Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

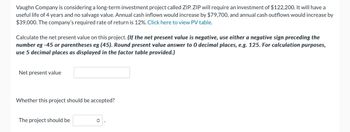

Transcribed Image Text:Vaughn Company is considering a long-term investment project called ZIP. ZIP will require an investment of $122,200. It will have a

useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,700, and annual cash outflows would increase by

$39,000. The company's required rate of return is 12%. Click here to view PV table.

Calculate the net present value on this project. (If the net present value is negative, use either a negative sign preceding the

number eg -45 or parentheses eg (45). Round present value answer to 0 decimal places, e.g. 125. For calculation purposes,

use 5 decimal places as displayed in the factor table provided.)

Net present value

Whether this project should be accepted?

The project should be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,560,000 per year in net cash inflows from the solar network installation. The solar network would cost $8.8 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 12% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) IRR (as a percentage):arrow_forwardBlink of an Eye Company is evaluating a 5-year project that will provide cash flows of $39,300, $80,430, $63,170, $61,250, and $44,470, respectively. The project has an initial cost of $182,560 and the required return is 8.8 percent. What is the project's NPV?arrow_forwardPeng Company is considering buying a machine that will yield income of $2,400 and net cash flow of $16,000 per year for three years. The machine costs $48,900 and has an estimated $8,100 salvage value. Compute the accounting rate of return for this investment. Numerator: Accounting Rate of Return Denominator: = Accounting Rate of Return Accounting rate of returnarrow_forward

- As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The purchase price of the equipment, including installation, is $65,000, and the equipment will be fully depreciated at t = 0. Annual sales would be 4,000 units at a price of $50 per cartridge, and the project’s life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At the end of 3 years, the equipment could be sold for $10,000. Variable costs would be 70% of sales revenues, fixed costs would be $30,000 per year, the marginal tax rate is 25%, and the corporate WACC is 11%. The firm’s project CVs generally range from 1.0 to 1.5. A 3% risk premium is added to the WACC if the initial CV exceeds 1.5, and the WACC is reduced by 0.5% if the CV is 0.75 or less. Then a revised NPV is calculated. What are the revised values for the NPV? NPV Best Case Scenario = $ . NPV Base Case Scenario = $ . NPV Worst-case Scenario = -$ . Expected NPV = $arrow_forwardDynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,460,000 per year in net cash inflows from the solar network installation. The solar network would cost $7.2 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 13% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) The IRR is %.arrow_forwardThreeRivers Corp. is considering the purchase of a new piece of equipment with a life of 12 years. The internal rate of return of the project is 20%. ThreeRivers has a required rate of return (hurdle rate) of 17%. The project would have: Multiple Choice a net present value greater than zero. a payback period more than 12 years. a net present value of zero. an accounting rate of return greater than 17%.arrow_forward

- Mayberry, Inc., is considering a design change that will cost $6,000 and will result in an annual savings of $1,000 per year for the 6-year life of the project. A cost of $2,000 will be avoided at the end of the project as a result of the change. MARR is 8%/year. What is the annual worth of this investment? $Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±4.arrow_forwardPharoah Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,338. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,500, and annual cash outflows would increase by $41,250. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to O decimal places, e.g. 15%.) Internal rate of return on this project is between Determine whether this project should be accepted? The project be accepted. % and %.arrow_forwardBrown Company is considering purchasing a machine that would cost $320,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $50,000. The machine would provide annual cost savings of $75,000. The company requires a rate of return of 11% on all investment projects. What is the net present value of the proposed project? (Select the answer that is closest to your calculations.) Present value tables are provided below. Present Value of $1 Table (Exhibit 11B-1) (Partial table) Periods 4% 5% 6% 7% 8% 9% 10% 11 12% 13% 14% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 1 2. 4 5. 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.760 0.711 0.665 0.623…arrow_forward

- Novak Company is contemplating an investment costing $168,810. The investment will have a life of 8 years with no salvage value and will produce annual cash flows of $30,500. Click here to view PV tables. What is the approximate internal rate of return associated with this investment? (Use the above table.) (Round answer to O decimal places, e.g. 15%) Internal rate of return. %6arrow_forwardThe management of XY Company is considering to purchase an equipment to be attached with the main manufacturing machine. The equipment will cost $6,000 and will increase annual cash inflow by $2,200. The useful life of the equipment is 6 years. After 6 years it will have no salvage value. The management wants a 20% return on all investments. Compute net present value (NPV) of this investment project.arrow_forwardConsider a project with a 3-year life and no salvage value. The initial cost to set up the project is $100,000. This amount is to be linearly depreciated to zero over the life of the project. The price per unit is $90, variable costs are $72 per unit and fixed costs are $10,000 per year. The project has a required return of 12%. Ignore taxes. 1. How many units must be sold for the project to achieve accounting break-even? 2. How many units must be sold for the project to achieve cash break-even? 3. How many units must be sold for the project to achieve financial break-even? 4. What is the degree of operating leverage at the financial break-even?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education