Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

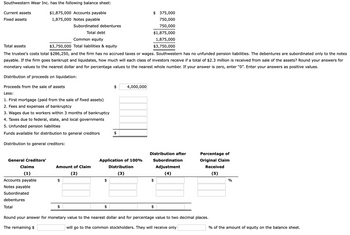

Transcribed Image Text:Southwestern Wear Inc. has the following balance sheet:

Current assets

Fixed assets

$1,875,000 Accounts payable

1,875,000 Notes payable

Subordinated debentures

Total assets

Total debt

Common equity

$3,750,000 Total liabilities & equity

$ 375,000

750,000

750,000

$1,875,000

1,875,000

$3,750,000

The trustee's costs total $286,250, and the firm has no accrued taxes or wages. Southwestern has no unfunded pension liabilities. The debentures are subordinated only to the notes

payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of $2.3 million is received from sale of the assets? Round your answers for

monetary values to the nearest dollar and for percentage values to the nearest whole number. If your answer is zero, enter "0". Enter your answers as positive values.

Distribution of proceeds on liquidation:

Proceeds from the sale of assets

Less:

1. First mortgage (paid from the sale of fixed assets)

2. Fees and expenses of bankruptcy

3. Wages due to workers within 3 months of bankruptcy

4. Taxes due to federal, state, and local governments

5. Unfunded pension liabilities

Funds available for distribution to general creditors

Distribution to general creditors:

$

4,000,000

General Creditors'

Claims

(1)

Accounts payable

Notes payable

Subordinated

debentures

Total

Distribution after

Application of 100%

Subordination

Percentage of

Original Claim

Amount of Claim

(2)

Distribution

(3)

Adjustment

(4)

Received

(5)

%

$

$

Round your answer for monetary value to the nearest dollar and for percentage value to two decimal places.

The remaining $

will go to the common stockholders. They will receive only

% of the amount of equity on the balance sheet.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The summarized balance sheet of WIPRO Itd forthe year ended 31/03/2020 and 31/03/2021 are given below. Prepare funds flow statement. Liabilities Equity share capital General Reserve Pro fit&loss a/c Sundry Creditor Provision for Tax 2020 5,00,000 2,00,000 40,000 1,58,000 45,000 2021 Assets 2020 2021 Land & Building 6,00,000 2,20,000 1,32,000 1,72,000 30,000 1,80,000 Plant and Machinery 2,10,000 80,000 2,00,000 1,70,000 1,03,000 9,43,000 3,00,000 2,76,000 95,000 1,90,000 1,95,000 98,000 11,54,000 Other fixed Assets Stock Debtors Cash at bank Total 9,43,000 The following adjustment the company faces during the year. 11,54,000 Total Dividend Rs. 30,000 was paid during the year. An old machinery costing 1,20.000 was sold for 1,00,000 and the depreciation Rs 50,000.arrow_forwardThe balance sheets for Sports Unlimited for 2021 and 2020 are provided below.SPORTS UNLIMITED Balance Sheets For the years ended December 31 2021 2020AssetsCurrent assets:Cash $ 103,500 $ 70,400Accounts receivable 46,800 32,000Inventory 44,550 71,200Prepaid rent 7,200 3,600Long-term assets:Investment in bonds 54,900 0Land 117,450 141,600Equipment 106,200 102,000Less: Accumulated depreciation (30,600) (20,800)Total…arrow_forwardJamison Corp.'s balance sheet accounts as of December 31, 2021 and 2020 and information relating to 2021 activities are presented below. December 31, 2021 2020 AssetsCash $ 440,000 $ 200,000Short-term investments 600,000 —Accounts receivable (net) 1,020,000 1,020,000Inventory 1,380,000 1,200,000Long-term investments 400,000 600,000Plant assets 3,400,000 2,000,000Accumulated depreciation (900,000)…arrow_forward

- Veltri Incorporated has the following assets and liabilities (assets are stated at net realizable value): Assets pledged with secured creditors $ 80,000 Assets pledged with partially secured creditors 70,000 Other assets 180,000 Secured liabilities 40,000 Partially secured liabilities 95,000 Liabilities with priority 55,000 Unsecured liabilities 225,000 In a liquidation, what is the amount of free assets after payment of liabilities with priority?arrow_forwardThe financial information for ABC company is: Receivables $200,000; Payables $350,000; Inventory $100,000; Non-current assets $750,000; Long-term loan $400,000. A It can be said that for the company ABC the dollar value of Shareholders' funds would be: 750,000 650,000 1,050,000 300,000arrow_forwardMondesto Company has the following debts: Unsecured creditors $ 243,000 Liabilities with priority 123,000 Secured liabilities: Debt 1, $236,000; value of pledged asset 193,000 Debt 2, $198,000; value of pledged asset 113,000 Debt 3, $133,000; value of pledged asset 166,000 The company also has a number of other assets that are not pledged in any way. The creditors holding Debt 2 want to receive at least $170,800. For how much do these free assets have to be sold so that the creditors associated with Debt 2 receive exactly $170,800?arrow_forward

- The following information is available for J Ltd. for the year ended 2021: Net working capital Long-term debt Total assets Fixed assets Calculate the amount of the total liabilities. $6,880 $4,970 $2,480 $460 $4,970 $8,390 $5,910 $6,990arrow_forwardThe comparative balance sheets for Metlock Corporation show the following information. December 312020 2019Cash $33,500 $12,900Accounts receivable 12,400 10,000Inventory 12,100 9,000Available-for-sale debt investments –0– 3,000Buildings –0– 29,800Equipment 44,800 19,900Patents 5,000 6,300 $107,800 $90,900Allowance for doubtful accounts $3,100 $4,500Accumulated depreciation—equipment 2,000 4,500Accumulated depreciation—building –0– 6,000Accounts payable 5,000 3,000Dividends payable –0– 4,900Notes payable, short-term (nontrade) 3,000 4,100Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings 20,700 5,900 $107,800 $90,900 Additional data related to 2020 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500.2. $10,000 of the long-term note payable was paid by issuing common stock.3. Cash dividends paid were $4,900.4. On January…arrow_forwardWhat is the amount of the net fixed assets on these general accounting question?arrow_forward

- Mondesto Company has the following debts: $ 236,000 116,000 Unsecured creditors Liabilities with priority Secured liabilities: Debt 1, $222,000; value of pledged asset Debt 2, $186,000; value of pledged asset Debt 3, $126,000; value of pledged asset 186,000 106,000 152,000 The company also has a number of other assets that are not pledged in any way. The creditors holding Debt 2 want to receive at least $158,800. For how much do these free assets have to be sold so that the creditors associated with Debt 2 receive exactly $158,800? Selling value of free assets MacBook Proarrow_forwardThe trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Gain on debt securities Cost of goods sold Loss on projected benefit obligation Selling expense Goodwill impairment loss Interest expense General and administrative expense Debits Credits $ 8,350,000 55,000 115,000 137,500 $ 155,000 6,155,000 750,000 525,000 25,000 450,000 The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been recorded. The effective tax rate is 25%. Required: Prepare a 2024 separate statement of comprehensive income for Kroeger Incorporated. Note: Amounts to be deducted should be indicated with a minus sign. KROEGER INCORPORATED Statement of Comprehensive Income For the Year Ended December 31, 2024 Net income Other…arrow_forwardABC Industry and Trade Inc. Balance Sheet as of 31.12.2020 (TL) transactions ASSETS(Assets) I-Current Assets Ready Values Securities Commercial debts Stocks Other Current Assets Current Assets Total I-Fixed Assets Financial Fixed Assets Tangible Fixed Assets Total Fixed Assets TOTAL ASSETS 31.12.2020 Amount Vertical Percent (%) 360.000 12 45.000 1.5 870.000 29 840.000 28 255.000 8.5 2.370.000 79 390.000 13 240.000 8. 630.000 21 3.000.000 100 LIABILITIES(RESOURCES) l-Short Term Liv. resources Financial Debts Trade payables Short Term Foreign Resource Total Il-Long-Term Liabilities Financial Debts Long Term Liv. Source Ball. III-Equity Paid-in capital Profit Reserves Net profit for the period Previous Year's profit Total Equity TOTAL LIABILITIES (RESOURCES) 39.000 1.3 120.000 4 159.000 5.3 81.000 2.7 81.000 2.7 120.000 4 420.000 14 1.950.000 65 270.000 9 2.760.000 92 3.000.000 100 Requested: Calculate the vertical percentages of the Balance Sheet items of ABC Sanayi ve Ticaret A.Ş. dated…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education