FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

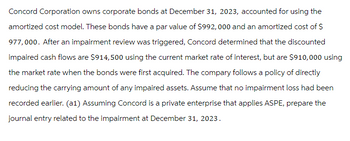

Transcribed Image Text:Concord Corporation owns corporate bonds at December 31, 2023, accounted for using the

amortized cost model. These bonds have a par value of $992,000 and an amortized cost of $

977,000. After an impairment review was triggered, Concord determined that the discounted

impaired cash flows are $914,500 using the current market rate of interest, but are $910,000 using

the market rate when the bonds were first acquired. The compary follows a policy of directly

reducing the carrying amount of any impaired assets. Assume that no impairment loss had been

recorded earlier. (a1) Assuming Concord is a private enterprise that applies ASPE, prepare the

journal entry related to the impairment at December 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Avatar Ltd (Avatar) purchased $55,000 of bonds at par. The bonds has been classified as one to be held at fair value through other comprehensive income. At the maturity date, the principal of bonds is redeemed at par when the carrying amount of the bonds is $54,200. Total cumulative losses previously recognized in Avatar’s other comprehensive income in respect of the bonds are $800 before derecognition. Required: In accordance with HKFRS 9 ‘Financial Instruments’, what is the net effect of the disposal of the bonds to be recognized in profit or loss and balance of fair value reserve after derecognition? A. Profit or loss: $0; Fair value reserve: ($1,600) B. Profit or loss: $800 loss; Fair value reserve: $0 C. Profit or loss: $0; Fair value reserve: $0 D. Profit or loss: $800 gain; Fair value reserve: $0arrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2018. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. Company management has classified the bonds as available-for-sale investments. As a result of changing market conditions, the fair value of the bonds at December 31, 2018, was $210 million. 1. Prepare any journal entry necessary for Tanner-UNF to report its investment in the December 31, 2018, balance sheet. 2. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $190 million. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale PLEASE SHOW WORKarrow_forwardBlossom Company purchased $1180000 of 8%, 5-year bonds from Carlin, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $1230096 at an effective interest rate of 7%. Using the effective interest method, Blossom Company decreased the Available-for-Sale Debt Securities account for the Carlin, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortízed premiums of $4048 and $4192, respectively. At February 1, 2022, Blossom Company sold the Carlin bonds for $1215800. After accruing for interest, the carrying value of the Carlin bonds on February 1, 2022 was $1220500. Assuming Blossom Company has a portfolio of available-for-sale debt investments, what should Blossom Company report as a gain (or loss) on the bonds? $-4700. $0. $-9596. $-14296.arrow_forward

- In its first year of operations, Wildhorse Corporation purchased, available-for-sale debt securities costing $65.000 as a long-term investment. At December 31, 2022, the fair value of the securities is $60,500. Show the financial statement presentation of the securities and related accounts. Assume the securities are noncurrent. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) WILDHORSE CORPORATION Balance Sheet 4 $arrow_forwardManjiarrow_forward(Impairment of Debt Securities) Hagar Corporation has municipal bonds classified as a held-to-maturity at December 31, 2017. These bonds have a par value of $800,000, an amortized cost of $800,000, and a fair value of $720,000. The company believes that impairment accounting is now appropriate for these bonds.Instructions(a) Prepare the journal entry to recognize the impairment.(b) What is the new cost basis of the municipal bonds? Given that the maturity value of the bonds is $800,000, should Hagar Corporation amortize the difference between the carrying amount and the maturity value over the life of the bonds?(c) At December 31, 2018, the fair value of the municipal bonds is $760,000. Prepare the entry (if any) to record this information.arrow_forward

- Pharoah Company purchased $3200000 of 9%, 5-year bonds from Wildhorse, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3320740 at an effective interest rate of 8%. Using the effective-interest method, Pharoah Company decreased the Available-for-Sale Debt Securities account for the Wildhorse, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $11020 and $11380, respectively.At April 1, 2022, Pharoah Company sold the Wildhorse bonds for $3290000. After accruing for interest, the carrying value of the Wildhorse bonds on April 1, 2022 was $3297440. Assuming Pharoah Company has a portfolio of Available-for-Sale Debt Securities, what should Pharoah Company report as a gain or loss on the bonds?arrow_forwardOn June 30, 2021, Waterway Industries had outstanding 8%, $8020000 face amount, 15-year bonds maturing on June 30, 2031. Interest is payable on June 30 and December 31. The unamortized balance in the bond discount account on June 30, 2021 was $361000. On June 30, 2021, Waterway acquired all of these bonds at 94 and retired them. What net carrying amount should be used in computing gain or loss on this early extinguishment of debt? $7538800. $7659000. $7939000. $7739200.arrow_forwardFuzzy Monkey Technologies Inc purchased as a long-term investmetn $60 million of 6% bonds, dated Jan 1, on Jan 1 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $46 million. Interest is received semianually on June 30 and Dec 31. Due to changing market conditions the fair value of the bonds at Dec 31 2021 was $50 million. 1 to 3. Prepare the relevant journal entries on the respective dates. 4. At what amount will Fuzzy Monkey report its investment in Dec 31, 2021 balance sheet? 5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment?arrow_forward

- On November 1, 2015, Journeyman, LLC purchased 900 of the $1,000 face value, 9% bonds of Celebration Incorporated, for $948,000, including accrued interest of $13,500. The bonds matured on January 1, 2017, and interest was paid on March 1 and September 1. If Journeyman uses the straight-line method of amortization and the bonds are classified as available-for-sale, how should the net carrying value of the bonds be shown on Journeyman’s December 31, 2015 balance sheet?arrow_forwardCullumber Company purchased $3050000 of 9%, 5-year bonds from Vaughn, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3173740 at an effective interest rate of 8%. Using the effective-interest method, Cullumber Company decreased the Available-for-Sale Debt Securities account for the Vaughn, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $10720 and $11080, respectively.At April 1, 2022, Cullumber Company sold the Vaughn bonds for $3140000. After accruing for interest, the carrying value of the Vaughn bonds on April 1, 2022 was $3147440. Assuming Cullumber Company has a portfolio of Available-for-Sale Debt Securities, what should Cullumber Company report as a gain or loss on the bonds? $-7440. $-123740. $-21800. $ 0.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education