FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

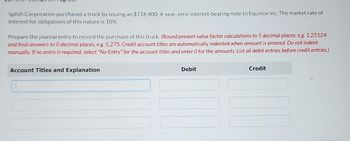

Transcribed Image Text:Splish Corporation purchased a truck by issuing an $118,400, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of

interest for obligations of this nature is 10%.

Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124

and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Madison Company issued an interest-bearing note payable with a face amount of $25,800 and a stated interest rate of 8s to the Metropolitan Bark on August 1, Year 1. The note carried a one year term. Based on this information alone, the amount of total liablities appearing on Madisoris Year 1 balance sheet would be Select one O A $25,800 OB $27864 OC $26,660 OD $27,004 Denver Co. issued bonds with a face value of $79,000 and a stated interest rate of 7% The bonds have a life of five years and were sold at 103.50. If Denver amortizes discounts and premiums using the straight ine method, the amount of interest expense each full year would be Select one O A S6083. OB. $5530. OC S4977. OD $5724. Victor Company issued bonds with a $400,000 face value and a 3% stated rate of interest on January 1, Year 1. The bonds carried a Syear term and sold for 93. Victor uses the straight-line method of amortization. Interest is payable on December 31 of each year. The carrying value of the bond…arrow_forwardOn January 1 of Year 1, Bryson Company obtained a $147,750, 4-year, 7% installment note from Campbell Bank. The note requires annual payments of $43,620, beginning on December 31 of Year 1. Question Content Area a. Prepare a table for this installment note, similar to the one presented in Exhibit 4. Enter all amounts as positive numbers. (Note: Due to rounding, the Year 4 Interest expense is provided.) Round the computation of the interest expense to the nearest whole dollar. If an amount box does not require an entry, leave it blank. b. Journalize the entries for the issuance of the note and the four annual note payments. If an amount box does not require an entry, leave it blank.arrow_forwardSpring Designs & Decorators issued a 180-day, 6% note for $76,800, dated April 13 to Jaffe Furniture Company on account. Required: A. Determine the due date of the note. B. Determine the maturity value of the note. Assume a 360-day year when calculating interest. C. Journalize the entries to record the following: (1) receipt of the note by Jaffe Furniture and (2) receipt of payment of the note at maturity. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Jaffe Furniture Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Spring Designs & Decorators 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment…arrow_forward

- BBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forwardCullumber Company borrowed $313,000 on January 1, 2022, by issuing a $313,000, 10% mortgage note payable. The terms call for annual installment payments of $54,000 on December 31. (a) Prepare the journal entries to record the mortgage loan and the first two installment payments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit ILOR Credarrow_forwardCrane Taco Company receives a $94,500, 6-year note bearing interest of 8 % (paid annually) from a customer at a time when the discount rate is 10%. Click here to view the factor table. What is the present value of the note received by Crane? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Present value of note received e Textbook and Media Save for Later $ Attempts: unlimited Submit Answerarrow_forward

- Detwiler Orchard issues a $558,020, 10%, 15-year mortgage note to obtain needed financing for a new lab. The terms call for semiannual payments of $36,300 each.Prepare the entries to record the mortgage loan and the first installment payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places e.g. 8,970.) Account Titles and Explanation Debit Credit (To record mortgage loan)arrow_forwardLeon Acrobats lent $12,174 to Donaldson, Inc., accepting Donaldson's 2-year, $15,000, zero-interest-bearing note. The implied interest rate is 11%. Prepare Leon's journal entries for the initial transaction, recognition of interest each year, and the collection of $15,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) Debit Credit [] |||||arrow_forwardwhat is notes recievable for On December 31;2025, Blue Inc. rendered services to Beghun Corporation at an agreed price of $106,641, accepting $41,800 down and agreeing to accept the balance in four equal installments of $20,900 receivable each December 31 . An assumed interest rate of 11% is imputed. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Danali Corporation borrowed $400,000 on October 1. The note carried a 13 percent interest rate with the principal and interest payable on May 1 of next year. Prepare the following journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardPlease solve with Full details and Do not give solution in image formatarrow_forwardBramble Company purchased a building on January 2 by signing a long-term $606000 mortgage with monthly payments of $5100. The mortgage carries an interest rate of 10 percent. The entry to record the first monthly payment will include a credit to the Mortgage Payable account for $5100. O credit to the Cash account for $5050. O debit to the Interest Expense account for $5050. O debit to the Cash account for $5100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education