FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

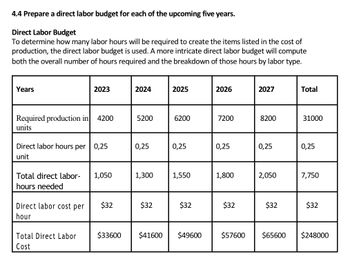

Transcribed Image Text:**4.4 Direct Labor Budget for the Next Five Years**

**Direct Labor Budget Overview**

The direct labor budget is essential to determine the number of labor hours required for production. It computes the overall hours needed and the breakdown by labor type.

| Years | 2023 | 2024 | 2025 | 2026 | 2027 | Total |

|-------|------|------|------|------|------|-------|

| **Required production in units** | 4200 | 5200 | 6200 | 7200 | 8200 | 31000 |

| **Direct labor hours per unit** | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| **Total direct labor-hours needed** | 1,050 | 1,300 | 1,550 | 1,800 | 2,050 | 7,750 |

| **Direct labor cost per hour** | $32 | $32 | $32 | $32 | $32 | $32 |

| **Total Direct Labor Cost** | $33,600 | $41,600 | $49,600 | $57,600 | $65,600 | $248,000 |

**Explanation:**

- **Required production in units**: The number of units projected for production each year.

- **Direct labor hours per unit**: Fixed at 0.25 hours across all years, reflecting the time required to produce each unit.

- **Total direct labor-hours needed**: Calculated by multiplying required production by direct labor hours per unit.

- **Direct labor cost per hour**: Set at $32 for each year.

- **Total Direct Labor Cost**: The overall expenditure on labor, based on the total labor hours and cost per hour.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4.4 Prepare a direct labor budget for each of the upcoming five years. Labor = $8arrow_forwardPulham Company is preparing its direct labor budget for 2019 from the following production budget based on a calendar year: Quarter 1 2 3 4 Units 60,000 30,000 45,000 75,000 Each unit requires 2 hours of direct labor. The union contract provides for a 10% increase in wage rate to $11 per hour on October 1. Prepare a direct labor budget for 2019. V First Quarter PULHAM COMPANY Direct Labor Budget For the Year Ended December 31, 2019 Second Quarter Third Quarter Fourth Quarter Totalarrow_forwardSolve requriement a and barrow_forward

- Man Hours: Budgeted hours: 40 hours Actual hours used: 44 hours Rate is $28 per hour What is the current and projected budget allotted answer? Project Budget allotted =arrow_forwardManagement Accounting Course Project – Part 1, B Group The Terranova Company is preparing information to complete its master budget for the quarter ending December 31, 2020. The company intends to make unit sales in the related months as follows: September 5,000 October 9,750 November 11,700 December 14,625 Units are to be sold for $10 each. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following the sale. *Required: 1) Prepare a sales budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. (Hint: a quarter = 3 months.) 2) Complete a schedule of expected cash collections for the quarter ending December 31, 2020. Show activity by month and in total.arrow_forwardThe production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter. 4th Quarter 9,800 Units to be produced 7,500 7,900 10,200 Each unit requires 0.75 direct labor-hours, and direct laborers are paid $14.00 per hour. Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. Assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 7,000 hours of work each quarter. If the number of required direct labor-hours is less than this number, the workers are paid for 7,000 hours anyway. Any hours…arrow_forward

- Part #6: H Company’s Direct Labor Budget indicates the number of direct labor hours to be used in July, August, and September are 21,000 and 18,900 and 23,000 respectively. Variable overhead is expected to be $0.90 per direct labor hour. Fixed overhead per month is expected to be $8,200. Prepare an Overhead Budget with columns for July, August, September, and Total 3rd Quarter.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education