FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

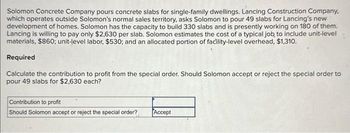

Transcribed Image Text:Solomon Concrete Company pours concrete slabs for single-family dwellings. Lancing Construction Company,

which operates outside Solomon's normal sales territory, asks Solomon to pour 49 slabs for Lancing's new

development of homes. Solomon has the capacity to build 330 slabs and is presently working on 180 of them.

Lancing is willing to pay only $2,630 per slab. Solomon estimates the cost of a typical job to include unit-level

materials, $860; unit-level labor, $530; and an allocated portion of facility-level overhead, $1,310.

Required

Calculate the contribution to profit from the special order. Should Solomon accept or reject the special order to

pour 49 slabs for $2,630 each?

Contribution to profit

Should Solomon accept or reject the special order?

Accept

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Isaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,100,000 of manufacturing overhead to individual jobs. However, Delores Cermak,owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $740,000 of manufacturing overhead while the Finishing Department incurs $360,000 of manufacturing overhead. Cermak has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. The Isaacson's plant completed Jobs 450 and 455 on May 15. Both jobs incurred a total of 6 DL hours throughout the entire production process. Job 450 incurred 1 MH in the Machining Department and 5 DL hours in the Finishing Department (the other DL hour occurred in the Machining…arrow_forwardThe Park Avenue Corporation currently makes a part required in its finished product. The company uses 2,054 units of this part annually. Park Avenue Corp has been approached by a vendor to provide this part for $13.29 each. The following cost information is provided Direct Materials per unit $5.71 Direct Labor per unit $7.30 Variable Factory Overhead per unit $2.50 Fixed Factory Overhead per unit $7.50 How much would Park Avenue Corporation save by having the vendor make the part, instead of making it themselves? Enter your answer rounded to the nearest whole number. Don't enter dollar signs or commas. ch ASUS F3 f5 E3 f6 [X f7 f8 f10 f12 & 3 4 7. 8. T. Y U D F G JK L %24arrow_forwardWalton Concrete Company pours concrete slabs for single-family dwellings. Lancing Construction Company, which operates outside Walton's normal sales territory, asks Walton to pour 53 slabs for Lancing's new development of homes. Walton has the capacity to build 400 slabs and is presently working on 140 of them. Lancing is willing to pay only $2,690 per slab. Walton estimates the cost of a typical job to include unit-level materials, $990; unit-level labor, $580; and an allocated portion of facility-level overhead, $1,160. Required Calculate the contribution to profit from the special order. Should Walton accept or reject the special order to pour 53 slabs for $2,690 each? Contribution to profit Should Walton accept or reject the special order?arrow_forward

- Marvel Parts, Inc., manufactures auto accessories. One of the company’s products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,035 hours each month to produce 2,070 sets of covers. The standard costs associated with this level of production are: Total Per Setof Covers Direct materials $ 31,878 $ 15.40 Direct labor $ 6,210 3.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,347 2.10 $ 20.50 During August, the factory worked only 500 direct labor-hours and produced 1,700 sets of covers. The following actual costs were recorded during the month: Total Per Setof Covers Direct materials (5,000 yards) $ 25,500 $ 15.00 Direct labor $ 5,440 3.20 Variable manufacturing overhead $ 4,080 2.40 $ 20.60 At…arrow_forwardBlue River Inc. produces horse and rancher equipment. The company’s production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company’s production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $283,000. The total cost of the Cafeteria Department is $185,000. The number of employees and the square footage in each department are as follows:Department Employees Square FeetSecurity 15 585Cafeteria 27 2,500Laser 38 4,200Forming 42 1,550 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to each of the production…arrow_forwardHaver Company currently pays an outside supplier $35 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $15 per unit, direct labor of $18 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $15 per unit, direct labor of $12 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of making the part. 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Should Haver make or buy the part? If Haver makes the part, which production method should it use? Should Haver make or buy the part? If Haver makes the part, which production method should it use?arrow_forward

- Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the parts for its engines, including the carburetors. An outside supplier offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $35 per unit. To evaluate this offer, Troy Engines, Limited, summarized the cost of producing the carburetor internally as follows: Per Unit 15,000 Units Per Year Direct materials $ 14 $ 210,000 Direct labor 10 150,000 Variable manufacturing overhead 3 45,000 Fixed manufacturing overhead, traceable 6* 90,000 Fixed manufacturing overhead, allocated 9 135,000 Total cost $ 42 $ 630,000 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: If the company has no alternative use for the facilities being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 15,000 carburetors from the outside supplier?…arrow_forwardAlter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to them: Activity Picking order Delivering order Handling complaints Total delivery cost Cost Driver Number of items Number of orders Number of complaints Annual Cost $ 308,125 720,000 40,000 Annual Driver Volume 362,500 items 30,000 orders 160 complaints $ 1,068,125 The intern selected two customers, who were frequent customers, to use as an…arrow_forwardWaterway Engine Incorporated produces engines for the watercraft industry. An outside manufacturer has offered to supply several component parts used in the engine assemblies, which are currently being produced by Waterway. The supplier will charge Waterway $315 per engine for the set of parts. Waterway's current costs for those part sets are direct materials, $140; direct labor, $80; and manufacturing overhead applied at 100% of direct labor. Variable manufacturing overhead is considered to be 20% of the total, and fixed overhead will not change if the part sets are acquired from the outside supplier. Required: a. What would be the net cost advantage or disadvantage if Waterway decided to purchase the parts? b. Should Waterway Engine continue to make the part sets or accept the offer to purchase them for $315? a. b. Waterway Engine Incorporated shouldarrow_forward

- Marvel Parts, Incorporated, manufactures auto accessories. One of the company’s products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,035 hours each month to produce 2,070 sets of covers. The standard costs associated with this level of production are: Total Per Set of Covers Direct materials $ 31,878 $ 15.40 Direct labor $ 6,210 3.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,347 2.10 $ 20.50 During August, the factory worked only 500 direct labor-hours and produced 1,700 sets of covers. The following actual costs were recorded during the month: Total Per Set of Covers Direct materials (5,000 yards) $ 25,500 $ 15.00 Direct labor $ 5,440 3.20 Variable manufacturing overhead $ 4,080 2.40 $ 20.60 At standard, each set of covers…arrow_forwardIsaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. 1. Compute the plantwide overhead rate assuming that Isaacson's expects to incur 26,000 total DL hours during the year 2. Compute departmental overhead rates assuming that Isaacson's expects to incur 15,000 MH in the Machining Department and 17,400 DL hours in the…arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. A. Lumber used to construct decks ($12.00 per square foot) B. Carpenter labor used to construct decks ($10 per hour) C. Construction supervisor salary ($45,000 per year) D. Depreciation on tools and equipment ($6,000 per year) E. Selling and administrative expenses ($35,000 per year) F. Rent on corporate office space ($34,000 per year) G. Nails, glue, and other materials required to construct deck (varies per job)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education