FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

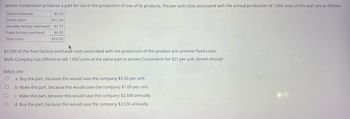

Transcribed Image Text:Jensen Corporation produces a part for use in the production of one of its products. The per-unit costs associated with the annual production of 1,000 units of this part are as follows:

Direct materials

Direct labor

Variable factory overhead

Fixed factory overhead

Total costs

$5.25

$12.00

$2.75

$6.00

$26.00

$2,500 of the fixed factory overhead costs associated with the production of this product are common fixed costs.

Wells Company has offered to sell 1,000 units of the same part to Jensen Corporation for $21 per unit. Jensen should:

Select one:

O

a. Buy the part, because this would save the company $5.00 per unit.

O

b. Make the part, because this would save the company $1.00 per unit.

O

c. Make the part, because this would save the company $2,500 annually.

O

d. Buy the part, because this would save the company $2,500 annually.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The company has the following financial information:Manufacturing overhead- P30,101,800Increase in raw materials- P2,430,000Decrease in work in process- P590,000Increase in finished goods- P1,320,400Manufacturing overhead amounts to 50% of direct labor, and the direct labor and manufacturing overhead combined equal 50% of the total cost of manufacturing.How much is the cost of goods sold? Choices: • P181,200,800 • P179,880,400 • P177,590,800 • P180,020,800arrow_forwardHelio Company has two products: A and B. The annual production and sales of Product A is 1,850 units and of Product B is 1,250 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $100,485. What is the company’s predetermined overhead rate?arrow_forwardThe Grouper Company manufactures 1,478 units of a part that could be purchased from an outside supplier for $14 each. Grouper’s costs to manufacture each part are as follows: Direct materials $2 Direct labor 4 Variable manufacturing overhead 3 Fixed manufacturing overhead 8 Total $17 All fixed overhead is unavoidable and is allocated based on direct labor. The facilities that are used to manufacture the part have no alternative uses. (a) Calculate relevant cost to make. Relevent cost to make $ ___ per unit (c) Calculate net cost to buy if Grouper leases the manufacturing facilities to another company for $9,260 per year. Net cost to buy $ ______arrow_forward

- Buren Company manufactures two products, Regular and Supreme. Buren's overhead costs consist of machining, $2,000,000; and assembling, $1,000,000. Information on the two products is: Regular Supreme Direct labor hours 10,000 15,000 Machine hours 10,000 30,000 Number of parts 90,000 160,000 Overhead applied to Supreme using traditional costing using direct labor hours is: A) $860,000. B) $1,200,000. C) $1,800,000. D) $2,140,000.arrow_forwardGlover Company makes three products in a single facility. These products have the following unit product costs: Product A B C Direct materials $ 32.80 $ 49.30 $ 55.70 Direct labor 20.20 22.80 13.60 Variable manufacturing overhead 1.20 0.60 0.90 Fixed manufacturing overhead 13.50 9.10 9.70 Unit product cost $ 67.70 $ 81.80 $ 79.90 Additional data concerning these products are listed below. Product A B C Mixing minutes per unit 1.20 1.20 0.20 Selling price per unit $ 58.00 $ 80.40 $ 73.90 Variable selling cost per unit $ 0.60 $ 1.10 $ 2.30 Monthly demand in units 2,000 3,300 1,300 The mixing machines are potentially the constraint in the production facility. A total of 6,520 minutes are available per month on these machines. Direct labor is a variable cost in this company. Required: a. How many minutes of mixing machine time would be required to satisfy demand for all three products? b. How much of…arrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 87,600 units per year is: Direct materials Direct labor Variable manufacturing overhead Fixed nanufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $2.40 5 3.00 5 0.80 $ 4.15 $ 1.70 $ 2.00 The normal selling price is $22.00 per unit. The company's capacity is 120,000 units per year. An order has been received from a mail- order house for 2,700 units at a special price of $19.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantege (disadvantage) of accepting the special order?arrow_forward

- Hansabenarrow_forwardVaughn Company manufactures two products, Mini A and Maxi B. Vaughn's overhead costs consist of setting up machines- $890,000; machining- $2,030,000; and inspecting- $640,000. Information on the two products is: Mini A Мaxi В Direct labour hours 14,000 26,000 Machine setups 700 500 Machine hours 21,000 23,000 Inspections 700 600 Overhead applied to Maxi B using traditional costing and direct labour hours isarrow_forwardConsider zagol manufacturing which is engaged in the manufacturing of product ABC. To produce one unit of the product the company incurs the following costs: Direct material ______$5/kg Direct labor_________$10/hour Total Manufacturing overhead __________________$30000 The company produces a total of 10000 units per month. And the actual price the product is sold is around $24. Company XYZ offers to buy a total of 5000 units this month at the price of $ 17/unit. Would you accept the order if you are the manager? (assume 20% of the manufacturing overhead is variable costarrow_forward

- Qriole Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, William Brown, has developed the following information: Estimated wheels produced Direct labour hours per wheel Car Car wheels $ Truck 45,000 11,000 4 Total estimated overhead costs for the two product lines are $1,340,000. Calculate the overhead cost assigned to the car wheels and truck wheels, assuming that direct labour hours are used to allocate overhead costs. 8 180,000arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Required: 1. What is the total amount of traceable fixed manufacturing overhead for each of the two products? what is the alpha and betaarrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 2. What is the company’s total amount of common fixed expenses? 3. Assume that Cane expects to produce and sell 87,000 Alphas during the current year. One of Cane's sales representatives has found a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education