FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

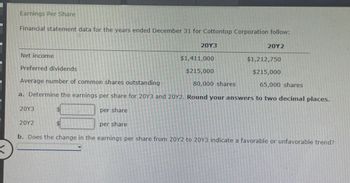

Transcribed Image Text:Earnings Per Share

Financial statement data for the years ended December 31 for Cottontop Corporation follow:

Net income

Preferred dividends

Average number of common shares outstanding

20Y3

$1,411,000

$215,000

80,000 shares

20Y2

$1,212,750

$215,000

65,000 shares

a. Determine the earnings per share for 20Y3 and 20Y2. Round your answers to two decimal places.

20Y3

$

20Y2

$

per share

per share

b. Does the change in the earnings per share from 20Y2 to 20Y3 indicate a favorable or unfavorable trend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Analyzing EPS through Financial Statement Presentation Sundry Inc. reported the following information in its consolidated statement of earnings for the fiscal year ended January 31. Required a. Estimate the average number of common shares outstanding for its fiscal year ended January 31. Note: Round your answer to the nearest whole share (in millions). ✓ million shares. b. Does the company have a simple or a complex capital structure? ✓ capital structure. c. If diluted weighted-average common shares were 1,547 million, recompute diluted EPS. d. Based on part c, what type(s) of dilutive securities would we assume the company reported in its financial statements? Stock plans Convertible securitiesarrow_forwardEarnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,761,000 $2,555,500 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 90,000 shares 115,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Υ6 Earnings per Share $ b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable?arrow_forwardDividend Per Share Windborn Company has 15,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: Year 1 $56,300 Year 2 18,000 Year 3 67,500 Determine the dividend per share for preferred and common stock for each year. Round all answers to two decimal places. If an amount box does not require an entry, leave it blank. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) Common stock (Dividend per share)arrow_forward

- Earnings Per Share Financial statement data for the years ended December 31 for Cottontop Corporation follow: 20Y3 20Y2 Net income Preferred dividends Average number of common shares outstanding 95,000 shares a. Determine the earnings per share for 20Y3 and 20Y2. Round your answers to two dectmal places. per share 20Y2 per share b. Does the change in the earnings per share from 20Y2 to 20Y3 indicate a favorable or unfavorable trend?arrow_forwardDividends Per Share Seacrest Company has 25,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: Year 1 $50,000 Year 2 20,000 Year 3 75,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Year 1 Year 2 Year 3 Preferred stock (Dividends per share) $ $ $ Common stock (Dividends per share) $ $ $arrow_forwardRendivir Company had the following transactions during the year: January 1 Ordinary shares outstanding 200,000 March 1 Isued a 20% share dividend 30,000 May 1 Issued ordinary shares 40,000 September 1 Treasury shares purchased 10,000 November 1 Issued 3 for 1 share split What is the weighted average number of shares outstanding?arrow_forward

- Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,761,000 $2,532,500 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 90,000 shares 115,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Y6 Earnings per Share $fill in the blank 1 $fill in the blank 2 b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable? fill in the blankarrow_forwardVaiarrow_forwardFinancial statement data for the years ended December 31 for Cottontop Corporation follow: 20Y3 20Y2 Net income $957,250 $832,250 Preferred dividends $146,000 $146,000 Average number of common shares outstanding 55,000 shares 45,000 shares a. Determine the earnings per share for 20Y3 and 20Y2. Round your answers to two decimal places. 20Y3 $fill in the blank 1 per share 20Y2 $fill in the blank 2 per share b. Does the change in the earnings per share from 20Y2 to 20Y3 indicate a favorable or unfavorable trend?Unfavorablearrow_forward

- Dividends per share Zero Calories Company has 20,000 shares of cumulative preferred 1% stock, $50 par and 200,000 shares of $10 par common stock. The following amounts were distributed as dividends: Year Amount 20Y1 $30,000 20Y2 8,000 20Y3 110,000 Determine the dividends per share for preferred and common stock for each year. If an answer is zero, enter '0'. Round all answers to two decimal places.arrow_forwardEarnings Per Share Calculati ons Informatlon Provlded: Common Shares Balance at the beginning of the ye ar On July 1, the company sold an additional 5,000,000 shares 8,000,000 shares Each share sold for $3.00 and had a par value of $ 0.10 Preferrred Shares Beginning of the Year End of the Year 50,000 150,000 Dividends pald to Preferred Shareholders Dividends pald to Common Sharehol ders 650, 000 1,000, 000 Ex ce pt from Income Statement Income from Continuing Operations 22,000, 000 Income from Discontinued Ope rations (aftertaxImpact) 2,100, 000 Net Income 24,100, 000 Requlred: Based on the Information provided above: 1 Prepare the Joumal entry to record the July 1 sale of shares 2 Calculate the welghted average common shares outstandi ng 3 Calculate e arnings pershare (as required). Note: Show your detal led calaulatlons.arrow_forwardDividends Per Share Windborn Company has 30,000 shares of cumulative preferred 1% stock, $150 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 18,000 135,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y3 20Y1 20Y2 20Y3 $112,500 Preferred Stock (dividends per share) G LA Common Stock (dividends per share) U Sarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education