FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:mance or pr,200.

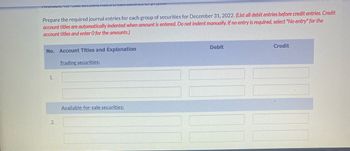

Prepare the required journal entries for each group of securities for December 31, 2022. (List all debit entries before credit entries. Credit

account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the

account titles and enter O for the amounts.)

No. Account Titles and Explanation

Debit

Credit

Trading securities:

Available-for-sale securities:

1.

2.

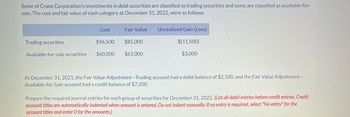

Transcribed Image Text:Some of Crane Corporation's investments in debt securities are classified as trading securities and some are classified as available-for-

sale. The cost and fair value of each category at December 31, 2022, were as follows.

Cost

Fair Value

Unrealized Gain (Loss)

Trading securities

$96,500

$85,000

$(11,500)

Available-for-sale securities

$60,000

$63,000

$3,000

At December 31, 2021, the Fair Value Adjustment-Trading account had a debit balance of $2,100, and the Fair Value Adjustment-

Available-for-Sale account had a credit balance of $7,200.

Prepare the required journal entries for each group of securities for December 31, 2022. (List all debit entries before credit entries. Credit

account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the

account titles and enter O for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of 2018, Terry Company prepared the following schedule of investments in available-for-sale debt securities (all of which were acquired at par value): Company Amortized Cost 12/31/18 Fair Value Cumulative Change in Fair Value Morgan Company $35,000 $34,200 $(800) Nance Company 50,000 53,100 3,100 Totals $85,000 $87,300 $2,300 During 2019, the following transactions occurred: July 1 Purchased Oscar Company debt securities with a par value of 100,000 for $98,000. The securities carry an annual interest rate of 10%, mature on December 31, 2021, and pay interest seminannually on July 1 and December 31. Terry uses the straight-line method to amortize any discounts or premiums. Oct. 11 Sold all of the Morgan Company securities for $33,000 plus interest of $1,300. Dec. 31 Received interest of $6,000 on the Nance Company and Oscar Company debt securities, and the following yearend total market values were available: Nance Company debt securities, $55,000; Oscar…arrow_forwardpleas helparrow_forward3arrow_forward

- At December 31, 2025, the available-for-sale debt portfolio for Pharoah, Inc. is as follows. Security Cost Fair Value Unrealized Gain (Loss) A $17,900 $14,400 $(3,500) B 11,100 14,000 2,900 C 23,300 25,700 2,400 Total $52,300 $54,100 1,800 Previous fair value adjustment balance-Dr. 400 Fair value adjustment-Dr. $1,400 On January 20, 2026, Pharoah, Inc. sold security A for $14,500. The sale proceeds are net of brokerage fees. Pharoah, Inc. reports net income in 2025 of $115,000 and in 2026 of $138,000. Unrealized holding gains or losses equal $41,000 in 2026. (a) Prepare a statement of comprehensive income for 2025, starting with net income. PHAROAH, INC Statement of Comprehensive Income (b) eTextbook and Media Save for Later $ Attempts: 0 of 3 used Submit Answer The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardSubject: acountingarrow_forwardOn its December 31, 2024, balance sheet, Sandhill Company reported its investment in equity securities, which cost $690000, at fair value of $618000. At December 31, 2025, the fair value of the securities was $649000. What should Sandhill report on its 2025 income statement as a result of the increase in fair value of the investments in 2025? O Realized gain of $31000 O Unrealized gain of $31000 O Unrealized loss of $41000 O $0arrow_forward

