FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

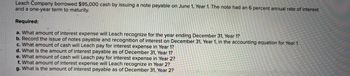

Transcribed Image Text:Leach Company borrowed $95,000 cash by issuing a note payable on June 1, Year 1. The note had an 6 percent annual rate of interest

and a one-year term to maturity.

Required:

a. What amount of interest expense will Leach recognize for the year ending December 31, Year 1?

b. Record the issue of notes payable and recognition of interest on December 31, Year 1, in the accounting equation for Year 1.

c. What amount of cash will Leach pay for interest expense in Year 1?

d. What is the amount of interest payable as of December 31, Year 1?

e. What amount of cash will Leach pay for interest expense in Year 2?

f. What amount of interest expense will Leach recognize in Year 2?

g. What is the amount of interest payable as of December 31, Year 2?

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Dan Dayle started a business by issuing an $98,000 face value note to First State Bank on January 1, Year 1. The note had a 8 percent annual rate of interest and a five-year term. Payments of $24,545 are to be made each December 31 for five years. Required: a. What portion of the December 31, Year 1, payment is applied to interest expense and principal? b. What is the principal balance on January 1, Year 2? c. What portion of the December 31, Year 2, payment is applied to interest expense and principal? Note: Round your answers to the nearest dollar amount. a. Interest expense a. Principal b. Principal balance c. Interest expense c. Principalarrow_forwardOn the first day of the fiscal year, Shiller Company borrowed $33,000 by giving a seven-year, 8% installment note to Soros Bank. The note requires annual payments of $6,404, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $2,640 and principal repayment of $3,764. Journalize the entries to record the following: a1. Issued the installment note for cash on the first day of the fiscal year. If an amount box does not require an entry, leave it blank. Cash fill in the blank 9d174cf85026fb7_2 fill in the blank 9d174cf85026fb7_3 Notes Payable fill in the blank 9d174cf85026fb7_5 fill in the blank 9d174cf85026fb7_6 a2. Paid the first annual payment on the note. If an amount box does not require an entry, leave it blank. Interest Expense fill in the blank 6e673f01702302e_2 fill in the blank 6e673f01702302e_3 Notes Payable fill in the blank 6e673f01702302e_5 fill in the blank…arrow_forwardSelkirk Company obtained a $16,000 note receivable from a customer on January 1, 2024. The note, along with interest at 12%, is due on July 1, 2024. On February 28, 2024, Selkirk discounted the note at Unionville Bank. The bank’s discount rate is 15%. Required: Prepare the journal entries required on February 28, 2024, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale.arrow_forward

- Keesha Company borrows $115,000 cash on November 1 of the current year by signing a 180-day, 11%, $115,000 note. 1. On what date does this note mature? 2. & 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 4 On what date does this note mature? (Assume that February has 28 days.) On what date does this note mature?arrow_forwardAbardeen Corporation borrowed $122,000 from the bank on October 1, Year 1. The note had an 6 percent annual rate of interest and matured on March 31, Year 2. Interest and principal were paid in cash on the maturity date. Required a. What amount of cash did Abardeen pay for interest in Year 1? b. What amount of interest expense was recognized on the Year 1 income statement? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) c. What amount of total liabilities was reported on the December 31, Year 1, balance sheet? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) d. What total amount of cash was paid to the bank on March 31, Year 2, for principal and interest? e. What amount of interest expense was reported on the Year 2 income statement? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) a. Amount of cash paid b. Interest expense c. Total liabilities d. Amount of cash…arrow_forwardabardeen corporation borrowed 58,000 from the bank on october 1, year 1. the note had a 4 percent annual rate of interest and matured on march 31, year 2. interest and principal were paid in cash on the maturity date. d. what total amount of cash was paid to the bank on march 31, year 2, for principle and interest? e. what amount of interest expense was reported on the year 2 income statement?arrow_forward

- Keesha Co. borrows $100,000 cash on November 1 of the current year by signing a 150-day, 10%, $100,000 note. 1. On what date does this note mature? 2. & 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 4 On what date does this note mature? (Assume that February has 28 days.) On what date does this note mature?arrow_forwardLinstrum Company received a 60-day, 6% note for $28,000, dated July 23, from a customer on account. Required: a. Determine the due date of the note. b. Determine the maturity value of the note. Assume 360 days in a year. Do not round your intermediate calculations and round your final answer to the nearest dollar. c. Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardAbardeen Corporation borrowed $118,000 from the bank on October 1, Year 1. The note had an 6 percent annual rate of interest and matured on March 31, Year 2. Interest and principal were paid in cash on the maturity date. Required a. What amount of cash did Abardeen pay for interest in Year 1? b. What amount of interest expense was recognized on the Year 1 income statement? Note: Do not round intermediate calculations. Round your answer to the nearest dollar amount. c. What amount of total liabilities was reported on the December 31, Year 1, balance sheet? Note: Do not round intermediate calculations. Round your answer to the nearest dollar amount. d. What total amount of cash was paid to the bank on March 31, Year 2, for principal and interest? e. What amount of interest expense was reported on the Year 2 income statement? Note: Do not rbund intermediate calculations. Round your answer to the nearest dollar amount. a. Amount of cash paid b. Interest expense c. Total liabilities d.…arrow_forward

- A company issues a note receivable in place of an outstanding accounts receivable balance. The note is issued March 1. The amount of the note is $10,000, the interest rate is 4.5% and the term is 2 months. When the note matures May 1, the note plus the interest is paid. Assuming the accounts receivable replacement with the note, and the payment of the note all occurred in the same fiscal year, what impact does this have on the year's financial statements? O no overall impact on assets or profit for the year O total assets increase by $10,000 and profit increases by $75 O total assets and profits increase by $75 O total assets increase by $75 and profit decreases $10,000arrow_forwardOn May 31, Baker Co. issued an $35,679, 8%, 120-day note payable to Samunck Co. Assume Baker's fiscal year ends on June 30. Assume a 360- day year for your calculations. a) What is the interest EXPENSE recognized by Baker in the current fiscal year? b) What is the maturity value of the note? c) What is the maturity date of the note?arrow_forwardBBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education