Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December he performed $20,000 of legal services for a client. Manny typically requires his clients to pay his bills immediately upon receipt. Assume Manny’s marginal tax rate is 37 percent this year and next year, and that he can earn an after-tax rate of return of 12 percent on his investments.

a. What is the after-tax income if Manny sends his client the bill in December?

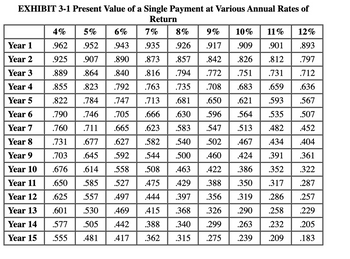

b. What is the after-tax income if Manny sends his client the bill in January? Use Exhibit 3.1. (Round your answer to the nearest whole dollar amount.)

c. Based on requirements a and b, should Manny send his client the bill in December or January?

multiple choice

-

December

-

January

Step by stepSolved in 2 steps

- Grove Media plans to acquire production equipment for $845,000 that will be depreciated for tax purposes as follows: year 1, $329,000; year 2, $189,000; and in each of years 3 through 5, $109,000 per year. A 10 percent discount rate is appropriate for this asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9. Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($169,000 per year). Complete this question by entering your answers in the tabs below. Required A Required B Compute the present value of the tax shield resulting from depreciation. Note: Round PV factor to 3 decimal places. Present value of the tax shieldarrow_forwardExhibit 1-B Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) 1% 3% 1.000 2.030 Period 2% 4% 5% 6% 7% 8% 9% 10% 11% 1 1.000 2.020 3.060 4.122 5.204 6.308 7.434 1.000 2.040 3.122 1.000 2.050 3.153 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 3.030 2.070 3.215 4.440 5.751 2.090 3.278 4.573 5.985 2.100 3.310 4.641 6.105 7.716 9.487 2.110 3.342 4.710 6.228 7.913 2.060 2.080 3 3.184 4.375 3.091 3.246 4.184 5.309 6.468 7.662 4 4.060 4.246 4.310 4.506 5.101 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 21.825 23.698 25.645 27.671 29.778 41.646 56.085 5.526 5.637 5.867 6.975 8.394 7.336 8.923 6.152 6.802 7.153 7.523 7 7.214 8.142 8.654 9.200 9.783 8.583 11.028 13.021 15.193 17.560 20.141 22.953 8.286 10.260 11.436 13.579 11.859 14.164 16.722 8. 8.892 9.549 9.897 10.637 9.369 9.755 10.159 11.027 11.491 11.978 12.488 12.578 14.207 10 10.462 10.950 11.464 13.181 13.816 14.487 15.937 12.169 13.412…arrow_forwardNet present value-unequal lives Project 1 requires an original investment of $50,100. The project will yield cash flows of $10,000 per year for 8 years. Project 2 has a computed net present value of $11,600 over a 6-year life. Project 1 could be sold at the end of 6 years for a price of $38,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest 6% 10% Year 1 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 0.943 0.890 0.840 0.792 0.747 7 0.705 0.665 0.627 0.592 0.558 0.943 1.833 2.673 3.465 4.212 4.917 0.909 5.582 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.909 1.736 2.487 3.170 3.791 4.355 12% 4.868 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.893 1.690 2.402 3.037 3.605 4.111 15% 4.564 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.870 1.626 2.283 2.855 3.353…arrow_forward

- Winett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year municipal contract. The equipment costs $222,000 and would have no salvage value when the contract expires at the end of four years. Estimated annual operating results of the project are as follows. Revenue from contract sales. Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from contract work $211,000 55,500 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Winett's proposal to undertake this contract. a. Payback period b. C. a. Payback period. b. Return on average investment. (Round your percentage answer to 1 decimal place (i.e., 0.123 to be entered as 12.3).) c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in…arrow_forwardNet Present Value Method for a Service Company Opulence Corporation has recently placed into service some of the largest cruise ships in the world. One of these ships, the Bellwether, can hold up to 3,200 passengers and it can cost $640 million to build. Assume the following additional information: There will be 300 cruise days per year operated at a full capacity of 3,200 passengers. • The variable expenses per passenger are estimated to be $95 per cruise day. The revenue per passenger is expected to be $475 per cruise day. The fixed expenses for running the ship, other than depreciation, are estimated to be $94,848,000 per year. • The ship has a service life of 10 years, with a residual value of $100,000,000 at the end of 10 years. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7…arrow_forwardThe investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $490,000. The estimated net cash flows from each project are as follows: Year 1 2 Year 3 4 5 The committee has selected a rate of 12% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $180,000. 6 7 8 9 10 1 1 2 3 2 4 5 6 3 0.943 0.890 0.840 Present Value of $1 at Compound Interest 6% 10% 12% 0.792 0.747 0.705 0.665 0.627 0.592 0.558 Net Cash Flows Office Expansion $125,000 125,000 125,000 125,000 125,000 125,000 0.943 1.833 2.673 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 Net Cash Flows Servers $165,000 165,000 165,000 165,000 0.909 1.736 2.487 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322…arrow_forward

- The investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $490,000. The estimated net cash flows from each project are as follows: Year 1 1 2 3 4 2 Year 5 6 3 7 8 9 10 4 The committee has selected a rate of 12% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $180,000. 5 6 0.943 0.890 0.840 Present Value of $1 at Compound Interest 6% 10% 0.792 0.747 0.705 0.665 0.627 Net Cash Flows Office Expansion $125,000 125,000 125,000 125,000 125,000 125,000 0.592 0.558 0.909 0.826 0.751 0.683 0.621 0.564 0.513 Net Cash Flows Servers 0.467 $165,000 165,000 165,000 165,000 0.424 0.386 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 15% 0.870 0.756 0.658 0.572 0.497 0.432…arrow_forwardInternal Rate of Return Method The internal rate of return method is used by King Bros. Construction Co. in analyzing a capital expenditure proposal that involves an investment of $110,610 and annual net cash flows of $18,000 for each of the 10 years of its useful life. Present Value of an Annuity of $1 at Compound Interest 6% Year 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 1.626 1.528 1.833 1.736 1.690 2.402 2.283 2.673 2.487 2.106 3.170 3.465 3.037 2.855 2.589 2.991 4.212 3.791 3.605 3.352 4.111 4.917 4.355 3.784 3.326 5.582 4.868 4.564 4.160 3.605 4.487 3.837 6.210 5.335 4.968 6.802 5.759 5.328 4.772 4.031 5.650 10 7.360 6.145 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round ecimal places. your answer to threearrow_forwardPresent value of an Annuity of $1 in Arrears Periods 4% 6% 8% 10% 12% 14% 1 0.962 0.943 0.926 0.909 0.893 0.877 2 1.886 1.833 1.783 1.736 1.690 1.647 3 2.775 2.673 2.577 2.487 2.402 2.322 4 3.630 3.465 3.312 3.170 3.037 2.914 5 4.452 4.212 3.993 3.791 3.605 3.433 6 5.242 4.917 4.623 4.355 4.111 3.889 7 6.002 5.582 5.206 4.868 4.564 4.288 8 6.733 6.210 5.747 5.335 4.968 4.639 9 7.435 6.802 6.247 5.759 5.328 4.946 10 8.111 7.360 6.710 6.145 5.650 5.216 Lucas Company is considering a project with an initial investment of $530,250 in new equipment that will yield annual net cash flows of $95,000, and will be depreciated at $75,750 per year over its seven year life. What is the internal rate of return? a.6% b.14% c.10% d.12% e.8%arrow_forward

- Net Present Value-Unequal Lives Project 1 requires an original investment of $88,600. The project will yield cash flows of $17,000 per year for six years. Project 2 has a calculated net present value of $23,200 over a four-year life. Project 1 could be sold at the end of four years for a price of $69,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest 12% Year 6% 10% 15% 20% 0.909 1 0.943 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 0.712 3 0.840 0.751 0.658 0.579 0.792 0.683 0.636 0.572 4 0.482 0.621 5 0.747 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 0.424 0.592 0.361 0.284 0.194 0.247 10 0.558 0.386 0.322 0.162arrow_forwardests - X þver Reference Reference Present Value of Ordinary Annuity of $1 Present Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 0.905 0.820 | 0.744 0.676 0.614 | 0.558 0.508 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% us Period 1 Period 2 Period 3 Period 4 Period 5 0.935 0.952 0.943 0.935 1.859 1.833 1.808 0.926 0.917 0.909 0.893 0.877 0.870 1.783 1.759 1.736 2.577 2.531 2.487 0.990 0.990 0.980 0.971 0.962 | 0.952 0.980 0.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.864 0.961 0.924 0.888 0.855 0.823 0.951 0.906 0.863 0.822 0.784 0.943 0.917 0.909 0.893 | 0.877 0.842 0.826 0.797 0.769 0.772 0.751 0.712 0.675 0.658 | 0.641 0.708 0.683 0.636 | 0.592 0.572 0.552 0.516 0.482 0.650 0.621 0.567 0.980 0.971 0.962 0.862 0.847 0.833 0.926 0.862 0.847 0.833 1.566 | 1.528 2.174 2.106 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798…arrow_forwardTait is entering high school and is determined to save money for college. Tait feels he can save $2,500 each year for the next four years from his part-time job. If Tait is able to invest at 6%, how much will he have when he starts college? (Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) E (Click the icon to view Future Value of Ordinary Annuity of $1 table.) - X Reference (Round your answer to the nearest dollar.) Reference When Tait starts college he will have Present Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Future Value of $1 0.990 0.980 0.971 0.962 0.952 0.943 0.980 0.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.864 0.840 0.961 0.924 0.888 0.855 0.823 0.792 0.951 0.906 0.863 0.822 0.784 0.747 0.917 0.909 0.893 | 0.877 0.870 0.862 0.847 0.833 0.826 0.797 0.769 0.756 0.743…arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning