FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

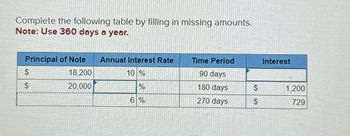

Transcribed Image Text:Complete the following table by filling in missing amounts.

Note: Use 360 days a year.

$

Principal of Note

18.200

Annual Interest Rate

Time Period

Interest

10 %

90 days

S

20,000

%

180 days

$

1,200

6 %

270 days

$

729

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Complete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. $ Principal 1,328 Interest rate 5% Date borrowed June 08 Date repaid January 19 Exact time Interest Maturity valuearrow_forwardFrom page 5-9 of the VLN, the last practice problem where the company invested money for 4 months, how much interest revenue did the company earn in year 20XB?arrow_forwardComplete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,900 Interest rate 9% Date borrowed May 21 Date repaid August 9 Exact time Interest Maturity valuearrow_forward

- Using the ordinary interest method, find the amount of interest on a loan of $5,000 at 12 % interest, for 274 days. (Round to the nearest cent.) 2 O $380.56 O$469.18 O $475.69 O $575.00arrow_forwardDomestic Don't upload image pleasearrow_forwardComplete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,100 Interest rate 5% Date borrowed May 9 Date repaid August 14 Exact time Interest Maturity valuearrow_forward

- Presented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date May 31 August 1 September 7 Principal $570,000 93,600 115,000 Annual Interest Rate 10 % % 11 % $ tA $ Total Interest $702arrow_forwardHarrison Corporation borrowed $39,000 from F&M Bank on June 1 of the current year. The bank required 8% interest. Interest will be paid when the nine-month note becomes due. What is the interest expense for the subsequent year in which the note is due and paid? (Do not round intermediate calculations. Only round your final answer to the nearest dollar.) ○ A. $1,560 OB. $1,820 OC. $520 OD. $2,340arrow_forwardThe interest on a $3,000, 10%, 180-day note receivable is (assume 360 days per year) O $150 O $3.300 O $300 $3000 Onmi ERCO DUTOarrow_forward

- E10-3A Accrued Interest Payable Compute the interest accrued on each of the following notes payable owed by Northland, Inc., on December 31: Lender Date of Note Principal Interest Rate Term Maple 11/21 $18,000 11% 120 day Wyman 12/13 14,000 8 90 days Nahn 12/10 16,000 12 60 daysarrow_forwardJournal Entries (Note Received, Renewed, and Collected) Jan. Received a 30-day, 6% note in payment for merchandise sale of $20,000. 16 Feb. Received $100 (interest) on the old (January 16) note; the old note is renewed for 30 15 days at 7%. Mar. Received principal and interest on the new (February 15) note. 17 19 Received a 60-day, 6% note in payment for accounts receivable balance of $8,000. May Received $80 (interest) plus $1,000 principal on the old (March 19) note; the old note 18 renewed for 60 days (from May 18) at 6%. July Received principal and interest on the new (May 18) note. 17 Prepare general journal entries for the transactions. Assume 360 days in a year. Page: 1 ACCOUNT TITLE DOC. POST. NO. REF. DATE DEBIT CREDIT 20-- 1 Jan. 16 3 4 Feb. 15 4 6 7 8 9 Mar. 17 9 10 10 11 11 12 12 13 Mar. 19 13 14 14 15 15 16 May 18 16 17 17 18 18 19 19 20 20 21 July 17 21 22 22 23 23 24 24 inarrow_forwardTell me why this is the answer as opposed to the othersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education