Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

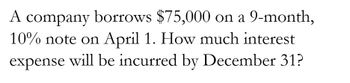

Transcribed Image Text:A company borrows $75,000 on a 9-month,

10% note on April 1. How much interest

expense will be incurred by December 31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardA companys sales for January are $250,000. If the company projects warranty obligations to be 5% of sales, what is the warranty liability amount for January?arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forward

- Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual interest rate of 6%, and payable in four months. How much interest will Marathon Peanuts owe at the end of four months? A. $2,600 B. $7,800 C. $137,800 D. $132,600arrow_forwardSub-Cinema Inc. borrowed $10,000 on Jan. 1 and will repay the loan with 12 equal payments made at the end of the month for 12 months. The interest rate is 12% annually. If the monthly payments are $888.49, what is the journal entry to record the cash received on Jan. 1 and the first payment made on Jan. 31?arrow_forwardA company receives a 6%, 120-day note for $2,400. The total interest due on the maturity date is (Use 360 days a year.) ?arrow_forward

- On January 23 of a non-leap year, a loan is taken out for $15,230 at 8.8% simple interest. What is the maturity value of the loan on October 23?arrow_forwardA nine months, 15% note for $9000 dated April 15 is reciebed for a customer. The maturity value of the note is what?arrow_forwardA 60-day, 9% note for $10,000, dated May 1, is received from a customer on account. Use 30 day months and 360 day years in calculations of interest. The maturity value of the note is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT