EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

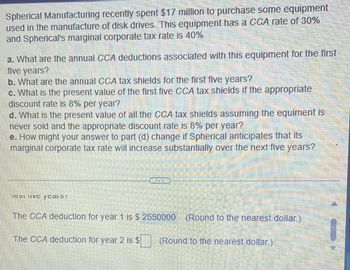

Transcribed Image Text:Spherical Manufacturing recently spent $17 million to purchase some equipment

used in the manufacture of disk drives. This equipment has a CCA rate of 30%

and Spherical's marginal corporate tax rate is 40%.

a. What are the annual CCA deductions associated with this equipment for the first

five years?

b. What are the annual CCA tax shields for the first five years?

c. What is the present value of the first five CCA tax shields if the appropriate

discount rate is 8% per year?

d. What is the present value of all the CCA tax shields assuming the equiment is

never sold and the appropriate discount rate is 8% per year?

e. How might your answer to part (d) change if Spherical anticipates that its

marginal corporate tax rate will increase substantially over the next five years?

11131 IVC ycaib!

The CCA deduction for year 1 is $ 2550000 (Round to the nearest dollar.)

The CCA deduction for year 2 is $ (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Spherical Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 30% and Spherical's marginal corporate tax rate is 29%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 8% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 8% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What are the annual CCA deductions associated with this equipment for the first five years? The CCA deduction for year 1 is $ (Round to the nearest dollar.)arrow_forwardSpherical Manufacturing recently spent $19 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 25% and Spherical's marginal corporate tax rate is 38%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 10% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 10% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years?arrow_forwardSpherical Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 30% and Spherical's marginal corporate tax rate is 36%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 12% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 12% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What are the annual CCA deductions associated with this equipment for the first five years? The CCA deduction for year 1 is $ (Round to the nearest dollar.) Question Viewerarrow_forward

- Spherical Manufacturing recently spent $16 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 45% and Spherical's marginal corporate tax rate is 34% a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 12% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 12% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What are the annual CCA deductions associated with this equipment for the first five years? The CCA deduction for year 1 is $3600000 (Round to the nearest dollar) The CCA deduction for year 2 is $ (Round to the…arrow_forwardSpherical Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 25%, and Spherical's marginal corporate tax rate is 35% a What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 10% per year? d. What is the present value of all the CCA tax shields, assuming the equipment is never sold and the appropriate discount rate is 10% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years?arrow_forwardround to nearest dollararrow_forward

- The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $299,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $181,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $ (Round to the nearest dollar.)arrow_forwardThe Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $298,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $179,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $ (Round to the nearest dollar) b. If Jones sells the equipment today for $179,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? The total after-tax proceeds from the sale will be $. (Round to the nearest dollar.)arrow_forwardGenesis Corporation want to purchase a piece of machinery for $150,000 that will cost $20,000 to have it delivered and installed. Based on past information, they believe they can sell the machinery for $25,000 in 5 years. The company’s marginal tax rate is 34%. If the applicable CCA rate is 20% and the required return on this project is 15%, what is the present value of the CCA tax shield?arrow_forward

- C Corp. faces a marginal tax rate of 35 percent. One project that is currently under evaluation has a cash flow in the fourth year of its life that has a present value of $10,000 (after-tax). C Corp. assumes that all cash flows occur at the end of the year and the company uses 11 percent as its discount rate. What is the pre-tax amount of the cash flow in year 4? (Round to the nearest dollar.) * A. $15,181 B. $23,356 C. $9,868 D. $43,375arrow_forwardb) You purchase equipment for $50,000 and it costs $5,000 to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $8,500 when you are done with it in 3 years. The company's marginal tax rate is 20%. If the applicable CCA rate is 10% and the required return on this project is 5%, what is the present value of the CCA tax shield by using the formula (10 Marks) IdTc 1+0.5r 1 PV tax shield on CCA Hea d+r 1+r d+r (1 + r)" redictions: On Ps video DELLarrow_forwardC Corp. faces a marginal tax rate of 35 percent. One project that is currently under evaluation has a cash flow in the fourth year of its life that has a present value of P10,000 (after-tax). C Corp. assumes that all cash flows occur at the end of the year and the company uses 11 percent as its discount rate. What is the pre-tax amount of the cash flow in year 4? (Round final answer to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning