabilities Equity Gross margin Interest coverage Current ratio 2021 $m 286.41 180.03 51.18 37.07 35.13 43.85 226.18 55.99 98.99 127.19 0.37 1.38 0.78 Year 2020 $m 280.80 166.69 51.08 33.70 35.10 43.20 221.75 53.58 91.66 130.09 0.41 1.52 0.81 2019 $m 275.29 154.35 50.98 30.64 35.06 42.56 217.40 51.27 84.87 132.53 0.44 1.66 0.89 2018 $m 269.89 142.91 50.88 27.85 35.03 41.93 213.13 49.06 78.58 134.56 0.47 1.83 U.OJ 2017 $m 264.60 134.19 49.88 25.32 34.51 41.31 206.93 47.40 74.48 132.44 0.49 1.97 0.87 2016 $m 252.00 126.00 48.90 24.00 34.00 40.70 200.90 45.80 70.60 130.30 0.50 2.04 0.89arrow_forwardYou are given the following information. What is your liquidity ratio? Annual disposable income: $45,000 Total liabilities: $17,400 Annual savings: $2,400 Long-term assets: $85,000 Current ratio: 2 Debt-to-asset ratio: 0.2 Select one: a. 0.90 b. 0.56 c. 0.89 d. 0.53arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning