International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

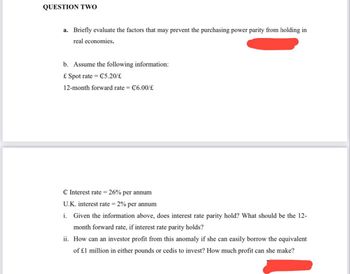

Transcribed Image Text:QUESTION TWO

a. Briefly evaluate the factors that may prevent the purchasing power parity from holding in

real economies.

b. Assume the following information:

£ Spot rate = C5.20/€

12-month forward rate = C6.00/£

C Interest rate = 26% per annum

U.K. interest rate = 2% per annum

i. Given the information above, does interest rate parity hold? What should be the 12-

month forward rate, if interest rate parity holds?

ii. How can an investor profit from this anomaly if she can easily borrow the equivalent

of £1 million in either pounds or cedis to invest? How much profit can she make?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose the dollar interest rate and the pound sterling interest rate are the same, 6 percent per year. What is the relation between the current equilibrium dollar/pound exchange rate and its expected future level? O A. Expected dollar/pound exchange rate is higher than the current one. O B. Expected dollar/pound exchange rate is lower than the current one. C. Expected dollar/pound exchange rate is equal to the current one. O D. One cannot tell given the information above. Suppose the expected future exchange rate, $1.44 per pound, and the US interest rate remain constant, while Britain's interest rate rises to 8 percent per year. What is the new equilibrium dollar/pound exchange rate? New equilibrium exchange rate is $ per pound. (Enter your response to the nearest penny.)arrow_forwardMarket observes the “exchange rates” as of today:($1/$0)=0.95 , ($2/$0)=0.87 1. What is the implied interest rate between time t=0 and t=2 ? 2. Now there is a project with three certain cashflows:CF0=−$10MMCF1=$5MMCF2=$7MMWhat is NPV0? 3. How much is CF1 worth at t=2?arrow_forwardAssume that interest rate parity holds and that 90-day risk-freesecurities yield a nominal annual rate of 3% in the United States and a nominal annual rateof 3.5% in the United Kingdom. In the spot market, 1 pound = $1.29.a. What is the 90-day forward rate?b. Is the 90-day forward rate trading at a premium or a discount relative to the spot rate?arrow_forward

- Question Il: Suppose that the exchange rate is $0.92/e. Let rs= 4%, and re= 3%, u = 1.2, d = 0.9, T = 0.75, number of binomial periods = 3, and K = $1.00 Use Binomial Option pricing to answer the following two questions. (a) What is the price of a 9-month European call? (b) What is the price of a 9-month American call?arrow_forwardSuppose current one-year interest rate in Europe is 5%, whereas one-year interest rate in the U.S. is 3%. Assume the current spot price of euro (EUR) is $1.10. Answer questions a) and b) below. If the exchange rate movement is consistent with the international Fisher effect (IFE), what will the spot price of EUR in one year be? Consider a trader who does not believe the IFE holds. The trader has decided to borrow $110,000 to invest in EUR-denominated deposits for one year without hedging. Recall the current EUR spot rate is $1.10. If the EUR spot rate in one year turns out to be $1.09, what will be the percentage return on this trading strategy?arrow_forwardAssume that spot rate of New Zealand dollar is AUD 0.64/NZD, the 1-year forward rate of New Zealand dollar is AUD 0.62/NZD, 1-year interest rate on NZD is 9% and 1-year interest rate on AUD is 6%. If there is a possible arbitrage opportunity, the appropriate arbitrage strategy should be and the rate of return from covered interest arbitrage would be arbitrage; %. Select one: a. Inward; 0.38 b. Outward; 9.42 c. Inward; 9.42 d. Outward; 0.38arrow_forward

- 2. If the current inflation rate is 3.6% and you have an investment opportunity that pays 10.9%, then what is the real rate of interest on your investment? Please use both exact formula and approximate formula.arrow_forwardIt is given that dP/dt = rP (r being the annually compounded interest rate and P is the amount in the account at any given time). Suppose that an account earns at an annual rate of r percent compounded continuously and a person is drawing an income of H dollars per year withdrawn continuously (impossible, but a modeling assumption). Use phase line analysis to analyze the behavior of the account. Discuss the meaning of any equilibrium points and their stability. If r = 10% (a reasonable rate for long-term stock investments), and H = $10,000, how long should an initial investment of $50,000 be left untouched so that when withdrawals begin the capital is not depleted?arrow_forwardThis is part a) question and it's answer in order to answer part b) question Question: You hold a consol that pays a coupon C in perpetuity. The current interest rate is i, and the average expectation in the market is that this will remain unchanged. What will be the price of the consol today? answer : According to the question we need to calculate the current price of the perpetual consol. Perpetual consoles are priced differently because their expected income is spread through an indefinite period. So, perpetual consoles are priced using the current yield. The current yield is calculated as:- coupon amountMarket price×100coupon amountMarket price×100 After calculating the current yield price is calculated by the above formula where, i = Current interest rate y = yield so, the price of this consol will be Price = i/y I please need the solutions for part b) question b) In the next period however, the interest rate changes unexpectedly to i . What is the new price of the bond? If…arrow_forward

- Use the following information about today's U.S. Treasury STRIP yield curve to answer questions 19-21. One year spot rate Two year spot rate Three year spot rate 1.95 % p.a. 2.30% p.a. 2.45% p.a. 19. What is the market consensus expectation of one year spot rates for delivery one year from now? a. 1.95% p.a. b. 2.65% p.a. c. 2.70% p.a. d. 2.30% p.a. e. 2.75% p.a. 20. What is the market consensus expectation of one year spot rates for delivery two years from now? a. 1.95% p.a. b. 2.65% p.a. c. 2.70% p.a. d. 2.30% p.a. e. 2.75% p.a. 21. How is the one year spot rate expected to change over the next year? a. An increase of 8 basis points. b. An increase of 50 basis points. c. A decrease of 5 basis points. d. An increase of 70 basis points. e. An increase of 35 basis points.arrow_forwardUsing the UIP equation, assume that the expected future rate (after one year) for euros (in terms of dollars) equals $1.20, while the current spot rate is 1.15. The current interest rate on euro deposits is 2%, and the interest rate on dollar deposits is 3%. Should you invest in the US or in Europe? Neither one In the US In Europe It is indifferentarrow_forwardCurrently, you canexchange 1 euro for 1.25 dollars in the 180-dayforward market, and the risk-free rate on 180-daysecurities is 6% in the United States and 4% inFrance. Does interest rate parity hold? If not, whichsecurities offer the highest expected return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you