FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

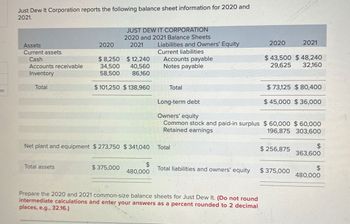

Transcribed Image Text:Just Dew It Corporation reports the following balance sheet information for 2020 and

2021.

JUST DEW IT CORPORATION

2020 and 2021 Balance Sheets

Liabilities and Owners' Equity

Current liabilities

Accounts payable

Notes payable

2020

2021

$ 43,500 $48,240

29,625 32,160

Assets

2020

2021

Current assets

Cash

$ 8,250

$ 12,240

Accounts receivable

34,500

40,560

Inventory

58,500

86,160

Total

$101,250 $ 138,960

Total

es

Long-term debt

Owners' equity

$ 73,125 $ 80,400

$ 45,000 $ 36,000

Common stock and paid-in surplus $60,000 $60,000

Retained earnings

196,875 303,600

$

Net plant and equipment $273,750 $341,040

Total

$ 256,875

363,600

$

Total assets

$375,000

480,000

Total liabilities and owners' equity

$

$375,000

480,000

Prepare the 2020 and 2021 common-size balance sheets for Just Dew It. (Do not round

intermediate calculations and enter your answers as a percent rounded to 2 decimal

places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Current assets Liabilities and Owners' Equity Current liabilities 2020 2021 Cash $12,000 $ 17,775 Accounts payable Accounts receivable 12,750 16,425 Notes payable $46,875 $55,575 19,125 24,750 Inventory 50,250 56,925 Total $75,000 $91,125 Total $66,000 $80,325 Long-term debt $30,000 $27,000 Owners' equity Common stock and paid-in surplus $45,000 $45,000 Retained earnings 234,000 297,675 Net plant and equipment $ 300,000 $ $ 358,875 Total $279,000 342,675 $ $ Total assets $375,000 Total liabilities and owners' equity $375,000 450,000 450,000 Prepare the 2021 common-base year balance sheet for Just Dew It. (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., 32.1616.) Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Liabilities and Owners' Equity 2020 2021 $ 12,000 $ 17,775 12,750 16,425 50,250 56,925 $ 69 75,000 $…arrow_forwardCondensed financial data of Waterway Company for 2020 and 2019 are presented below. WATERWAY COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,790 $1,150 Receivables 1,780 1,330 Inventory 1,620 1,890 Plant assets 1,930 1,700 Accumulated depreciation (1,200 ) (1,180 ) Long-term investments (held-to-maturity) 1,310 1,420 $7,230 $6,310 Accounts payable $1,210 $920 Accrued liabilities 210 240 Bonds payable 1,370 1,530 Common stock 1,860 1,670 Retained earnings 2,580 1,950 $7,230 $6,310 WATERWAY COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,970 Cost of goods sold 4,680 Gross margin 2,290 Selling and administrative expenses 940 Income from…arrow_forwardThe current sections of Vaughn Inc's balance sheets at December 31, 2019 and 2020, are presented here. Vaughn's net income for 2020 was $214,500. Depreciation expense was $48,000. Current assets Cash Accounts receivable Inventory Prepaid expense Total current assets Current liabilities Accrued expenses payable Accounts payable Total current liabilities 2020 2019 128.000 $126.500 $110,500 100.500 165,500 195,000 50,000 32,500 $470,000 $438.500 $38,000 $16.500 96,500 116,000 $134,500 $132,500 Prepare the net cash provided by operating activities section of the company's statement of cash flows for the year ended December 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a sign eg-15,000 or in parenthesis eg. (15,000)) VAUGHN INC. Partial Statement of Cash Flowsarrow_forward

- Font Paragraph Styles The current asset section of the Excalibur Tire Company's balance sheet consists of cash, marketable securities, accounts receivable, and inventory. The December 31, 2021, balance sheet revealed the following: Inventory Total assets Current ratio Acid-test ratio Debt to equity ratio $1,000,000 $3,500,000 2.20 1.20 1.5 Required: Determine the following 2021 balance sheet items: 1. Current assets 2. Shareholders' equity 3. Long-term assets 4. Long-term liabilitiesarrow_forwardAn extract from a computer company's 2021 financial statements follows: Balance sheet As of December 31, 2021 As of December 31, 2020 Total assets 57,699 54,013 Total liabilities 37,682 37,919 Total stockholders' equity 20,017 16,096 What was the company's debt-to- equity ratio for 2021? OA. 2.5 OB. 1.6 O C. 0.9 O D. 1.9arrow_forwardSubject: acountingarrow_forward

- Which of the following statements is TRUE about Verizon's financial statements? verizon Consolidated Balance Sheets (In millions of dollars) As of As of Dec 31, 2020 $ 22,171 Dec 31, 2019 $ 2,594 ASSETS Cash and cash equivalents Accounts receivable 23,917 25,429 Inventories 1,796 1,422 Prepaid expenses and other current assets 6,710 8,028 Total current assets 54,594 37,473 Property and equipment, net Intangible assets Other long-term assets 94,833 91,915 152,814 151,640 10,699 $ 291,727 14,240 Total assets $ 316,481 LIABILITIES & EQUITY Debt maturing within one year $ 5,889 $ 10,777 Accounts payable and accrued liabilities 20,658 21,806 Other current liabilities 13,113 12,285 Total current liabilities 39,660 44,868 Long-term debt 123,173 100,712 Other long-term liabilities 84,376 83,312 Total liabilities 247,209 228,892 Common stock and additional paid in capital 13,833 13,858 Retained earnings 60,464 53,147 Accumulated other comprehensive income (5,025) (4,170) Total shareholders'…arrow_forwardCondensed financial data are presented below for the Tulsa Corporation: Accounts receivable Inventory C. d. Total current assets Total assets Current liabilities Long-term liabilities Sales Cost of goods sold Interest expense Net income Tax rate 2021 $277,500 310,000 675,000 800,000 700,000 250,000 200,000 77,500 75,000 1,640,000 985,000 10,000 130,000 25% 2020 $230,000 250,000 565,000 The profit margin used to calculate return on assets for 2021 is (rounded): a. b. 8.9% 16.3% 17.2% 18.3%arrow_forwardBased on the financial statements provided, compute the following financial ratios. Show your workings and round your figures to 2 decimal places. Ratio 2020 2019 Current Ratio Quick Ratio Debt Ratio (%)arrow_forward

- 1arrow_forwardData from the financial statements of Kroger King and SuperDeal Inc. are presented below (in millions): Kroger King SuperDeal Inc. Total liabilities, 2019 $18,261 $13,549 Total liabilities, 2018 18,052 15,023 Total assets, 2019 23,093 16,436 Total assets, 2018 23,257 17,604 Net sales, 2019 76,733 40,851 Net income, 2019 70 883 To the nearest hundredth of a percent, what is the 2019 profit margin for SuperDeal, Inc.? Select one: a. 2.39% b. 2.90% c. 2.16% d. Not enough information is providedarrow_forward25. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education