FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

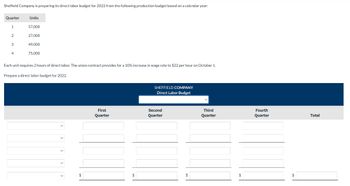

Transcribed Image Text:Sheffield Company is preparing its direct labor budget for 2022 from the following production budget based on a calendar year:

Quarter

1

2

3

4

Units

57,000

27,000

49,000

75.000

Each unit requires 2 hours of direct labor. The union contract provides for a 10% increase in wage rate to $22 per hour on October 1.

Prepare a direct labor budget for 2022.

$

First

Quarter

$

SHEFFIELD COMPANY

Direct Labor Budget

Second

Quarter

$

Third

Quarter

$

Fourth

Quarter

$

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pulham Company is preparing its direct labor budget for 2019 from the following production budget based on a calendar year: Quarter 1 2 3 4 Units 60,000 30,000 45,000 75,000 Each unit requires 2 hours of direct labor. The union contract provides for a 10% increase in wage rate to $11 per hour on October 1. Prepare a direct labor budget for 2019. V First Quarter PULHAM COMPANY Direct Labor Budget For the Year Ended December 31, 2019 Second Quarter Third Quarter Fourth Quarter Totalarrow_forwardvnt.23arrow_forwardAlpesharrow_forward

- Current Attempt in Progress The budget components for Novak Company for the quarter ended June 30 appear below. Novak sells recycling bins for $14 each. Budgeted production for the next three months is: April 24,500 units May 49,000 units June 31,000 units Novak desires to have recycling bins on hand at the end of each month equal to 20 percent of the following month's budgeted sales in units. On March 31, Novak had 3,500 bins on hand. Five pounds of plastic are required for each recycling bin. At the end of each month, Novak desires to have 10 percent of the following month's direct material needed for production on hand. At March 31, Novak had 12.250 pounds of plastic on hand. The direct materials used in production cost $0.60 per pound. Eachrecycling bin produced requires 0.10 hours of direct labor. Compute the budgeted dollar value of the ending direct materials inventory at the end of May. Cost of ending inventory $ eTextbook and Media Save for Later Attempts: 0 of 6 used Submit…arrow_forwardManagement Accounting Course Project – Part 1, B Group The Terranova Company is preparing information to complete its master budget for the quarter ending December 31, 2020. The company intends to make unit sales in the related months as follows: September 5,000 October 9,750 November 11,700 December 14,625 Units are to be sold for $10 each. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following the sale. *Required: 1) Prepare a sales budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. (Hint: a quarter = 3 months.) 2) Complete a schedule of expected cash collections for the quarter ending December 31, 2020. Show activity by month and in total.arrow_forwardA7arrow_forward

- Preparing an Overhead Budget Patrick Inc. makes industrial solvents. Budgeted direct labor hours for the first 3 months of the coming year are: January 13,140 February 12,300 March 15,075 The variable overhead rate is $0.60 per direct labor hour. Fixed overhead is budgeted at $2,580 per month. Required: Prepare an overhead budget for the months of January, February, and March, as well as the total for the first quarter. Do not include a multiplication symbol as part of your answer. Round total variable overhead and total overhead to the nearest dollar. Patrick Inc. Overhead Budget For the Coming First Quarter Overhead: January February March Total Total direct labor hrs Variable overhead rate Total variable overhead $4 Add: Fixed overhead Total overheadarrow_forwardanswer in text form please (without image)arrow_forwardDelta Manufacturing has budgeted the following unit sales: 2019 April May June July Units 25,000 40,000 60,000 45,000 Of the units budgeted, 40% are sold by the Coastal Division at an average price of $15 per unit and the remainder are sold by the Central Division at an average price of $12 per unit. Prepare separate sales budgets for each division and for the company in total for the second quarter of 2019.arrow_forward

- Preparing a Direct Labor Budget Patrick Inc. makes industrial solvents. Planned production in units for the first three months of the coming year is: January 40,000 February 55,000 March 60,000 Each drum of industrial solvent takes 0.3 direct labor hours. The average wage is $18.40 per hour. Required: Prepare a direct labor budget for the months of January, February, and March, as well as the total for the first quarter. Do not include a multiplication symbol as part of your answer. Patrick Inc. Direct Labor Budget For the Coming First Quarter Direct Labor Budget: January February March Total Units to be produced Direct labor hrs per unit Total direct labor hrs Wage rate Direct labor costarrow_forwardPart #6: H Company’s Direct Labor Budget indicates the number of direct labor hours to be used in July, August, and September are 21,000 and 18,900 and 23,000 respectively. Variable overhead is expected to be $0.90 per direct labor hour. Fixed overhead per month is expected to be $8,200. Prepare an Overhead Budget with columns for July, August, September, and Total 3rd Quarter.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education