Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hi expert please give me answer general accounting question

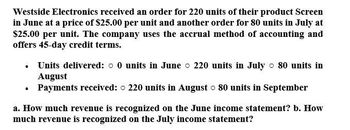

Transcribed Image Text:Westside Electronics received an order for 220 units of their product Screen

in June at a price of $25.00 per unit and another order for 80 units in July at

$25.00 per unit. The company uses the accrual method of accounting and

offers 45-day credit terms.

Units delivered: 0 units in June 220 units in July 80 units in

August

⚫ Payments received: 220 units in August 80 units in September

a. How much revenue is recognized on the June income statement? b. How

much revenue is recognized on the July income statement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forwardSmith Company is required to charge customers an 8% sales tax on all goods it sells. At the time of sale, Smith includes the combined amount of both sales and sales tax in the sales account. At the end of May, Smiths sales account for May has a credit balance of 540,000. Prepare the sales tax adjusting journal entry for the end of May.arrow_forwardI want to correct answer general accounting questionarrow_forward

- Spencer Consulting, which invoices its clients on terms 2/10, n/30, had credit sales for May and June of $56,000 and $64,000, respectively. Analysis of Spencer's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales): Receiving Discount Beyond Discount Period Totals In month of sale In month of following sale 50% 20% 70% 15% 10% 25% Uncollectible accounts, returns, and allowances 5% 100% Determine the estimated cash collected on customers' accounts in June.arrow_forwardSpencer Consulting, which invoices its clients on terms 2/10, n/30, had credit sales for May and June of $245,000 and $280,000, respectively. Analysis of Spencer's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales): Receiving Discount Beyond Discount Period Totals In month of sale 50% 20% 70% In month of following sale 15% 10% 25% Uncollectible accounts, returns, and allowances 5% 100% Determine the estimated cash collected on customers' accounts in June. $Answerarrow_forwardPlease help me with this question general Accountingarrow_forward

- ABC Incorporated, has a beginning receivables balance on January 1st of $620. Sales for January through April are $380, $410, $490 and $510, respectively. The accounts receivable period is 60 days. How much did the firm collect in the month of March? Assume 365 days per year. Multiple Choice $620 $490 $510 $380 $410arrow_forwardWhat is the payable deferral period on these general accounting question?arrow_forwarda. Record Navis, Incorporated's sales for a month at $75,000. The items sold cost $62,500. Navis records sales at the total invoice amount. b. Record the return of $7,500 of the above sales within the 30-day return period. c. Record the receipt of payment on the remainder of the month's sales, assuming that customers purchasing $50,000 took advantage of a 2 percent cash discount for early payment. None of the customers taking advantage of the cash discount were among those that returned their purchases. Complete this question by entering your answers in the tabs below. Required A Required B Required C Record the receipt of payment on the remainder of the month's sales, assuming that customers purchasing $50,000 took advantage of a 2 percent cash discount for early payment. None of the customers taking advantage of the cash discount were among those that returned their purchases. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first…arrow_forward

- Alpha Company makes all its sales on account. Accounts receivable payment experience is as follows: Percent paid in the month of sale 35% Percent paid in the month after the sale 54% Percent paid in the second month after the sale 6% Alpha provided information on sales as follows: May $150,000 June $125,000 July $136,000 August (expected) $142,000 How much of June's credit sales is expected to be collected in the month of July? Group of answer choices $30,000 $60,000 $36,000 $67,500 $80,000arrow_forwardPutman Company had cash sales of $75,950 (including taxes) for the month of June. Sales are subject to 8.5% sales tax.Prepare the entry to record the sale. Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardOn April 30, Gomez Services had an Accounts Receivable balance of $30,100. During the month of May, total credits to Accounts Receivable were $65,200 from customer payments. The May 31 Accounts Receivable balance was $24,000. What was the amount of credit sales during May?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,