FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

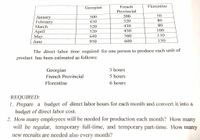

Transcribed Image Text:Georgian

French

Florentine

Provincial

300

200

50

January

February

March

450

320

80

520

430

80

450

100

April

Мay

520

640

560

130

June

950

600

150

The direct labor time required for one person to produce each unit of

product has been estimated as follows:

Georgian

3 hours

French Provincial

5 hours

Florentine

6 hours

REQUIRED:

1. Prepare a budget of direct labor hours for each month and convert it into a

budget of direct labor cost.

2. How many employees will be needed for production each month? How many

will be regular, temporary full-time, and temporary part-time. How many

new recruits are needed also every month?

Transcribed Image Text:Irene Corporation manufactures three lines of decorative cabinets for

stereo and television sets. Skill is required of the workers and it is not easy to

hire persons qualified for the work. At the present time, there are 15 qualified

employees (all regular workers) available for this type of work and new

personnel are to be hired and trained for the busy first six months of 2021. Each

employee works approximately 150 hours a month and is paid the rate of P100

per hour.

Production plans based on anticipated sales demand, are given next page

in units for each of the three lines of cabinets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor Indirect materials Utilities $1.30 0.80 0.30 Fixed overhead costs per month are Supervision $4,100, Depreciation $1,100, and Property Taxes $800. The company believes it will normally operate in a range of 7,100-11.300 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2020 for the expected range of activity, using increments of 1,400 direct labor hours. (List variable costs before fixed costs) MYERS COMPANY Monthly Manufacturing Overhead Flexible Budget For the Year 2020arrow_forwardQ.prepare Manufacturing overhead cost budgets for each of the three activities for april.arrow_forwardComputing unit costs at different levels of production Scentsation, Inc., budgeted for 12,000 bottles of perfume Oui during the month of May. The unit cost of Oui was $20, consisting of direct materials, $7; direct labor, $8; and factory overhead,$5 (fixed, $2; variable, $3).a. What would be the unit cost if 10,000 bottles were manufactured? (Hint: You must first determine the total fixed costs.)b. What would be the unit cost if 20,000 bottles were manufactured?c. Explain why a difference occurs in the unit costs.arrow_forward

- Please solve both a and b questionsarrow_forwardVikrambahiarrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.40q Indirect labor $4,000 + $1.40q Utilities $5,300 + $0.30q Supplies $1,600 + $0.10q Equipment depreciation $18,500 + $3.00q Factory rent $8,200 Property taxes $2,500 Factory administration $13,600 + $0.60q The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March Direct labor $ 70,480 Indirect labor $ 9,340 Utilities $ 7,010 Supplies $ 2,250 Equipment depreciation $ 31,100 Factory rent $ 8,600 Property taxes $ 2,500 Factory…arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.30q $4,300 +$1.50g $5,300 +$0.40g $1.400+ $0.30q $18,200+ $2.70g $8,400 $13,800+ $0.60g $2,600 The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Actual Cost Incurred in March $ 66,780 Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: $ 9,780 $ 7,370 $ 2,870 $ 29,000 $ 8.800 $ 2,600 $ 15,550 1. Prepare the Production…arrow_forwardItern Cost per Unit Classification M&M's $2.00 Product Mixed Nuts $1.00 Product Dried Fruits $1.76 Product Granola $ 0.35 Product Manufacturing Machine $400 per month Period Product Packaging $75 per month Period Workplace Rental $1,200 per month Period Factory Workers Salary $3,000 per month Period Quality Control $0.75 Product Writing assignment three using the same information you've established previously, create a master budget for the next quarter. Please use excel for this one.arrow_forwardEliezrie Corporation makes a product with the following standard costs: Standard Quanity or Hours Standard Price or Rate Standard Cost per unit Direct Materials 6.5 kilos $1 per kilo $6.50 Direct Labor 0.3 hours $10 per hour $3.00 Variable Overhead 0.3 hours $4 per hour $1.20 In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials price variance for January is: Select one: a. $4,875 F b. $4,875 U c. $4,850 U d. $4,850 Farrow_forward

- Please help me to solve this problemarrow_forwardPlease solve all requirementsarrow_forwardA company has two products A and B. The budgeted fixed manufacturing overhead is $10,000. It is expected to work in full capacity. It plans to use cost-based pricing by using the absorption method. Assume the company can produce and sell 1,000 units Product A and 1,000 units Product B. Product A Product B Direct Labor $1 $3 Direct Materials $3 $2 Variable Manufacturing Overhead $2 $1 Budgeted labor hours used for each unit product 1 4 Budgeted machine hours used for each unit product 3 1 Sale Demand 1000units 1000units Required ROI Rate 10% 5% Required Investment $5000 $30000 Fixed Selling Expenses $2000 $4000 Unit Variable Selling Expenses $1 $2 If allocating fixed manufacturing overhead based on machine hour basis, calculate the sale price of products A and B and budgeted profit of products A and B.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education