ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

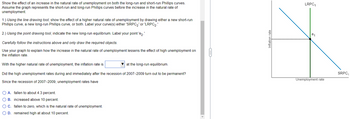

Transcribed Image Text:Show the effect of an increase in the natural rate of unemployment on both the long-run and short-run Phillips curves.

Assume the graph represents the short-run and long-run Phillips curves before the increase in the natural rate of

unemployment.

1.) Using the line drawing tool, show the effect of a higher natural rate of unemployment by drawing either a new short-run

Phillips curve, a new long-run Phillips curve, or both. Label your curve(s) either 'SRPC₂' or 'LRPC2.'

2.) Using the point drawing tool, indicate the new long-run equilibrium. Label your point 'e

Carefully follow the instructions above and only draw the required objects.

Use your graph to explain how the increase in the natural rate of unemployment lessens the effect of high unemployment on

the inflation rate.

With the higher natural rate of unemployment, the inflation rate is

at the long-run equilibrium.

Did the high unemployment rates during and immediately after the recession of 2007-2009 turn out to be permanent?

Since the recession of 2007-2009, unemployment rates have

O A. fallen to about 4.3 percent.

O B. increased above 10 percent.

O C. fallen to zero, which is the natural rate of unemployment.

O D. remained high at about 10 percent.

Inflation rate

LRPC₁

e₁

Unemployment rate

SRPC₁

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the model of unemployment with job separation rate s = 0.05 and job finding rate f = 0.20. If the unemployment rate U = 10,000, L = 200,000, and E = 190,000 then what will the natural rate of unemployment be? Please show your calculation. If U were to fall to 5,000 because of an exogenous shock, how would the unemployment rate change in the short run? In the long run? If s were to fall to 0.03 because of an exogenous shock, how would the unemployment rate change in the short run? In the long run?arrow_forwardCan you please help me with D) and E) please and thanks.arrow_forwardConsider the Friedman-Phelps model of the Phillips Curve as discussed in lecture. Assume the economy is currently at Y-full employment. When the Fed sells government securities to the public, and there are no other exogenous shocks to the economy, which one of the following is predicted to happen? The actual inflation rate increases, and the unemployment rate increases permanently. O The actual inflation rate increases, and the unemployment rate increases first and then gradually goes back to the natural rate of unemployment. O The actual inflation rate decreases, and the unemployment rate increases first and then gradually goes back to the natural rate of unemployment. The actual inflation rate decreases, and the unemployment rate increases permanently. The actual inflation rate decreases, and the unemployment rate decreases first and then gradually goes back to the natural rate of unemployment.arrow_forward

- Illustrate the effects of the following developments on Phillips curves. Give the economic reasoning underlying your answers. a) In order to increase the amount of highly skilled labour in Indonesia, the government decided to make an online training program. What will happen to the Phillips Curve?arrow_forwardAssume that the economy self corrects to long-run equilibrium without a governmental policy. Which of the following is the correct adjustment on the Phillips Curve Graph?arrow_forwardAccording to the St. Louis Federal Reserve the natural unemployment rate is 4.44 percent (Q2 2022 B) and the U.S. Bureau of Labor Statistics (BLS) estimates the U.S. unemployment rate (U3, March 2022 ) to be 3.6 percent. If you expect unemployment to continue to fall the short-run Phillips curve would predict: O A decrease in the inflation rate. An increase in the inflation rate. A decrease in the unemployment rate. An increase in the unemployment rate.arrow_forward

- 2. Analyze the effects of the following developments on both the short-run and the long-run Phillips curves. Use the graphs and explain in detail: a) a rise in the natural rate of unemployment b) a substantial increase in the price of energyarrow_forwardI need help with this question with explanation.arrow_forwardAssume that the federal government increases unemployment compensation, which of the following is the correct adjustment on the Phillips Curve Graph?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education