FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

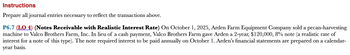

Transcribed Image Text:Instructions

Prepare all journal entries necessary to reflect the transactions above.

P6.7 (LO 4) (Notes Receivable with Realistic Interest Rate) On October 1, 2025, Arden Farm Equipment Company sold a pecan-harvesting

machine to Valco Brothers Farm, Inc. In lieu of a cash payment, Valco Brothers Farm gave Arden a 2-year, $120,000, 8% note (a realistic rate of

interest for a note of this type). The note required interest to be paid annually on October 1. Arden's financial statements are prepared on a calendar-

year basis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 2020 Giant Jumbo Clown Costumes borrowed money from Second Friendly National Bank by issuing a $125,000, 180-day, non-interest bearing note. The note was discounted on a 13.5% basis. Assume 360 days in a year. Required: Compute the following: 1. How much money did Giant Jumbo receive? 2. What was the total amount of interest paid? 3. What is the effective 180-day interest rate on this note payable? 4. What is the approximate annual effective interest rate on this note payable? 5. Record the journal entry(ies)for the issuance of the note.arrow_forwardRequired information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $122,400 on December 31, 2022. The proceeds of the note were $116,400. c. 1. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1, 2022. 2. Record the journal entry to show the effects of recording interest expense for the month of September. 3. Record the journal entry to show the effects of repaying the note on December 31, 2022. Complete this question by entering your answers in the tabs below. Required C1 Required C2 Required C3 Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1arrow_forward6. On December 31, 2010, Chelsea Co. provides a service for its customer Villas Boas Co. inexchange for a promissory note requiring five annual payments of $1,000 each. The paymentsare to occur on December 31 of each year beginning on December 31, 2011. The note does notspecify any interest, and there is no market for the note. Based on the credit worthiness of VillasBoas Co. and the length of the note, it is estimated that Villas Boas Co. would have to pay 10%interest if it borrowed a similar amount from a bank. The amount of interest revenue recognizedby Chelsea for the year ended December 31, 2013 is:a. $174b. $249c. $317d. $347arrow_forward

- vxccvgdrrrrrarrow_forwardPlease provide correct solutionarrow_forward. On April 30, 2022, Lenny Inc. borrowed $10 million cash from Colonial Bank and issued a 5-month, noninterest-bearing note, priced to yield an effective interest rate of 10%. The stated discount rate on this loan is: A. More than the effective interest rate. B. Less than the effective interest rate. C. Equal to the effective interest rate. D. Unrelated to the effective interest ratearrow_forward

- On January 1, 2024, Evanston Corporation borrowed $7 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $2,570,460 on December 31 of each year. The payments include interest at a rate of 5%. Required: 1. Record the cash received when the note is issued. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000).) View transaction list Journal entry worksheet < 1 Record the receipt of cash from the issue of the note payable. Note: Enter debits before credits. Date January 01, 2024 Cash Notos Davahin General Journal Debit Creditarrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardCrane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forward

- A loan of $10,000 is taken out on November 7, 2020 at a simple interest rate of r = 9%. The loan will be paid back on May 11, 2021. If the bank uses ordinary interest (the Banker's Rule), how much interest is charged? a $450.00 b $456.16 c $443.84 d $462.50arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. $ b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardOn January 1, 2023, Karen Hong lent $64612 to Ben Bachu. A zero-interest-bearing note (face amount, $86000) was exchanged solely for cash; no other rights or privileges were exchanged. The note is to be repaid on December 31, 2025. The market rate of interest for a loan of this type is 10%. To the nearest dollar, and using the effective interest method, how much interest revenue should Ms. Hong recognize in 2023? $19383 $6461 $25800 ○ $8600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education