FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

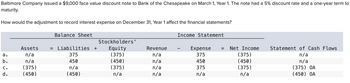

Transcribed Image Text:Baltimore Company issued a $9,000 face value discount note to Bank of the Chesapeake on March 1, Year 1. The note had a 5% discount rate and a one-year term to

maturity.

How would the adjustment to record interest expense on December 31, Year 1 affect the financial statements?

Balance Sheet

Income Statement

Stockholders'

a.

Assets

n/a

= Liabilities +

Equity

Revenue

Expense

=

Net Income

Statement of Cash Flows

375

(375)

n/a

375

(375)

n/a

b.

n/a

450

(450)

n/a

450

(450)

C.

(375)

n/a

(375)

n/a

375

(375)

n/a

(375) OA

d.

(450)

(450)

n/a

n/a

n/a

n/a

(450) OA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Assuming a 360-day year, proceeds of $43,722 were received from discounting a $44,958, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was O a. 12.24% b. 11.00% c. 9% Od. 12.75%arrow_forwardThe following transactions apply to Hooper Co. for Year 1, its first year of operations: 1. Issued $130,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Collected $88,000 cash from accounts receivable. 4. Loaned $11,000 to Mosby Co. on November 30, Year 1. The note had a one-year term to maturity and a 6 percen interest rate. 5. Paid $34,000 of salaries expense for the year. 6. Paid a $2,000 dividend to the stockholders. 7. Recorded the accrued interest on December 31, Year 1 (see item 4). 8. Estimated that 1 percent of service revenue will be uncollectible. Problem 5-26A (Algo) Part b b. Prepare the income statement, balance sheet, and statement of cash flows for Year 1.arrow_forwardL. How much interest income should be reported on December 31, 2020 with regards to the note from Company B? 2-2 Notes Receivables The trial balance for BLUE Corporation prepared at December 31, 2020 showed a balance of P4,000,000 for Notes Receivables broken as follows: Notes receivable from Company A Notes receivable from Company B 3,000,000 1,000,000 Total 4,000,000 Additional information: The notes receivable from Company A is a three-year non- interest bearing note, with face value of P3,000,000. The note was received in exchange for a piece of land sold by BLUE on May 1, 2020. The land was carried in the books at the date of sale at P2,600,000. The difference between the face amount of the note and the carrying value of the land was credited to gain on sale of land. The market interest rate for a note of this type is 10%. The notes receivable from Company B bears interest at 10%. The note was received from sale of goods in the normal course of business. The note is dated October…arrow_forward

- LO 8-3 E8-10 Recording Notes Receivable Transactions, Including Accrual Adjustment for Interest domic The following transactions took place for Smart Solutions Inc. 2020 a. July 1 b. Dec. 31 2021 c. July 1 250 06 Loaned $70,000 to employees of the company and received back one-year, 10 percent notes. shunt at las Accrued interest on the notes. d. July 1 berupa wollReceived interest on the notes. (No interest has been recorded since December 31.) ele St Received principal on the notes. noxidoa bed to Jouons tedW oli ni songly Bubanu adi 11 sqx mis bs& lo tuoms isrw Required: Prepare the journal entries that Smart Solutions Inc. would record for the above transactions.arrow_forwardAssuming a 360-day year, proceeds of $45,552 were received from discounting a $46,830, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was а. 12.16% b. 12.67% C. 8.92% Od. 10.92%arrow_forwardAssuming a 360-day year, proceeds of $46,510 were received from discounting a $47,941, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was a.13.18% b.13.69% c.9.94% d.11.94%arrow_forward

- Please! help me with this questionarrow_forwardOn August 1, 2022, Colombo Company’s treasurer signed a note promising to pay $122,700 on December 31, 2022. The proceeds of the note were $116,100. Use the horizontal model to show the effects of recording interest expense for the month of September. Indicate the financial statement effect. What is the discount on notes payable and what is the interest expense?arrow_forwardWhile performing the monthly bank reconciliation, Avon Company adjusted for a bank service charge of $20. Which of the following correctly shows how the adjustment for the bank service charge affects the financial statements? A. B. C. D. Assets N/A (20) (20) (20) Multiple Choice Option A Option C Option B Option D Balance Sheet Liabilities + N/A (20) N/A N/A Stockholders' Equity N/A N/A (20) (20) Revenue N/A N/A (20) N/A Income Statement Expense = N/A N/A N/A 20 Net Income N/A N/A (20) (20) Statement of Cash Flows (20) OA (20) OA (20) OA (20) OAarrow_forward

- On June 3, a company borrows $200,000 cash by giving its bank a 90-day, interest-bearing note. On the statement of cash flows, where should this be reported?arrow_forwardRiley Company borrowed $32,000 on April 1, Year 1 from Titan Bank. The note issued by Riley carried a one-year term and a 8% annual interest rate. Riley earned cash revenues of $980 during Year 1 and $1,300 during Year 2. Assume no other transactions. Based on this information alone, what are the amounts of total liabilities that would appear on Riley's December 31 balance sheets for Year 1 and Year 2, respectively? Multiple Choice ○ $32,000 and $0 ○ $1,920 and $660 $33,920 and $0 $33,920 and $34,580arrow_forwardConsider the following balance sheet for Northern Highland Credit Union (NHCU) before answering parts (i) through (v). Assets ($ million) $ Liabilities ($ million) $ Cash 30 Overnight interbank borrowing (7.00%) 160 T-notes 2 month (7.05%) 60 2-year CD (5%) 20 T-notes 3 months (7.25%) 80 7 year fixed rate Subordinated debt (8.55%) 150 T-notes two-year (7.50%) 60 Equity 25 T-notes 10-year (8.96%) 100 Corporate bonds (>5 years to maturity) 25 Total assets 355 Total liabilities and Equity 355 What is the repricing (funding) gap over the 0-to-6 months maturity bucket?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education