FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

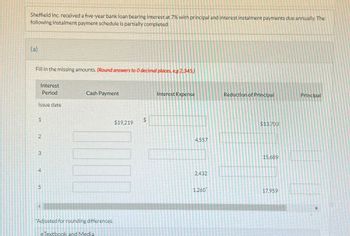

Transcribed Image Text:Sheffield Inc. received a five-year bank loan bearing interest at 7% with principal and interest instalment payments due annually. The

following instalment payment schedule is partially completed:

(a)

Fill in the missing amounts. (Round answers to O decimal places, eg 2,345.)

Interest

Period

Cash Payment

Issue date

1

2

3

4

ԼՈ

5

*Adjusted for rounding differences.

eTextbook and Media

$

SA

$19,219

Interest Expense

Reduction of Principal

Principal

4,557

2,432

$13.703

15.689

1,260

17,959

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assuming a 360-day year, proceeds of $45,552 were received from discounting a $46,830, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was а. 12.16% b. 12.67% C. 8.92% Od. 10.92%arrow_forwardA 7% p.a. demand loan was paid off with payments of $3,000 on April 10th, $2,000 on September 25th and a final payment of $5,447.13 on December 5th. If it uses the standard declining balance method, what was the original amount of the loan back on March 8?arrow_forwardLoans Scotiabank approved a $230,000.00 line of credit for Buhler Industries at prime + 1%. It requires only the repayment of accrued interest on the 24th of each month, which is automatically deducted from the checking account of Buhler Industries. Buhler took out an advance on December 6 for $160,000.00 and made a payment of $130,000.00 on January 16. The prime rate was 5.25% initially and increased to 6.5% on January 7. Complete the repayment schedule below by filling in the payment and principal amounts. Date Balance Annual before Interest Transaction Rate Number Interest of Days Charged Accrued Interest Payment (+) or Advance (-) Principal Balance after Amount Transaction Dec 6 Dec 24 $160,000.00 $160,000.00 6.25% 18/365 $493.15 $493.15 $160,000.00 Jan 7 6.25% $160,000.00 14/365 $383.56 $383.56 $160,000.00 Jan 16 $160,000.00 7.5% 9/365 $295.89 $679.45 $30,000.00 Jan 24 $30,000.00 7.5% 8/365 $49.32 $728.77 $30,000.00 You can earn partial credit on this problem.arrow_forward

- nces On 1 October 20X6, Halpern Co borrowed $180,000 from Canada Bank The note has a two-year term, and requires that interest of 9% be paid each 30 September, with the principal payable 30 September 20X8 Required: Provide all entries for the note from 20X6 to 20X8 (If no entry is required for a transaction/event. select "No journal entry required" in the first account field.) View transaction list 1 Record the borrowings from Canada Bank. 2 Record the accrual of intest for the period ending 31st December 20x6. a Record the interest payment on 30 September 20x7. 4 Record the accrual of interest for the period ending 31st December 20X7 5 Record the interest payment on 30 September 20X8. Record the repayment of borrowings to Canada Bank 6 Note: journal entry has been entered Record entry Clear entry EX - - 2 Credit View gener al journalarrow_forwardPresented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date May 31 August 1 September 7 Principal $570,000 93,600 115,000 Annual Interest Rate 10 % % 11 % $ tA $ Total Interest $702arrow_forwardBulldogs Inc. loaned a certain amount from a reputable bank for a term of one year at 8% quoted rate for a principal of P415,000. Out of the face value of the loan, only P375,000 can be used due to the provision of a compensating balance. What is the effective rate of interest and the compensating balance? A. 8%; 33,200 B. 8%; 40,000 C. 8.55%; 33,200 D. 8.85%; 40,000arrow_forward

- Gray Inc. lends White Ltd. $60,000 on April 1, accepting a 6-month, 4.5% interest note. Interest is due the first of each month, commencing May 1. Gray Inc. has an April 30 year-end. What adjusting entry should be made before the financial statements can be prepared? Cash 225 Interest Revenue. 225 Note Receivable. Cash. 60,000 60,000 Interest Receivable. Interest Revenue. 1,350 1350 Interest Receivable.. Interest Revenue. 225 225arrow_forward14. Gingerbread Corp was issued a $220,000 loan at 6%. The amortization schedule created by the company accountant is presented below. How much interest will Gingerbread Corp record in interest expense over a period of 6 years?arrow_forwardAssuming a 360-day year, the interest charged by the bank, at the rate of 8%, on a 90-day, discounted note payable of $105,987 is a.$4,240 b.$8,479 c.$2,120 d.$105,987arrow_forward

- Bright Inc. acquired a debt of $252,000. Acme agrees to repay the loan with payments of $13,500 made at the end of every three months. Interest is 8.52% compounded semi-annually. Answer the following questions in the designated input box (Format currency with $, commas and two decimal places): Input Box #3: What is the principal repaid in the 15th payment? Input Box #4: What is the cost of the debt (i.e. the interest paid) for the first two years? Input Box #5: What is the outstanding balance after the 11th payment?arrow_forward104.arrow_forwardHalep Inc. borrowed $36,000 from Davis Bank and signed a 4-year note payable stating the interest rate was 4% compounded annually. Halep Inc. will make payments of $9,917.64 at the end of each year. Prepare an amortization table showing the principal and interest in each payment. Round your answers to two decimal places. Year BeginningBalance Payment Interest To Principal EndingBalance 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 $fill in the blank 5 2 fill in the blank 6 fill in the blank 7 fill in the blank 8 fill in the blank 9 fill in the blank 10 3 fill in the blank 11 fill in the blank 12 fill in the blank 13 fill in the blank 14 fill in the blank 15 4 fill in the blank 16 fill in the blank 17 fill in the blank 18 fill in the blank 19 fill in the blank 20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education