Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

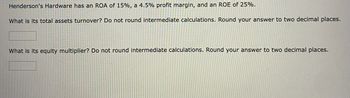

Transcribed Image Text:Henderson's Hardware has an ROA of 15%, a 4.5% profit margin, and an ROE of 25%.

What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places.

What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 9. The Merriam Company has determined that its return on equity is 15 percent. Management is interested in the various components that went into this calculation. You are given the following information: total 0.35 and total assets turnover = 2.8. What is the profit margin? debt/total assets = a. b. C. d. e. 3.48% 5.42% 6.96% 2.45% 12.82% 'c qurrent assets?arrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 15.5 percent. What is its assets turnover? Note: Round your answer to 2 decimal places. Assets turnover ratio b. If the Butters Corporation has a debt-to-total-assets ratio of 25.00 percent, what would the firm's return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. Return on equity % Return on equity times c. What would happen to return on equity if the debt-to-total-assets ratio decreased to 20.00 percent? Note: Input your answer as a percent rounded to 2 decimal places. $arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.58, total asset turnover of 1.80, and a profit margin of 6.8 percent, what is its ROE?arrow_forward

- Ladders, Inc. has a net profit margin of 5.4% on sales of $49.3 million. It has book value of equity of $41.7 million and total book liabilities of $29.2 million. What is Ladders' ROE? ROA? Note: Assume the value of Interest Expense is equal to zero. What is Ladders' ROE? Ladders' ROE is%. (Round to two decimal places.)arrow_forwardDuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardCan you please check my workarrow_forward

- ROE Needham Pharmaceuticals has a profit margin of 3.5% and an equity multiplier of 1.5. Its sales are $100 million and it has total assets of $60 million. What is its Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardRed Fire has an equity multiplier of 1.6, a return on assets of 10.35 percent, and an asset turnover of .9. What is its ROE?arrow_forwardJack Corp. has a profit margin of 4.0 percent, total asset turnover of 2.1, and ROE of 16.42 percent. What is this firm’s debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- 7. Frank's Used Cars has sales of $860316, total assets of $670249, and a profit margin of 0.12. The firm has an equity multiplier of 2.4. What is the return on equity? a. 0.29 b. 0.37 c. 3.08 d. 0.22arrow_forwardA firm has a profit margin of 4% and an equity multiplier of 1.8. Its sales are $370 million, and it has total assets of $111 million. What is its ROE? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 2.46, total asset turnover of 1.63, current ratio of 2.20, and profit margin of 11.6 percent, then its ROE is _______%. Round it to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education