Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

No Wrong Answer

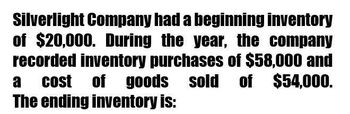

Transcribed Image Text:Silverlight Company had a beginning inventory

of $20,000. During the year, the company

recorded inventory purchases of $58,000 and

a cost of goods sold of $54,000.

The ending inventory is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, Pope Enterprises inventory was 625,000. Pope made 950,000 of net purchases during the year. On its year-end income statement, Pope reported cost of goods sold of 1,025,000. Calculate Popes December 31 ending inventory.arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardLangstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forward

- Assume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forwardShaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.arrow_forwardLogo Gear purchased $2,250 worth of merchandise during the month, and its monthly income statement shows cost of goods sold of $2,000. What was the beginning inventory if the ending inventory was $1,000?arrow_forward

- Carla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December.arrow_forwardOn December 31, Pitts Manufacturing Company reports the following assets: What is the total amount of Pitts inventory at year-end?arrow_forward

- Kulsrud Company would like to estimate the current inventory level. Using the gross profit method and the following information, estimate the current inventory level for Kulsrud Company. Goods available for sale 100,000 Net sales 150,000 Normal gross profit as a percent of sales 40%arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forwardBleistine Company had the following transactions for the month. Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $50 each. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning