FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

#7

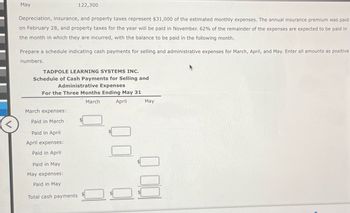

Transcribed Image Text:May

122,300

Depreciation, insurance, and property taxes represent $31,000 of the estimated monthly expenses. The annual insurance premium was paid

on February 28, and property taxes for the year will be paid in November. 62% of the remainder of the expenses are expected to be paid in

the month in which they are incurred, with the balance to be paid in the following month.

Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Enter all amounts as positive

numbers.

TADPOLE LEARNING SYSTEMS INC.

Schedule of Cash Payments for Selling and

Administrative Expenses

For the Three Months Ending May 31

March expenses:

Paid in March

March

Paid in April

April expenses:

Paid in April

Paid in May

May expenses:

Paid in May

Total cash payments

April

☐ ☐

May

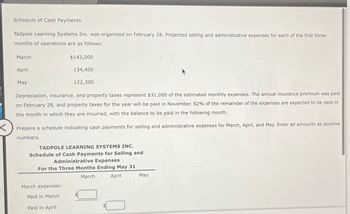

Transcribed Image Text:Schedule of Cash Payments

Tadpole Learning Systems Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three

months of operations are as follows:

March

$143,000

April

May

134,400

122,300

Depreciation, insurance, and property taxes represent $31,000 of the estimated monthly expenses. The annual insurance premium was paid

on February 28, and property taxes for the year will be paid in November. 62% of the remainder of the expenses are expected to be paid in

the month in which they are incurred, with the balance to be paid in the following month.

< Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Enter all amounts as positive

numbers.

TADPOLE LEARNING SYSTEMS INC.

Schedule of Cash Payments for Selling and

Administrative Expenses

For the Three Months Ending May 31

March expenses:

Paid in March

Paid in April

March

April

May

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- q15arrow_forwardJ 7 Choose from list of answer choices and show/explain work.arrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forward

- 18 pts Multiple Functions 88 MULTIPLE CHOICE Question 2 ◄ Listen When f(x)=-3x-6 and g(x) = x²-x-6, what is ? A B C f 54 g = 3 fg = -3 x-3x=3 f 51 g = -2x+2; x=1arrow_forwardKingcade Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below: Hours 18.3 Wait time Process time Move time Queue time 1. 1 Inspection time 0.1 2.0 9.1 The manufacturing cycle efficiency (MCE) was closest to: (Round your intermediate calculations to 1 decimal place.)arrow_forward88 MULTIPLE CHOICE Question 2 Listen Given 0=787°, what is the measure of the coterminal angle? A 67° B 23° C 157° D 113°arrow_forward

- ent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forwardRound 1.1235 to the nearest tenth. O 1.12 O 1.2 1.0 1.1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education