Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

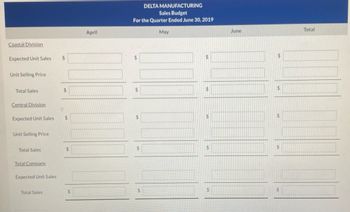

Transcribed Image Text:Coastal Division

Expected Unit Sales

Unit Selling Price

Total Sales

Central Division

Expected Unit Sales

Unit Selling Price

Total Sales

Total Company

Expected Unit Sales

Total Sales

$

$

$

$

$

April

DELTA MANUFACTURING

Sales Budget

For the Quarter Ended June 30, 2019

May

$

$

$

$

June

$

$

$

$

Total

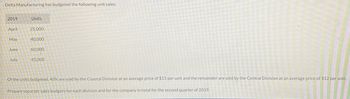

Transcribed Image Text:Delta Manufacturing has budgeted the following unit sales:

2019

April

May

June

July

Units

25,000

40,000

60,000

45,000

Of the units budgeted, 40% are sold by the Coastal Division at an average price of $15 per unit and the remainder are sold by the Central Division at an average price of $12 per unit.

Prepare separate sales budgets for each division and for the company in total for the second quarter of 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Echo Amplifiers prepared the following sales budget for the first quarter of 2018: It also has this additional information related to its expenses: Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018.arrow_forwardDigital Solutions Inc. uses flexible budgets that are based on the following data: Prepare a flexible selling and administrative expenses budget for October for sales volumes of 500,000, 750,000, and 1,000,000.arrow_forwardCASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forward

- Palmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next months sales. At the beginning of July, the beginning inventory of consumer products met that policy. Required: Prepare a production budget for the third quarter of the year. Show the number of units that should be produced each month as well as for the quarter in total.arrow_forwardThe following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardOperating Budget, Comprehensive Analysis Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing 166.06. The desired ending inventory for each month is 80% of the next months sales. b. The data on materials used are as follows: Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next months production needs. This is exactly the amount of material on hand on December 31 of the prior year. c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is 14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) f. The unit selling price of the subassembly is 205. g. All sales and purchases are for cash. The cash balance on January 1 equals 400,000. The firm requires a minimum ending balance of 50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January. Required: 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.) a. Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget g. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement j. Cash budget 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controller forecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.arrow_forward

- The data shown were obtained from the financial records of Italian Exports, Inc., for March: Sales are expected to increase each month by 10%. Prepare a budgeted income statement.arrow_forwardDelta Manufacturing has budgeted the following unit sales: 2019 Units April 25,000 May 40,000 June 60,000 July 45,000 Of the units budgeted, 40% are sold by the Coastal Division at an average price of $15 per unit and the remainder are sold by the Central Division at an average price of $12 per unit. Instructions: Prepare separate sales budgets for each division and for the company in total for the second quarter of 2020. What are the total consolidated sales dollars for quarter? Assune a calendar fiscal year end.arrow_forwardThe SK Industries, Inc. manufactures and sells two products, Accel Active and Accel Regular. In September 2018, SK Industries Budget Department gathered the following data in order to prepare budgets for 2019: 2019 Projected Sales Product Accel Active 45,000|s225 |Units Price Accel Regular 75,000 S1s5 Expected Target Inventories Product January 1, 2019 December 31, 2019 Accel Active 9,000 12,000 Accel Regular 17,000 25,000 The following direct materials are expected to be used in the two products: Material Used per Unit Direct Material Unit Accel Active Accel Regular pound One 6. Two pound 4 2 Three pound Projected data for 2019 with respect to direct materials are as follows: Direct Material Expected Purchase PriceExpected Inventories Target Inventories (January 1, 2019) (December 31, 2019) One $15 27,000 lb 35,000 lb Two S7 30,000 lb 35,000 lb Three $4 4,000 lb 7,000 lb Projected direct labor requirements and rates for 2019 are as follows: Product Hours Per Unit Rate Per Hour Accel…arrow_forward

- The SK Industries, Inc. manufactures and sells two products, Accel Active and Accel Regular. In September 2018, SK Industries Budget Department gathered the following data in order to prepare budgets for 2019: 2019 Projected Sales Product Accel Active 45,000|s225 |Units Price Accel Regular 75,000s1ss Expected Target Inventories Product January 1, 2019 December 31, 2019 Accel Active 9,000 12,000 Accel Regular 17,000 25,000 The following direct materials are expected to be used in the two products: |Material Used per Unit Direct Material Unit Accel Active Accel Regular pound One 6. 4 Two pound 4 Three pound 2 Projected data for 2019 with respect to direct materials are as follows: Direct Material Expected Purchase PriceExpected Inventories Target Inventories (January 1, 2019) (December 31, 2019) One $15 27,000 Ib 35,000 lb Two S7 30,000 lb 35,000 lb Three $4 4,000 lb 7,000 lb Projected direct labor requirements and rates for 2019 are as follows: Product Accel Active Hours Per Unit Rate…arrow_forwardElbert Company classifies its selling and administrative expense budget into variable and fixed components. Variable expenses are expected to be $25,100 in the first quarter, and $5,100 increments are expected in the remaining quarters of 2020. Fixed expenses are expected to be $40,100 in each quarter.Prepare the selling and administrative expense budget by quarters and in total for 2020. ELBERT COMPANYSelling and Administrative Expense Budget For the Year Ending December 31, 2020December 31, 2020For the Quarter Ending December 31, 2020 Quarter 1 2 3 4 Year Direct LaborDirect MaterialsFixed ExpensesProduction UnitsSalesTotal Selling and Administrative ExpensesVariable Expenses $ $ $ $ $ Direct LaborDirect MaterialsFixed ExpensesProduction…arrow_forwardSamano Industries has adopted the following production budget for the four quarters of 2020: Quarter 1 Quarter 2 Quarter 3 Units 6,300 8,100 9,100 Quarter 4 10,100 Each unit requires 3 kg of raw materials costing $6 per kilogram. On December 31, 2019, the ending raw materials inventory was 1,900 kg. Management wants to have a raw materials inventory at the beginning of each quarter equal to 30% of the current quarter's production requirements. The production budget for the first quarter of 2021 will be 12,100 units.Prepare a direct materials purchases budget by quarters for 2020.2.Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2017. Costs and Production Data Raw materials unit cost Raw materials units used Direct labor payroll Actual Standard $2.25 $2.10 10,600 10,000 $ 1,20,960 $ 1,20,000 Direct labor hours Manufacturing overhead Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning