Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

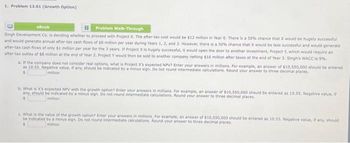

Transcribed Image Text:1. Problem 13.01 (Growth Option)

eBook

Problem Walk-Through

Singh Development Co. is deciding whether to proceed with Project X. The after-tax cost would be $12 million in Year 0. There is a 50% chance that X would be hugely successful

and would generate annual after-tax cash flows of $8 million per year during Years 1, 2, and 3. However, there is a 50% chance that X would be less successful and would generate

after-tax cash flows of only $1 million per year for the 3 years. If Project X is hugely successful, it would open the door to another investment, Project Y, which would require an

after-tax outlay of $8 million at the end of Year 2. Project Y would then be sold to another company netting $16 million after taxes at the end of Year 3. Singh's WACC is 9%.

a. If the company does not consider real options, what is Project X's expected NPV? Enter your answers in millions. For example, an answer of $10,550,000 should be entered

as 10.55. Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to three decimal places.

million

b. What is X's expected NPV with the growth option? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value, if

any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to three decimal places,

million

c. What is the value of the growth option? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value, if any, should

be indicated by a minus sign. Do not round intermediate calculations, Round your answer to three decimal places.

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is considering taking a project that will produce $12 million of revenue per year. Cash expenses will be $5 million, and depreciation expenses will be $1 million per year. If the firm takes that project, then it will reduce the cash revenues of an existing project by $3 million. What is the free cash flow on the project, per year, if the firm uses a 40 percent marginal tax rate? O$2.8 million O $2.4 million 0 $4.6 million $3.4 millionarrow_forwardZLIK Inc is considering methods by which to evaluate a multi-year project that requires a large $55 million investment. Assuming the project has conventional cash flows, under which conditions would the project be an acceptable investment for ZLIK? Select all that apply. A) NPV < 0 B) NPV > 0 C) IRR > firm's required return D) IRR < firm's required return E) Profitability Index > 1.0 F) Profitability Index < 1.0arrow_forwardA project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation.a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.)arrow_forward

- A project that costs $1000 today is expected to have cash flows of $200/year for 10 years. Under these projections, this is a positive NPV project: if your cost of capital is 10%/year, investing $1000 today and earning $200 per year for 10 years yields an NPV of $228.91 (you can verify this yourself, or take my word for it). However, those annual cash flows of $200 are based on the following expectations: A 50% probability that business will be good and the project will earn $300/year, and a 50% probability that business will be bad and the project will earn $100/year. (Note that the expected annual cash flows will be: [0.5 * $300] + [0.5 * $100] = $200/year, as stated above.) Unfortunately, you will not know which state of the world you will be in until you spend the $1000 and start the business; in year 1, after the business opens, you will find out. Obviously, if you open for business and business is good, you will want to stay open for the entire 10 years; if your cost of capital…arrow_forwardA project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27, 300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim a 100% bonus depreciation immediately on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation. Calculate the project NPV for each company. What is the IRR of the after-tax cash flows for each company?arrow_forwardConsider a project to produce solar water heaters. It requires a $10 million investment and offers a level after-tax cash flow of $1.68 million per year for 10 years. The opportunity cost of capital is 11.15%, which reflects the project's business risk. a. Suppose the project is financed with $4 million of debt and $6 million of equity. The interest rate is 7.15% and the marginal tax rate is 21%. An equal amount of the debt will be repaid in each year of the project's life. Calculate APV. (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number.) X Answer is complete but not entirely correct. Adjusted present value S 120,980 x b. If the firm Incurs issue costs of $610,000 to raise the $6 million of required equity, what will be the APV? (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number. Negative amount shoud be…arrow_forward

- The private firm TranspCom needs to invest $300 million to a freeway construction and management project on year 2, and $50 million less than previous year each year from year 3 through year 6. What is the present worth of all these potential investments? (Suppose the annual rate of return is 12%)arrow_forwardYou are planning to produce a new action figure called "Nia." However, you are very uncertain about the demand for the product. If it is a hit, you will have net cash flows of $80 million per year for three years (starting next year [i.e., at t = 1]). If it fails, you will only have net cash flows of $40 million per year for two years (also starting next year). There is an equal chance that it will be a hit or failure (probability = 50 percent). You will not know whether it is a hit or a failure until the first year's cash flows are in (i.e., at t = 1). You must spend $140 million immediately for equipment and the rights to produce the figure. If you can sell your equipment for $90 million once the first year's cash flows are received, calculate the value of the abandonment option. (The discount rate is 10 percent.) Multiple Choice $24.38 $18.56 -$5.82 $0.00arrow_forwardYou are considering opening a new plant. The plant will cost $97.5 million up front and will take one year to build. After that it is expected to produce profits of $29.1 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.8%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. The NPV of the project will be $ million. (Round to one decimal place.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education