FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

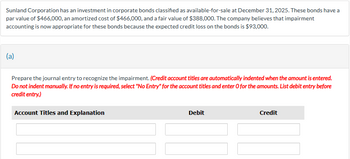

Transcribed Image Text:Sunland Corporation has an investment in corporate bonds classified as available-for-sale at December 31, 2025. These bonds have a

par value of $466,000, an amortized cost of $466,000, and a fair value of $388,000. The company believes that impairment

accounting is now appropriate for these bonds because the expected credit loss on the bonds is $93,000.

(a)

Prepare the journal entry to recognize the impairment. (Credit account titles are automatically indented when the amount is entered.

Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before

credit entry.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Recording Entries for Impairment of Investments–AFS Atlanta Inc. holds an AFS bond investment in Falcons Corporation. The amortized cost of the investment is $84,300 on December 31, 2020. Atlanta Inc. estimates the fair value of the bonds to be $78,000. The unrealized loss of $6,300 is partially due to a credit loss of $4,800, with the remaining portion due to other factors. The company adjusted the AFS bonds to fair value through OCI on December 31, 2020. a. Record the impairment loss on December 31, 2020, assuming that the company does not intend to sell the investment and does not believe it is more likely than not that it will be required to sell the investment before recovery of any unrealized loss. b. Record the impairment loss on December 31, 2020, now assuming that the company intends to sell the investment. • Note: List multiple debits or credits (when applicable) in alphabetical order. Date Account Name Dr. Cr. a. Dec. 31, 2020 Unrealized Gain or Loss--OCI 1500 Allowance for…arrow_forwardOn its December 31, 2023 statement of financial position, Mackeral Ltd. reported bonds payable of $500,000. The bonds had been issued at par. On January 2, 2024, Mackeral retired one half of the outstanding bonds at 101 plus a call premium of $20,000. Ignoring income taxes, what amount should Mackeral report on its 2024 income statement as loss on extinguishment of debt?arrow_forwardJ Marigold, Inc., purchased $372,000 of its bonds at 95 on June 30, 2020, and immediately retired them. The carrying value of the bonds on the retirement date was $360,000. The bonds pay annual interest and the interest payment due on June 30, 2020, has been made and recorded. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 30arrow_forward

- At January 1, 2021, Rothschild Chair Company, Inc., was indebted to First Lincoln Bank under a $20 million, 10% unsecured note. The note was signed January 1, 2018, and was due December 31, 2024. Annual interest was last paid on December 31, 2019. Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare all journal entries by Rothschild Chair Company, Inc., to record the restructuring and any remaining transactions relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $16 million but carried on Rothschild Chair Company’s books at $13 million. 2. First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b) reduce the remaining four…arrow_forwardPharoah Company has these data at December 31, 2022, the end of its first year of operations. Debt Securities Trading Available-for-sale (a) Cost $119,700 100,300 The available-for-sale securities are held as a long-term investment. Fair Value $125,700 98,300 Prepare the adjusting entries to report: (1) Trading securities at fair value and (2) Available-for-sale securities at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation (1) Debit Creditarrow_forwardOn May 1, 2025, Blossom Company issued 2.500 $1.000 bonds at 102. Each bond was issued with one detachable stock warrant Shortly after issuance, the bonds were selling at 99, but the fair value of the warrants cannot be determined. a. Prepare the entry to record the issuance of the bonds and warrants. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts)arrow_forward

- lake Tile Kaman Company paid $165,000 to purchase a portfolio of debt investments on March 1, 2020. Managemer intention is to hold them for less than one year. Management does not intend to hold any debt investment their maturity in this portfolio. Do not enter dollar signs or commas in the input boxes. For transactions with more than one debit or credit, enter the accounts in alphabetical order. Required a) Prepare the journal entry to record the purchase of these debt securities. Date Account Title and Explanation Debit Credit Mar 1 To record purchase of investments b) On March 15, 2020, Kaman Company received interest of $1,600 from the debt investments in this port Prepare the journal entry to record the receipt of interest. Debit Credit Date Account Title and Explanation Warrow_forwardThe following information is available for Tamarisk Corporation's available-for-sale debt securities at December 31, 2020. Security Cost Fair Value X $40,120 $35,400 28,320 37,760 $68,440 $73,160 Prepare the adjusting entry to record the securities at fair value at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardDuring the current year, Reed Consulting acquired long-term available-for-sale debt securities on July 1 at a $70,000 cost. At its December 31 year-end, these securities had a fair value of $58,000. This is the first and only time the company purchased such securities. 1. Prepare the July 1 entry to record the purchase of these debt securities. 2. Prepare the year-end adjusting entry related to these securities. View transaction list Journal entry worksheet 1 2 Record purchase of available-for-sale securities. Note: Enter debits before credits. Date July 01 General Journal Debit Creditarrow_forward

- Req. 4: 1) Record the fair-value adjustment. 2) Record any reclassification adjustment. 3) Record the sale of the investment by Mills.arrow_forwardOn its December 31, 2020 balance sheet, Sunland Company reported bonds payable of $5970000. The bonds had been issued at par. On January 2, 2021, Sunland retired $2985000 of the outstanding bonds at par plus a call premium of $68000. What amount should Sunland report in its 2021 income statement as loss on extinguishment of debt (ignore taxes)? $29000 $0 $34000 $68000arrow_forward9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education