FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

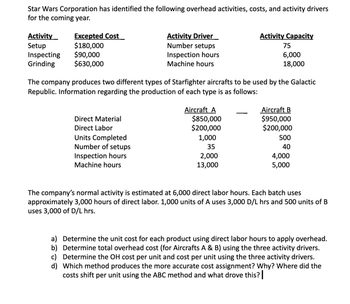

Transcribed Image Text:Star Wars Corporation has identified the following overhead activities, costs, and activity drivers

for the coming year.

Activity

Setup

Inspecting

Grinding

Excepted Cost

$180,000

$90,000

$630,000

Direct Material

Direct Labor

Units Completed

Activity Driver

Number setups

Inspection hours

Machine hours

Number of setups

Inspection hours

Machine hours

The company produces two different types of Starfighter aircrafts to be used by the Galactic

Republic. Information regarding the production of each type is as follows:

Aircraft A

Activity Capacity

$850,000

$200,000

1,000

35

2,000

13,000

75

6,000

18,000

Aircraft B

$950,000

$200,000

500

40

4,000

5,000

The company's normal activity is estimated at 6,000 direct labor hours. Each batch uses

approximately 3,000 hours of direct labor. 1,000 units of A uses 3,000 D/L hrs and 500 units of B

uses 3,000 of D/L hrs.

a) Determine the unit cost for each product using direct labor hours to apply overhead.

b) Determine total overhead cost (for Aircrafts A & B) using the three activity drivers.

c) Determine the OH cost per unit and cost per unit using the three activity drivers.

d) Which method produces the more accurate cost assignment? Why? Where did the

costs shift per unit using the ABC method and what drove this? |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Neely Systems Corporation manufactures and sells various high-tech office automation products. Two divisions of Neely Systems Corporation are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Selling price per chip $50 Variable costs per chip $20 Fixed production costs $60,000 Fixed SG&A costs $90,000 Monthly capacity 10,000 chips External sales 6,000 chips Internal sales 0 chips Presently, the Computer Division purchases no chips from the Computer Chips Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. Refer to Neely Systems Corporation. Two possible transfer prices (for 4,000 units) are under consideration by the two divisions: $35 and $40. Corporate profits would…arrow_forwardSchoen Corp. manufactures three types of electrical motors. Type A is sold upon completion of the production assembly. Types B and C can be sold after production or sent to a different plant for further processing to add various capabilities to the motors. The following data are available for each of the three types of motors at the beginning of the month: Units to be produced Total costs to produce before further processing Total sales revenue if sold immediately Additional processing costs Total sales revenue if processed further Additional profit (or loss) if B is processed further: $ A 10,000 $240,000 300,000 0 0 B 8,000 $250,000 320,000 30,000 340,000 6,000 $240,000 300,000 20,000 360,000arrow_forwardThe cost of operating the Maintenance Department is to be allocated to four production departments based on the floor space each occupies. Department A occupies 600 m²; Department B, 900 m²; Department C, 1200 m²; and Department D, 600 m². If the July cost was $17,600, how much of the cost of operating the Maintenance Department should be allocated to each production department? The operating cost for Department A is $ (Simplify your answer.) The operating cost for Department B is $ (Simplify your answer.) The operating cost for Department C is $ (Simplify your answer.) The operating cost for Department D is $ (Simplify your answer.)arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forwardSpring, Incorporated manufactures two products. It currently has 1,000 hours of direct labor and 2,080 hours of machine time available per month. The following table lists the contribution margin, labor and machine time requirements, and demand for each product: Unit contribution margin Demand Labor time Machine time Product A $21 1, 040 units 3/4 hour 1 hour How much of each product should Spring manufacture per month? Product B $18 2,080 units 1 hour 1/2 hourarrow_forward

- Eclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Assembly Department $280,000 Testing Department 800,000 Total $1,080,000 Direct machine hours were estimated as follows: Assembly Department 4,000 hours Testing Department 5,000 Total 9,000 hours In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: Commercial Residential Assembly Department 2.0 dmh 3.0 dmh Testing Department 6.0 1.5 Total machine hours per unit 8.0 dmh 4.5 dmh…arrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,347,400, divided into four activities: fabrication, $660,000; assembly, $276,000; setup, $224,400; and inspection, $187,000. Bardot Marine manufactures two types of boats: speedboats am bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 11,000 dlh 34,500 dlh 79 setups 138 inspections Bass boat 33,000 11,500 581 962 44,000 dlh 46,000 dlh 660 setups 1,100 inspections Each product is budgeted for 6,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly %$4 per direct labor hour Setup %$4 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat %$4 per unitarrow_forwardErie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Hours 27 minutes Standard Rate per Hour Standard Cost $2.79 $6.20 During August, 9,320 hours of direct labor time were needed to make 19,000 units of the Jogging Mate. The direct labor cost totaled $55,920 for the month. Required: 1. What is the standard labor-hours allowed (SH) to makes 19,000 Jogging Mates? 2. What is the standard labor cost allowed (SH × SR) to make 19,000 Jogging Mates? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is $4.50 per direct labor-hour. During August, the company incurred $44,736 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (For requirements 3 through 5, indicate…arrow_forward

- Scotch Brand Products produces packaging tape and has determined the following to be its standard cost of producing one case of budget packaging tape: Material (3.50 ounces at $1.30 per ounce) $4.55 Labor (0.30 hour at $12.00 per hour) 3.60 Overhead 2.40 Total $10.55 At the start of 2021, Scotch Brand planned to produce 80,000 cases of tape during the year. Overhead is allocated based on the number of cases of tape produced. Annual fixed overhead is budgeted at $64,000 and the variable overhead costs are budgeted at $1.60 per case. The following information summarizes the results for 2021: Actual production, 81,000 cases Purchased 275,000 ounces of material at a total cost of $343,750 Used 266,250 ounces of material in production Employees worked 22,000 hours, total labor cost $275,000 Actual overhead incurred,…arrow_forwardEvergreen Inc. expects to manufacture 4,000 refrigerators during the last quarter of the current year. The company uses activity-based costing to determine the product costs. The manufacturing activities and associated information is provided in the table below. Manufacturing Activities and Associated Information Overhead activities Overhead costs assigned ($) Number of cost driver Material handling 120,000 240,000 Parts Devising 400,000 50,000 Machine hours (MH) Assembling 168,000 240,000 Parts Finishing 240,000 4,000 Finishing hours (FH) Each refrigerator uses 30 parts and requires 5 machine hours and 1 finishing hour during the production process. The direct material costs and direct labor costs required for each refrigerator is $500 and $90, respectively. What would be the overhead rate per finishing hour (FH)? (Round your answer to two decimal points) Group of answer choices $8.00 per FH $0.70 per FH $60.00 per FH $0.50 per FHarrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,207,500, divided into four activities: fabrication, $595,000; assembly, $266,000; setup, $189,000; and inspection, $157,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Inspection Speedboat Bass boat Fabrication Assembly 462 525 setups Each product is budgeted for 7,500 units of production for the year. a. Determine the activity rates for each activity. 17 per direct labor hour 7 per direct labor hour Setup Inspection Fabrication 8,750 dlh $ $ Speedboat Bass boat Assembly Setup 28,500 dlh 9,500 38,000 dlh 26,250 35,000 dlh 63 setups 360 per setup 180 per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. $ per unit $ per unit 109 inspections 766 875 inspectionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education