FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

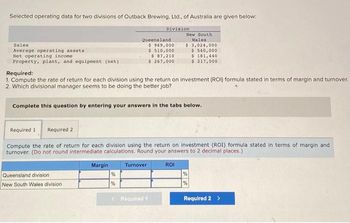

Transcribed Image Text:Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below:

Sales

Average operating assets

Net operating income

Property, plant, and equipment (net))

Queensland division

New South Wales division

Queensland

Margin

Division

Required:

1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover.

2. Which divisional manager seems to be doing the better job?

%

%

Complete this question by entering your answers in the tabs below.

$ 969,000

$ 510,000

Required 1 Required 2

Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and

turnover. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Turnover

$ 87,210

$ 267,000

< Required 1

New South

Wales

$ 3,024,000

$ 540,000

$ 181,440

$ 217,000

ROI

%

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below: Sales Average operating assets Net operating income Property, plant, and equipment (net) Required 1 Required 2 Required: 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Queensland division New South Wales division Queensland $ 1,984,000 $ 620,000 $ 148,800 $ 262,000 Margin Division Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. (Do not round intermediate calculations. Round your answers to 2 decimal places.) % % Turnover New South Wales $ 2,907,000 $570,000 $ 145, 350 $ 212,000arrow_forwardDivisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Investe assets and condensed income statement data for the past year for each division are as follows: Sales Cost of goods sold Operating expenses Invested assets Required: Road Bike Division $ 5,610,000 2,468,000 2,076,100 5,100,000 Mountain Bike Division $ 5,880,000 2,764,000 1,763,600 4,200,000 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no service department charges. Free Ride Bike Company Divisional Income Statements For the Year Ended December 31, 20Y7 Road Bike Division Mountain Bike Division Sales Cost of goods sold Gross profit Operating expenses Income from operationsarrow_forwardReturn on Investment The income from operations and the amount of invested assets in each division of Beck Industries are as follows: Income from Operations Retail Division Commercial Division Internet Division Division Retail Division Commercial Division $91,200 126,500 a. Compute the return on investment for each division. (Round to the nearest whole number.) Percent Internet Division 81,900 % Invested Assets % $480,000 390,000 550,000 b. Which division is the most profitable per dollar invested?arrow_forward

- Comparison of Performance Using Return on Investment (ROI) Comparative data on three companies in the same service industry are given below: Required: 1. What advantages are there to breaking down the ROI computation into two separate elements, margin and turnover? 2. Fill in the missing information above, and comment on the relative performance of the three companies in as much detail as the data permit. Makearrow_forwardHelparrow_forwardConsider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z Sales $ 1,470,000 $ 974,000 $ 4,861,000 Operating Income 173,200 172,300 180,500 Investment in assets 428,200 567,500 2,553,200 The return on sales (ROS) for Division Y is: Multiple Choice 3.7%. 30.4%. 17.7%. 11.8%.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardROI is effective because it takes into consideration the three factors under the control of an investment center manager: revenues, costs, and investments. ROI measures the income (or return) earned on each dollar of investment. APPLY THE CONCEPTS: Calculating return on investment The divisional income statements for three divisions of the McLaren Company are shown. McLaren Company Divisional Income Statements For the Year Ending December 31, 2012 Division A Division B Division C Sales Revenue $1,947,000 $1,197,000 $594,000 Operating expenses (1,148,730) (897,750) (314,820) Operating income before service department charges $798,270 $299,250 $279,180 Service department charges (467,280) (177,156) (166,320) Operating income $330,990 $122,094 $112,860 Additional financial data from the three divisions of the McLaren Company are shown. Division A Division B Division C Invested assets $1,100,000 $665,000 $450,000 Calculate the return on investment for each division. If required, round the…arrow_forwardMeiji Isetan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Division Osaka Yokohama Sales $ 9,600,000 $ 26,000,000 Net operating income $ 672,000 $ 2,340,000 Average operating assets $ 3,200,000 $ 13,000,000 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 16%. Compute the residual income for each division. 3. Is Yokohama’s greater amount of residual income an indication that it is better managed?arrow_forward

- Return on investment The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $72,600 $330,000 Commercial Division 117,600 490,000 Internet Division 224,100 830,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division % Commercial Division % Internet Division b. Which division is the most profitable per dollar invested?arrow_forwardMeiji Isetan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Division Osaka Yokohama Sales $ 9,800,000 $ 28,000,000 Net operating income $ 588,000 $ 2,240,000 Average operating assets $ 2,450,000 $ 14,000,000 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 14%. Compute the residual income for each division. 3. Is Yokohama’s greater amount of residual income an indication that it is better managed? Osaka Yokohama ROI % % Osaka Yokohama Residual incomearrow_forwardExercise 10-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income (LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A $ 6,300,000 $ 1,260,000 340,200 Division B $ 10,300,000 $ 5,150,000 968,200 18.80% Division C $ 9,400,000 $ 1,880,000 24 Sales Average operating assets Net operating income Minimum required rate of return 2$ 249,100 20.00% 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 20% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education