FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

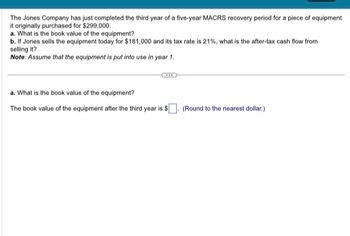

Transcribed Image Text:The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $299,000.

a. What is the book value of the equipment?

b. If Jones sells the equipment today for $181,000 and its tax rate is 21%, what is the after-tax cash flow from selling it?

**Note:** Assume that the equipment is put into use in year 1.

---

**a. What is the book value of the equipment?**

The book value of the equipment after the third year is $_____. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $302,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $184,000and its tax rate is 21%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $____ (Round to the nearest dollar.) b. If Jones sells the equipment today for $184,000 and its tax rate is 21%, What is the after-tax cash flow from selling it? The total after-tax proceeds from the sale will be $____ (Round to the nearest dollar.)arrow_forwardThe Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $298,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $179,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $ (Round to the nearest dollar) b. If Jones sells the equipment today for $179,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? The total after-tax proceeds from the sale will be $. (Round to the nearest dollar.)arrow_forwardWhat is the expected after - tax cash flow from selling a piece of equipment if Probst purchases the equipment today for $548, 860.00, the tax rate is 39.9 percent, the equipment will be sold in 3 years for $98, 800.00, and the equipment will be depreciated to $72, 600.00 over 12 years using straight - line depreciation? $106, 885.74 (plus or minus $10) $262, 538.29 (plus or minus $10) - $72, 688.20 (plus or minus $10) $230,867.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

- What is the expected after-tax cash flow from selling a piece of equipment if TwoPlus purchases the equipment today for $143,000.00, the tax rate is 23.00 percent, the equipment is sold in 2 years for $36,500.00, and MACRS depreciation is used where the depreciation rates in years 1, 2, 3, 4, and 5 are 20%, 32%, 19%, 12%, and 10%, respectively? O $17,102.80 (plus or minus $10) $37,643.10 (plus or minus $10) $50,470.20 (plus or minus $10) $43,892.20 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardNeed all three parts.....don't attempt if you will not solve all three partsarrow_forwardUrgent pleasearrow_forward

- Company A purchases P200,000 of equipment in year zero. It decides to use straight line depreciation over the expected 20 year life of the equipment. The interest rate is 14%. If its average tax rate is 40%, what is the present worth of the depreciation tax held?arrow_forward4arrow_forwardAn asset purchased today at a cost of $50,000 is depreciated straight-line down to value 0 over a period of 5 years, for tax purposes. Suppose the asset is sold at a price of $30,000 at the end of 2 years. What is the after-tax cash inflow from salvage (selling the asset), assuming a tax rate of 40%? a) $30,000 b) $26,000 c) $38,000 d) $20,000 e) None of the abovearrow_forward

- Sandhill Corporation just purchased computing equipment for $22,000. The equipment will be depreciated using a five-year MACRS depreciation schedule. If the equipment is sold at the end of its fourth year for $14,000, what are the after-tax proceeds from the sale, assuming the marginal tax rate is 35 percent? (Round answer to 2 decimal places, e.g. 15.25.)arrow_forwardCan you answer this general accounting question?arrow_forwardThank you in advance!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education