Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

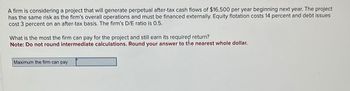

Transcribed Image Text:A firm is considering a project that will generate perpetual after-tax cash flows of $16,500 per year beginning next year. The project

has the same risk as the firm's overall operations and must be financed externally. Equity flotation costs 14 percent and debt issues

cost 3 percent on an after-tax basis. The firm's D/E ratio is 0.5.

What is the most the firm can pay for the project and still earn its required return?

Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar.

Maximum the firm can pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- WACC and NPV Pink, Inc., is considering a project that will result in initial aftertax cash savings of $1.82 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. The firm has a target debt-equity ratio of .85, a cost of equity of 12.2 percent, and an aftertax cost of debt of 5 percent. The cost-saving proposal is somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project?arrow_forwardSuppose your company needs $17 million to build a new assembly line. Your target debt- equity ratio is .75. The flotation cost for new equity is 10 percent, but the flotation cost for debt is only 7 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a. What is your company's weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole dollar amount, e.g., 1,234,5667.) a. Flotation cost b. Amount raised %arrow_forwardYou are considering a geographic expansion into the European market for Canopy Pharmaceuticals. Below are the incremental cash flows for the Canopy project for you to use in your analysis. Assume Canopy's marginal tax rate is 35%, their cost of capital is 15.7 %, and an expected growth rate of 5% after 2003. Calculate the NPV, IRR, Payback Period. Explain how do you determining the initial cost and the terminal value? (Using Gordon Model to find the terminal)arrow_forward

- A company is considering investing in a project whose present value without flexibility is 100 million. The project pays no dividends, and the initial investment required is 102 million. The appropriate cost of capital for the project is 20%. The risk-free rate is 5%. Every period the project cash flows either go up by a factor "u", or reduces by a factor "d". Use u = 2.2255 and d% = %3D 0.4493. a) Calculate the NPV of the project without the flexibility. b) Suppose the total investment of 102 million (present value) may be disaggregated into 3 installments, as follows: 52 million in year 0, 21 million in year 1, and 33.075 million in year 2. In any year management has the option to "default" on its planned investment, at which point the project is terminated. What is the NPV for the project with this default option? c) What is the value of this default option?arrow_forwardHelp pleasearrow_forwardA project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27, 300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim a 100% bonus depreciation immediately on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation. Calculate the project NPV for each company. What is the IRR of the after-tax cash flows for each company?arrow_forward

- Consider a project to produce solar water heaters. It requires a $10 million investment and offers a level after-tax cash flow of $1.68 million per year for 10 years. The opportunity cost of capital is 11.15%, which reflects the project's business risk. a. Suppose the project is financed with $4 million of debt and $6 million of equity. The interest rate is 7.15% and the marginal tax rate is 21%. An equal amount of the debt will be repaid in each year of the project's life. Calculate APV. (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number.) X Answer is complete but not entirely correct. Adjusted present value S 120,980 x b. If the firm Incurs issue costs of $610,000 to raise the $6 million of required equity, what will be the APV? (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number. Negative amount shoud be…arrow_forwardAriana, Incorporated, is considering a project that will result in initial aftertax cash savings of $5.7 million at the end of the first year, and these savings will grow at a rate of 3 percent per year, indefinitely. The firm has a target debt-equity ratio of .56, a cost of equity of 13.1 percent, and an aftertax cost of debt of 5 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. Calculate the required return for the project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What is the maximum cost the company would be willing to pay for this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardYou are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now 0 1-10 After-Tax Cash Flow -45 12 The project's beta is 1.4. Required: a. Assuming that ry=6% and E(M) = 14%, what is the net present value of the project? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. b. What is the highest possible beta estimate for the project before its NPV becomes negative? Note: Round your answer to 2 decimal places. a. Net present value b. Highest betaarrow_forward

- Universal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…arrow_forwardA firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: TimeAfter-tax Cash Flow XAfter-tax Cash Flow Y $70,000 35,000 35,000 35,000 35,000 5,000 Projects X and Y are equally risky and may be repeated indefinitely. If the firm's WACC is 11%, what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations. Round your answer to the nearest dollar. Choose Projectleid whose EAA-5 0 1 2 3 (4 5 -$80,000 40,000 $5,000 60,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education