FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't use

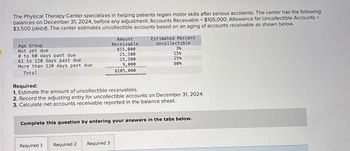

Transcribed Image Text:The Physical Therapy Center specializes in helping patients regain motor skills after serious accidents. The center has the following

balances on December 31, 2024, before any adjustment: Accounts Receivable = $105,000; Allowance for Uncollectible Accounts =

$3,500 (debit). The center estimates uncollectible accounts based on an aging of accounts receivable as shown below.

Age Group

Not yet due

0 to 60 days past due

61 to 120 days past due

More than 120 days past due

Total

Amount

Receivable

Estimated Percent

Uncollectible

$55,000

3%

25,500

15%

15,500

25%

9,000

80%

$105,000

Required:

1. Estimate the amount of uncollectible receivables.

2. Record the adjusting entry for uncollectible accounts on December 31, 2024.

3. Calculate net accounts receivable reported in the balance sheet.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mercy Hospital has the following balances on December 31, 2024, before any adjustment: Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Age Group Amount Receivable Estimated Percent Uncollectible Not yet due $50,000 15% 0 to 30 days past due 11,000 20% 31 to 90 days past due 8,000 45% More than 90 days past due 1,000 85% Total $70,000 Required:1. Estimate the amount of uncollectible receivables.2. Record the adjusting entry for uncollectible accounts on December 31, 2024.3. Calculate net accounts receivable reported in the balance sheet.arrow_forwardthank you so much!arrow_forwardMercy Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Age Group AmountReceivable Estimated PercentUncollectible Not yet due $50,000 15% 0 –30 days past due 11,000 20% 31– 90 days past due 8,000 45% More than 90 days past due 1,000 85% Total $70,000 Required:1. Estimate the amount of uncollectible receivables.2. Record the adjustment for uncollectible accounts on December 31, 2021.3. Calculate net accounts receivable.arrow_forward

- do not give solution in imagearrow_forwardPhysicians’ Hospital has the following balances on December 31, 2024, before any adjustment: Accounts Receivable = $60,000; Allowance for Uncollectible Accounts = $1,100 (credit). On December 31, 2024, Physicians’ estimates uncollectible accounts to be 15% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024.2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet.3. Calculate net accounts receivable reported in the balance sheet.arrow_forwardPhysicians’ Hospital has the following balances on December 31, 2024, before any adjustment: Accounts Receivable = $50,000; Allowance for Uncollectible Accounts = $1,000 (credit). On December 31, 2024, Physicians’ estimates uncollectible accounts to be 20% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024.2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet.3. Calculate net accounts receivable reported in the balance sheet.arrow_forward

- Southwest Pediatrics has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $130,000; Allowance for Uncollectible Accounts = $2,100 (debit). On December 31, 2021, Southwest estimates uncollectible accounts to be 20% of accounts receivable.Required:1. Record the adjustment for uncollectible accounts on December 31, 2021.2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet.3. Calculate net accounts receivable.arrow_forwardAt January 1, 2024, Betty DeRose, Inc. had an allowance for doubtful accounts with a $4,390 credit balance. During 2024, Betty recorded $9,560 of write-offs and recorded $2,750 of recoveries of accounts receivable that had been written off in prior years. At December 31, 2024, Betty prepared the following aging schedule: Accounts Receivable not past due $150,000 $ 64,000 1-30 days past due 31-60 days past due $ 39,000 61-90 days past due $ 47,000 over 90 days past due $ 11,000 Calculate Betty's bad debt expense for 2024. % Uncollectible 2% 6% 9% 16% 34%arrow_forward1) Accounting for uncollectible accounts using the allowance method (aging-of-receivables) and reporting receivables on the balance sheet At September 30, 2018, the accounts of Roxbury Medical Center (RMC) include the following: Accounts Receivable $154,000 Allowance for Bad Debts (credit balance) 3,700 During the last quarter of 2018, RMC completed the following selected transactions: Sales on account, $465,000. Ignore Cost of Goods Sold. Collections on account, $441,800. Wrote off accounts receivable as uncollectible: Jenkins, Co., $1,900; Sony, $800; and Smith, Inc., $500 Recorded bad debts expense based on the aging of accounts receivable, as follows: Age of Accounts 1–30 Days 31–60 Days 61–90 Days Over 90 Days Accounts Receivable $ 97,000 $ 37,000 $ 17,000 $ 14,000 Estimated percent uncollectible 0.2% 3.5% 29% 32% Page Break Requirements 1.Open T-accounts for Accounts Receivable…arrow_forward

- Please correct Solution with Explanation and do not give image formatarrow_forwardThe beginning balance in the Allowance for Uncollectible Accounts account is a $3,500 debit. After conducting an aging analysis, management has determined that $4,700 of accounts receivable will be uncollectible. What was the Uncollectible Accounts Expense for the year? $3,500 $8,200 $4,700 $1,200arrow_forwardAt the end of the year, Mercy Cosmetics' balance of Allowance for Uncollectible Accounts is $440 (credit) before adjustment. The balance of Accounts Receivable is $17,000. The company estimates that 12% of accounts will not be collected over the next year. What adjustment would Mercy Cosmetics record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education