FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can I get help with this question please 2 pics one is question and the second one is answers

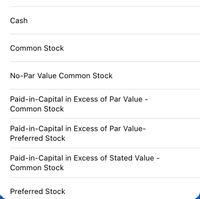

Transcribed Image Text:Cash

Common Stock

No-Par Value Common Stock

Paid-in-Capital in Excess of Par Value -

Common Stock

Paid-in-Capital in Excess of Par Value-

Preferred Stock

Paid-in-Capital in Excess of Stated Value -

Common Stock

Preferred Stock

Transcribed Image Text:Share Issuances for Cash

Minaret, Inc., issued 10,000 shares of $50 par value preferred stock at $68 per share and 12,000 shares of no-par value common stock at $15 per share. The common stock has no

stated value. All issuances were for cash.

a. Prepare the journal entries to record the share issuances.

b. Prepare the journal entry for the issuance of the common stock assuming that it had a stated value of $4 per share.

c. Prepare the journal entry for the issuance of the common stock assuming that it had a par value of $2 per share.

General Journal

Ref.

Description

Debit

Credit

а.

$

2$

Preferred Stock

Issued 10,000 shares of preferred stock.

Issued 12,000 shares of no-par value common stock.

b.

Common Stock

Issued 12,000 shares of no-par common stock, statedvalue of $4, at $15 per share.

С.

Common Stock

Issued 12,000 sharesat $2 par value common stock at$15 per share.

uoddns

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- whats the answer for number 2arrow_forwardHello, I need help solving this accounting problem.arrow_forwardClasswork for Basua, X A Classwork for Basua, X VA VIA Character Streng X The Three Questions X Which line from Utop X X Edgenuity for Studen X Look What You've O X Homework Help and X + https://classroom.google.com/u/1/w/MzEyNjg5MTkxMzly/t/all 120% D ... TIOW TIhUCIT UO they pudget fo Each Category? Basua, M Pers&Bu Multiply the weekly income by each of the budgeted percents. $1,276.50 X 30% $1,276.50 X 18% = $229.77 Housing $382.95 Clothes $1,276.50 x 7% $1,276.50 × 6% = $76.59 $1,276.50 × 5% = $63.83 $1,276.50 x 4% = $51.06 M292-000001 $89.36 Food Entertainment Transportation $1,276.50 × 10% = $127.65 Insurance $1,276.50 × 10% = $127.65 $1,276.50 x 10% = $127.65 Gifts Miscellaneous | Savings Directions Find the amount budgeted for each category. Use the percents shown in the example for each weekly income shown. Weekly Income 1) $416.50 2) $1,246.59 3) $661.40 | 4) $1,413.56 Housing Food Transportation Gifts Savings Clothing Entertainment Insurance Misc Weekly Income 5) $1,156.89 6)…arrow_forward

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardPlease answer this questions I need help on this questions from your accounting expert please help me. !!@#$%^$$^٪$$%^$!!#%^%#¥%%$##%^&$$$&$#$%@$$%%$$$$arrow_forwardW es D Edit View History Bookmarks Profiles Tab Window Help earch × ①QuickLaunchSSO :: Single Sig X M Question 5-Chapter 2 Home X M Chapter 2 Quiz - Connect + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%25... mework i Saved The transactions of Spade Company appear below. a. K. Spade, owner, invested $14,250 cash in the company. b. The company purchased supplies for $413 cash. c. The company purchased $7,880 of equipment on credit. d. The company received $1,682 cash for services provided to a customer. e. The company paid $7,880 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,021 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,269 cash as partial payment for the account receivable created in transaction f. i. K. Spade withdrew $1,100 cash from the company for personal use. Exercise 2-13 (Algo) Recording effects…arrow_forward

- annswer for practice 2 please ??????arrow_forwardted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Question 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forwardPlease solve in Excel with explanation computation for each steps answer in text formarrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education