FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

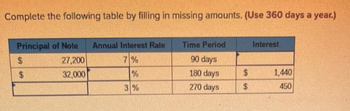

Transcribed Image Text:Complete the following table by filling in missing amounts. (Use 360 days a year.)

Principal of Note Annual Interest Rate

27,200

7%

32,000

%

3%

$

$

Time Period

90 days

180 days

270 days

$

$

Interest

1,440

450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The table below shows the amortization schedule for a $3000 debt, which is amortized in 3 equal quarterly payments at 2.8% interest per quarter. Fill in the blanks. (No need to show your calculations in this question). Payment number Payment Interest Unpaid balance reduction Unpaid balance $3,000.00 2 56.77 1,027.74 3 1,027.74 0.00arrow_forwardPresented below are data on three promissory notes. Determine the missing amounts. (Round answers for Total Interest to O decimal places, e.g. 825. Round annual interest rate to 0 decimal places, e.g. 15%. Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date Principal $780,000 80,400 165,000 Annual Interest Rate 15 % % 16 % $ $ Total Interest $938arrow_forwardkes Complete the following without using Table 19.1. (Round the "Total amount" and "Total interest" to the nearest cent.) Rate of compound interest Principal $ 1,360 Time. (years) 2 Compounded 10% Semiannually Periods Rate Total amount Total interestarrow_forward

- Concord Inc. received a five-year bank loan bearing interest at 7% with principal and interest instalment payments due annually. The following instalment payment schedule is partially completed: (a) Fill in the missing amounts. (Round answers to O decimal places, e.g 2,345.) Cash Payment $17,171 EA Interest Expense 4,071 2,173 1,129* Reduction of Principal $12,243 14,017 16,042 Principal Balance $70,400 58,157 45,057 16,042arrow_forwardplease answer do not image formatarrow_forwardplease answer this with explantion computation, formula for each thanks answer in textarrow_forward

- Presented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months eTextbook and Media Maturity Date May 31 August 1 September 7 # + Principal $810,000 99,000 180,000 Annual Interest Rate 10 7% 8 % $ Total Interest 8100 $495 6400arrow_forwardComplete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,900 Interest rate 9% Date borrowed May 21 Date repaid August 9 Exact time Interest Maturity valuearrow_forwardYou are told that a note has repayment terms of $1,700 per quarter for 6 years, with a stated interest rate of 8%. How much of the total payment is for principal, and how much is for interest? Calculate using (a) financial calculator or (b) Excel function PV. (Round answers to 2 decimal places, eg. 5,275.25.) Total payment for principal Total interest Determine if the total interest will be higher or lower than with an annual payment. The total interest will be than with an annual payment.arrow_forward

- Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,100 Interest rate 5% Date borrowed May 9 Date repaid August 14 Exact time Interest Maturity valuearrow_forwardPresented below are data on three promissory notes. Determine the missing amounts. (Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date May 31 August 1 September 7 Principal $570,000 93,600 115,000 Annual Interest Rate 10 % % 11 % $ tA $ Total Interest $702arrow_forwardThe interest on a $3,000, 10%, 180-day note receivable is (assume 360 days per year) O $150 O $3.300 O $300 $3000 Onmi ERCO DUTOarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education