FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

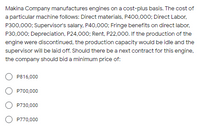

Transcribed Image Text:Makina Company manufactures engines on a cost-plus basis. The cost of

a particular machine follows: Direct materials, P400,000; Direct Labor,

P300,000; Supervisor's salary, P40,000; Fringe benefits on direct labor,

P30,000; Depreciation, P24,000; Rent, P22,000. If the production of the

engine were discontinued, the production capacity would be idle and the

supervisor will be laid off. Should there be a next contract for this engine,

the company should bid a minimum price of:

P816,000

O P700,000

O P730,000

O P770,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Futura Company purchases the 68.000 starters that it installs in its standard line of farm tractors from a supplier for the price of $11.00 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $11.60 as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $5.00 2.80 1.70 1.00 0.20 0.40 $11.60 Total $ 115,600 $ 68,000 $ 27,200 If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $115,600) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $84,000 per period.…arrow_forwardA local company has two machines for producing wrenches. Each machine requires a full- time operator - regardless of production - specialized on that machine. The operator for Machine A costs $75,000 a year in fixed costs in salary and benefits. The operator for Machine B costs $62,000 a year in fixed costs in salary and benefits. The production costs of Machine A is $16. B is $20. (a) if the wrenches sell for $28, find the break-even point of each machine. (b) at what level of production do the two production machines cost the same. ( Answer it in excel)arrow_forwardBeto Company pays $6.50 per unit to buy a part for one of the products it manufactures. With excess capacity, the company is considering making the part. Making the part would cost $7.20 per unit for direct materials and $1.00 per unit for direct labor. The company normally applies overhead at the predetermined rate of 200% of direct labor cost. Incremental overhead to make the part would be 80% of direct labor cost. (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Beto make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference (b) Company should Make Buyarrow_forward

- Futura Company purchases the 71,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $12.70 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $12.90 as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $ 6.00 3.00 1.50 1.30 0.70 0.40 $ 12.90 Total If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $106,500) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $84,000 per period. Depreciation is due to obsolescence…arrow_forwardZion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $25 each. Zion uses 10 000 units of Component K2 each year. The cost per unit of this component is as follows: 1 Direct materials Direct labour Variable overhead Fixed overhead Total Refer to the information for Zion Manufacturing. The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 2 3 $12.00 8.25 4.50 2.00 $26.75 What are the alternatives facing Zion Manufacturing with respect to production of Component K2? List the relevant costs for each alternative. If Zion decides to purchase the component from Bryce, by how much will operating income increase or decrease? Which alternative is better?arrow_forwardMunabhaiarrow_forward

- Penagos Corporation is presently making part Z43 that is used in one of its products. A total of 5,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity: Direct materials. Direct labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided. If management decides to buy part Z43 from the outside supplier rather than to…arrow_forwardThe cost of building an automated assembly line in a factory is P700,000; a manually operated assembly line would cost P250,000. What economic term is used to describe the P450,000 variation between these two amounts? Differential cost Sunk cost Marginal cost Out of pocket costarrow_forwardIf a Puma production plant produces six different types of tennis shoes and the plant manager receives a salary of $115,000 per year, the plant manager's salary is an example of a DIRECT cost. True Falsearrow_forward

- Beto Company pays $3.50 per unit to buy a part for one of the products it manufactures. With excess capacity, the company is considering making the part. Making the part would cost $2.70 per unit for direct materials and $1.00 per unit for direct labor. The company normally applies overhead at the predetermined rate of 200% of direct labor cost. Incremental overhead to make the part would be 80% of direct labor cost. (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Beto make or buy the part? (a) Make or Buy Analysis Make Buy Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference |(b) Company should:arrow_forwardSheffield Corp. incurs the following costs to produce 9000 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $9000 O $28950 O $(3500) $8950 O $(3250) 12500 12200 20000 An outside supplier has offered to sell Sheffield the subcomponent for $2.75 a unit. No fixed overhead costs are avoidable. If Sheffield accepts the offer, by how much will net income increase (decrease)?arrow_forwardThe James Company manufactures widgets that sell for $120 each. The company's unit cost for each widget is as follows: A company in another state has offered to purchase 1,000 widgets from James Company at a cost of $90 each. If James were to accept this special order, no additional Fixed Manufacturing Overhead costs would be incurred. Should James accept this special order? Show relevant calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education