Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer for this question

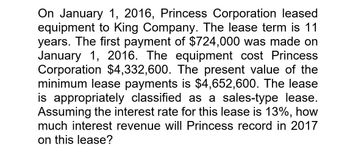

Transcribed Image Text:On January 1, 2016, Princess Corporation leased

equipment to King Company. The lease term is 11

years. The first payment of $724,000 was made on

January 1, 2016. The equipment cost Princess

Corporation $4,332,600. The present value of the

minimum lease payments is $4,652,600. The lease

is appropriately classified as a sales-type lease.

Assuming the interest rate for this lease is 13%, how

much interest revenue will Princess record in 2017

on this lease?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.arrow_forwardI want correct answerarrow_forwardOn January 1, Year 1, Savor Corporation leased equipment to Spree Company. The lease term is 9 years. The first payment of $698,000 was made on January 1, 2018. The present value of the lease payments is $4,561,300. The lease is appropriately classified as an operating lease. Assuming the interest rate for this lease is 9%, how much interest revenue will Savor record in Year 1 on this lease?arrow_forward

- On January 1, 2021, Wise Corporation leased equipment to Slim Company. The lease term is eight years. The first payment of $675,000 was made on January 1, 2021. The equipment cost Wise Corporation $3,600,000. The present value of the lease payments is $3,961,183. The lease is appropriately classified as a sales-type lease. suming the interest rate for this lease is 10%, how much interest revenue will Wise record in 2022 on this lease? A. $261,000. B. $293,980. C. $325,350. D. $328,615.arrow_forwardTimmer Company signs a lease agreement dated January 1, 2016, that provides for it to lease equipment from Landau Company beginning January 1, 2016. The lease terms, provisions, and related events are as follows: • The lease is noncancelable and has term of 5 years. • The annual rentals are $83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. • Timmer agrees to pay all executory costs at the end of each year. In 2016, these were insurance, $3,760; property taxes, $5,440. In 2017: insurance, $3,100; property taxes, $5,330. • There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of $300,000, an economic life of 5 years, and a zero residual value. Timmer's incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of…arrow_forwardThis is a two part question: 1. List the criteria used for determining if a lease agreement is accounted for as a capital lease. 2. Using the criteria, is the lease described below a capital or operating lease? On January 1, 2017, Burke Corporation signed a 5 year noncancelable lease for a machine. The terms of the lease called for Burke to make annual payments of $8,668 at the beginning of each year, starting January 1, 2017. The machine has an estimated useful life of 6 years and a $5,000 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Burke uses the straight-line method of depreciation for all of its plant assets. Burke's incremental borrowing rate is 10%, and the lessor's implicit rate is unknown.arrow_forward

- On March 31, 2016, Southwest Gas leased equipment from a supplier and agreed to pay $200,000 annually for 20 years beginning March 31, 2017. Generally accepted accounting principles require that a liability be recorded for this lease agreement for the present value of scheduled payments. Accordingly, at inception of the lease, Southwest recorded a $2,293,984 lease liability. Required: Determine the interest rate implicit in the lease agreement.arrow_forwardBrown Enterprises enter into a 4 year lease with ABC Leasing Company. The lease qualifies as an operating lease. The first lease payment of $100,000 was due on January 1, 2024, on the date the lease was executed and all subsequent lease payments due on December 31. The present value of the lease payments was $348,685 and Brown Enterprises correctly recorded the right of use asset and lease liability on January 1, 2024 for this amount. The implicit rate in the lease is 10%. On its 2024 income statement, when Brown Enterprises reports its lease expense for 2024, it will be made up of which of the following components? (Choose all that apply) DAROU amortization $75,132 8. Interest expense $12,829 OCROU amortization $87,171 OD. Interest expense $24,869 Quesdan 12 of 25arrow_forwardSkor Co. leased equipment to Douglas Corp. on January 2, 2011, for an 8-year period expiring December 31, 2018. Equal payments under the lease are $600,000 and are due on January 2 of each year. The first payment was made on January 2, 2011. The cost of the equipment is $2,800,000. The lease is appropriately accounted for as a sales-type lease. The present value of the lease payments is $3,300,000. What amount of net profit on the sale should Skor report for the year ended December 31, 2011? a. $720,000 b. $500,000 c. $90,000 d. $600,000 e. $2,800,000arrow_forward

- edom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2013. The lease terms, provisions, and related events are as follows: 11 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,00 to be made in advance at the beginning of eacy year. 2. The equipment costs $313,000. the equipment has an estimatd life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the leae is 14%. 5. The intial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Prepare journal entries for Edom for the years 2013 and 2014. Do not give answer in image formatearrow_forwardedom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2013. The lease terms, provisions, and related events are as follows: 11 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,00 to be made in advance at the beginning of eacy year. 2. The equipment costs $313,000. the equipment has an estimatd life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the leae is 14%. 5. The intial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Prepare journal entries for Edom for the years 2013 and 2014.arrow_forwardBerne Company (lessor) enters into a lease with Fox Company to lease equipment to Fox beginning January 1, 2016. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease noncancelable and requires annual rental payments of $50,000 to be made at the end of each year. 2. The equipment costs $130,000. The equipment has an estimated life of 4 years and an estimated residual value at the end of the lease term of zero 3. Fox agrees to pay all executory costs. 4. The interest rate implicit in the lease is 12%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Required: 1. Next Level Determine if the lease is a sales-type or direct financing lease from Berne's point of view (calculate the selling price and assume that this is also the fair value).…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning