Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Accounting calculate a. b. c.

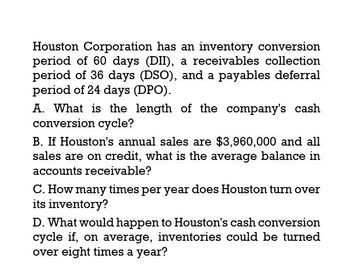

Transcribed Image Text:Houston Corporation has an inventory conversion

period of 60 days (DII), a receivables collection

period of 36 days (DSO), and a payables deferral

period of 24 days (DPO).

A. What is the length of the company's cash

conversion cycle?

B. If Houston's annual sales are $3,960,000 and all

sales are on credit, what is the average balance in

accounts receivable?

C. How many times per year does Houston turn over

its inventory?

D. What would happen to Houston's cash conversion

cycle if, on average, inventories could be turned

over eight times a year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Negus Enterprises has an inventory conversion period of 50 days, an average collection period of 35 days, and a payables deferral period of 25 days. Assume that cost of goods sold is 80% of sales. What is the length of the firm’s cash conversion cycle? If annual sales are $4,380,000 and all sales are on credit, what is the firm’s investment in accounts receivable? How many times per year does Negus Enterprises turn over its inventory?arrow_forwardThe Zocco Corporation has an inventory conversion period of 60 days, an average of collection period of 38 days, and a payable deferral period of 30 days. Assume that cost of goods sold 75% of sales. a. What is the length of the firm’s cash conversion cycle? a. Zocco’s annual sales are $3,421,875 and all sales are on credit, what is the firm’s investment in accounts receivable? b. How many times per year does Zocco turn over its inventory?arrow_forwardABC Inc. has the following data. What is the firm's cash (conversion) cycle? Inventory Conversion Period = 38 days Receivables Collection Period = 19 days Payables Deferral Period = 26 daysarrow_forward

- Zocco corporation has...Accounting questionsarrow_forwardеВook Zane Corporation has an inventory conversion period of 90 days, an average collection period of 34 days, and a payables deferral period of 48 days. Assume 365 days in year for your calculations. a. What is the length of the cash conversion cycle? Round your answer to two decimal places. days b. If Zane's annual sales are $3,454,540 and all sales are on credit, what is the investment in accounts receivable? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. How many times per year does Zane turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardHelparrow_forward

- Please give me answer general accountingarrow_forwardZane Corporation has an inventory conversion period of 48 days, an average collection period of 33 days, and a payables deferral period of 33 days. Assume 365 days in year for your calculations. What is the length of the cash conversion cycle? Round your answer to two decimal places. If Zane's annual sales are $4,137,145 and all sales are on credit, what is the investment in accounts receivable? Do not round intermediate calculations. Round your answer to the nearest cent. How many times per year does Zane turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardansarrow_forward

- FMT Trading Inc. has the following financial data: Annual sales 10,000,000Cost of goods sold 6,000,000Inventory 2,547,945Accounts receivable 1,643,836Accounts payable 1,200,000 a. What is the firm’s cash conversion cycle?b. Provide interpretations of the cash conversion cycle period of the firm.arrow_forwardNeed help with this question solution general accountingarrow_forwardZane Corporation has an inventory conversion period of 79 days, an average collection period of 43 days, and a payables deferral period of 50 days. Assume 365 days in year for your calculations. What is the length of the cash conversion cycle? Round your answer to two decimal places. days If Zane's annual sales are $3,598,365 and all sales are on credit, what is the investment in accounts receivable? Do not round intermediate calculations. Round your answer to the nearest cent. $ How many times per year does Zane turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. Do not round intermediate calculations. Round your answer to two decimal places. timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning