CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

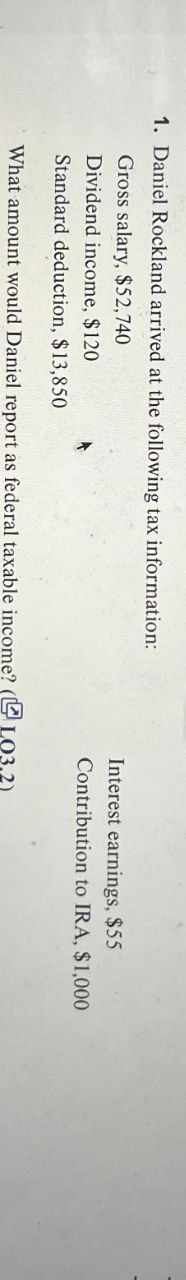

Transcribed Image Text:1. Daniel Rockland arrived at the following tax information:

Gross salary, $52,740

Dividend income, $120

Standard deduction, $13,850

Interest earnings, $55

Contribution to IRA, $1,000

What amount would Daniel report as federal taxable income? (LO3.2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute the 2019 tax liability and the marginal and average tax rates for the following taxpayers (use the 2019 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single taxpayer, has taxable income of 94,800. b. Lazare, who files as a head of household, has taxable income of 57,050.arrow_forwardMelodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forward1. Daniel Simmons arrived at the following tax information: Gross salary, Page 121 Standard deduction, $12,400 Interest earnings, $75 $62,250 Dividend income, Adjustments to $140 income, $850 What amount would Daniel report as taxable income? (LO3.2)arrow_forward

- LO.6 Compute the 2024 tax liability and the marginal and average tax rates for the following taxpayers: Chandler, who files as a single taxpayer, has taxable income of $108,700. Lazare, who files as a head of household, has taxable income of $65,100.arrow_forwardBen Jefferson arrived at the following tax information: Gross salary, $41,780 Interest earnings, $225 Dividend income, $80 One personal exemption, $2,650 Itemized deductions, $3,890 Adjustments to income, $1,150 What amount would Ben report as taxable income?arrow_forwardRoss Martin arrived at the following tax information: Gross salary, $56,145 Interest earnings, $205` Dividend income, $65 Standard deduction, $12,000 Itemized deductions, $11,250 Adjustments to income, $1,200 What amount would Ross report as taxable income? If Lola Harper had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is $12,000. Donations to church and other charities, $6,050 Medical and dental expenses that exceed 10 percent of adjusted gross income, $2,400 State income tax, $4,690 What would be the average tax rate for a person who paid taxes of $4,584 on a taxable income of $41,670? Using Federal Tax Rate Schedules. Using the tax rate schedule in Exhibit 4-6, determine the amount of taxes for the following taxable income amounts: a. Married Filing Jointly: Taxable income $50,000. b. Married Filing Jointly: Taxable income $70,000. c. Married Filing Jointly: Taxable…arrow_forward

- H1.arrow_forwardDaniel Simmons arrived at thefollowing tax information:Gross salary,$62,250Dividend income,$140Standarddeduction, $12,400Interest earnings,$75Adjustments toincome, $850 What amount would Daniel report astaxable income?arrow_forwardFranklin Stewart arrived at the following tax information: Gross salary Interest earnings Eligible dividend income Basic personal amount Union dues Moving expense (50 km for employment) $49,100 870 110 39744.5 3,650 7,880 1,860 What amount will Franklin report as taxable income? (Round your answer to the nearest dollar amount. Omit the "$" sign in your response.) Taxable incomearrow_forward

- Franklin Stewart arrived at the following tax information: Gross salary Interest earnings Eligible dividend income Basic personal amount Union dues Moving expense (50 km for employment) $ 47,780 225 100 12,069 3,890 1,150 What amount will Franklin report as taxable income? (Round your answer your response.) Taxable income $arrow_forwardUse the tax brackets and rates to compute the federal tax for Jim, who is declaring taxable income of$90,00O $44,701 or less 15% Over $44,701 - $89,401 22% Over $89,401 - $138,581 26% O $23,400 O $19,800 O $10,070.93 O $16,694.89arrow_forwardUsing the formula and methodology demonstrated in class, calculate the income tax for an individual who has: • $171,691.00 of income from all sources • $3,877.00 in Exclusions • $12,167.00 in Adjustments • $14,865.00 in below-the-line Deductions • $730.00 in Credits For the purposes of this question, assume this is an individual taxpayer. Also assume a standard deduction of $12,550.00. In calculating the tax, use the following tax rates and brackets: Answer: Income Up to $9,950 $9,951 to $40,525 Rate 10% 12% $40,526 to $86,375 22% $86,376 to $164,925 24% $164,926 to $209,425 32% $209,426 to $523,600 35% $523,601 and more 37% 32,872.42 x (27,078.44)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT