Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

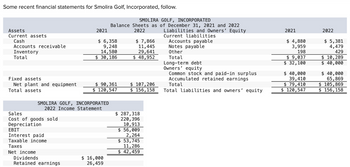

Transcribed Image Text:Some recent financial statements for Smolira Golf, Incorporated, follow.

Assets

Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Net plant and equipment

Total assets

Sales

Cost of goods sold

Depreciation

EBIT

Interest paid

Taxable income

Taxes

2021

SMOLIRA GOLF, INCORPORATED

2022 Income Statement

Net income

Dividends

Retained earnings

$ 6,358

9,248

14,580

$ 30,186

$ 90,361

$ 120,547

Balance Sheets as

2022

$ 16,000

26,459

SMOLIRA GOLF, INCORPORATED

of December 31, 2021 and 2022

Liabilities and Owners' Equity

Current liabilities

Accounts payable

Notes payable

Other

$ 7,866

11,445

29,641

$ 48,952

$ 107,206

$ 156,158

287,318

220, 396

10,913

$ 56,009

2,264

$ 53,745

11, 286

$ 42,459

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Accumulated retained earnings

Total

Total liabilities and owners' equity

2021

$ 4,880

3,959

198

$ 9,037

$ 32,100

$ 40,000

39,410

$ 79,410

$ 120,547

2022

$ 5,381

4,479

429

$ 10,289

$ 40,000

$ 40,000

65,869

$ 105,869

$ 156, 158

Transcribed Image Text:Construct the DuPont identity for Smolira Golf.

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your profit margin

and return on equity answers as a percent.

Profit margin

Total asset turnover

Equity multiplier

Return on equity

%

times

times

%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois Tool Works follows. $ millions 2019 2018 2017 Net operating profit after tax (NOPAT) $2,480 $2,575 Net income 2,395 2,435 Total assets 13,561 13,383 $15,102 Equity 2,723 2,929 2,929 Net operating profit after tax (NOA) 7,982 8,516 9,080 Treasury stock 18,033 16,668 14,784 Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). b. Adjust equity and total assets for the amount of treasury stock. Using these restated numbers, recompute RNOA, ROA and ROE for both years.Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity 2020 2021 Current assets Current liabilities Cash $ 10, 620 $ 13, 275 Accounts payable $ 52, 560 $ 60, 750 Accounts receivable 21,420 29, 925 Notes payable 19, 260 24,075 Inventory 67, 860 82, 575 Total $ 99,900 $ 125, 775 Total $ 71,820 $ 84, 825 Long-term debt $ 36,000 $ 27,000 Owners' equity Common stock and paid - in surplus $ 45,000 $ 45,000 Retained earnings 207, 180 293, 175 Net plant and equipment $ 260, 100 $ 324, 225 Total $ 252, 180 $ 338, 175 Total assets $ 360,000 $ 450,000 Total liabilities and owners' equity $ 360,000 $ 450,000 For each account on this company's balance sheet, show the change in the account during 2021 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter…arrow_forwardThe current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement: REGENT INC. Comparative Balance Sheet Accounts 2024 2023 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory 9,100 12,880 Prepaid expenses 2,100 1,624 Accounts payable 12,040 10,080 Accrued expenses payable 1,400 2,240 Dividends payable 6,720 4,760 Income tax payable 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2024 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses $24,640 Depreciation expense 6,440 Loss on sale of equipment 2,240 33,320 Profit before income tax 32,480 Income tax expense 8,120 Profit for the year $24,360 Instructions Prepare the operating section of the cash flow statement using the direct method.arrow_forward

- Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forwardThe balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets. Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable. Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $91,560. 2. Sales on account are $1,416,800. (All sales are credit sales.) 3. Cost of goods sold is $1,098,500. 2024 $149,560 72,000 92,000 3,700 450,000 760,000 2023 450,000 640,000 (398,000) (238,000) $1,129,260 $1,136,700 $95,400 6,000 8,000 $117,000 89,000 77,000 1,700 $82,000 11,700 4,700 220,000 670,000 148,300 110,000 670,000 239,860 $1,129,260 $1,136,700 Required: 1. Calculate the…arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forward

- Subject: acountingarrow_forwardThe comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 116 $ 95 Accounts receivable 136 140 Short-term investment 47 14 Inventory 137 135 Land 102 125 Buildings and equipment 695 530 Less: Accumulated depreciation (193 ) (140 ) $ 1,040 899 Liabilities Accounts payable $ 40 $ 48 Salaries payable 2 6 Interest payable 8 5 Income tax payable 5 10 Notes payable 0 33 Bonds payable 296 230 Shareholders’ Equity Common stock 390 330 Paid-in capital—excess of par 187 165…arrow_forward1arrow_forward

- Select all that are true with respect to historical data on risk and return in the U.S. financial markets since about 1926, Group of answer choices A portfolio of small stocks has earned higher returns than large stocks, with less risk A portfolio of small stocks has earned higher returns that large stocks, with higher risk Stocks have outperformed government bonds, albeit with higher risk With respect to a diversified stock portfolio, the longer the holding period, the higher the risk. With respect to a diversified stock portfolio, the longer the holding period, the lower the risk.arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forwardHere are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education