- Concord Corporation owns corporate bonds at December 31, 2023, accounted for using the amortized cost model. These bonds have a par value of $992,000 and an amortized cost of $ 977,000. After an impairment review was triggered, Concord determined that the discounted impaired cash flows are $914,500 using the current market rate of interest, but are $910,000 using the market rate when the bonds were first acquired. The compary follows a policy of directly reducing the carrying amount of any impaired assets. Assume that no impairment loss had been recorded earlier. (a1) Assuming Concord is a private enterprise that applies ASPE, prepare the journal entry related to the impairment at December 31, 2023.arrow_forwardRiverbed Company has the following investments as of December 31, 2020: ● Investment in common stock of Piedmont Company $738,000 ● Investment in debt securities of Touchdown Company $1,145,000 The carrying value and the fair value of these two investments are the same at December 31, 2020. Riverbed’s stock investment does not result in significant influence on the operations of Piedmont Company. Riverbed’s debt investment is considered held-to-maturity.At December 31, 2021, the shares in Piedmont Company are valued at $487,000; the debt investment securities of Touchdown are valued at $668,000. Assume that these investments are considered impaired. Prepare the journal entries to record the impairment of these two securities at December 31, 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles…arrow_forwardPlease help with problem. At the beginning of 2019, Ace Company had the following portfolio of investments in available-for-sale debt securities (all of which were acquired at par value): Security Cost 1/1/19 Fair Value A $25,000 $31,000 B 38,000 36,000 Totals $63,000 $67,000 During 2019, the following transactions occurred: Transactions: May 3 Purchased C debt securities at their par value for $50,000. July 1 Sold all of the A securities for $31,000 plus interest of $1,000. Dec. 31 Received interest of $1,000 on the B and C securities. Additionally the following information was available: Security 12/31/19 Fair Value B $42,000 C 53,000 Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019? 3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses…arrow_forward

- At December 31, 2020, the available-for-sale debt portfolio for Crane, Inc. is as follows. Security A B C Total Previous fair value adjustment balance-Dr. Fair value adjustment- Dr. Cost $17,500 12,200 500 Fair Value $1,300 $15,000 23,400 25,700 $53,100 $54,900 14,200 Unrealized Gain (Loss) $(2,500 2,000 2,300 1,800 ) On January 20, 2021, Crane, Inc. sold security A for $15,100. The sale proceeds are net of brokerage fees. Crane, Inc. reports net income in 2020 of $118,000 and in 2021 of $143,000. Total holding gains (including any realized holding gain or loss) equal $49,000 in 2021. Prepare a statement of comprehensive income for 2020, starting with net income. Prepare a statement of comprehensive income for 2021, starting with net income. Please show underlying calculations (especially for reclassification adjustment for 2021). I correctly identified the statement of income for 2020, but am stuck on the one for 2021. Thank you!arrow_forwardLoreal-American Corporation purchased several marketable securities during 2021. At December 31, 2021, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2020, and all are considered securities available-for-sale. Cost Fair Value Unrealized HoldingGain (Loss) Short term: Blair, Inc. $ 480,000 $ 405,000 $ (75,000 ) ANC Corporation 450,000 480,000 30,000 Totals $ 930,000 $ 885,000 $ (45,000 ) Long term: Drake Corporation $ 480,000 $ 560,000 $ 80,000 Aaron Industries 720,000 660,000 (60,000 ) Totals $ 1,200,000 $ 1,220,000 $ 20,000 Required:1. Prepare appropriate adjusting entry at December 31, 2021.2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry?arrow_forwardMartinez Company has the following investments as of December 31, 2020: Investments in common stock of Laser Company $1,540,000 Investment in debt securities of FourSquare Company $3,590,000 In both investments, the carrying value and the fair value of these two investments are the same at December 31, 2020. Martinez’s stock investments does not result in significant influence on the operations of Laser Company. Martinez’s debt investment is considered held-to-maturity. At December 31, 2021, the shares in Laser Company are valued at $1,120,000; the debt investment securities of FourSquare are valued at $2,740,000 and are considered impaired. Prepare the journal entry to record the impairment of the debt securities at December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education